This combination makes financial product management highly specialized, demanding a deep familiarity with the business itself. In this article, we will explore how financial product managers can enhance their skills and competencies.

Financial products differ from other B2B products like supply chains or CRMs in a unique way: they act like the ocean, gathering data from all upstream systems. Additionally, the threshold for financial products is high, involving a wide range of topics and deep content, making the learning curve steeper than other fields. Those who haven’t studied finance or participated in ERP implementation might feel like they’re reading an alien language.

When I first started learning about finance, I found financial jargon and specialized terms overwhelming. But over time, I came to appreciate the fascinating world it opens up once you become familiar with it.

After years immersed in the field of financial product development, I've observed that while research on financial informatization and digitization is abundant, resources specific to financial products are rare. Sadly, there are few comprehensive study materials or courses dedicated to financial products. Even authoritative institutions like the Beijing National Accounting Institute, the Shanghai Accounting Institute, and universities lack structured courses on this subject. Therefore, it is with great pride that I introduce the first-ever financial product course, which aims to help more people understand financial products and elevate the discipline.

Key Competencies for Financial Product Managers

As a financial product manager, product expertise is fundamental, and accounting knowledge is a must-have—one cannot function without the other. Otherwise, it’s akin to a blind person feeling an elephant or someone building a car without blueprints. Reflecting on the past, the glory days have passed; but looking toward the future, the possibilities are endless. Based on past experience, here are several areas where financial product managers can focus on improving their skills:

1. Strengthening Financial Fundamentals

A financial product manager must always consider whether every transaction will impact the financials. If it does, how will it affect specific accounts or accounting elements? Is it an asset or a liability? Is it a selling expense or a cost? How will it influence the company’s financial statements?

For example, when evaluating a new business model for consignment sales, where goods are sent to a third party to sell on behalf of the company in exchange for a commission, it's important to note that while the goods technically remain owned by the company, they are no longer under its control. This creates a situation where the company cannot effectively verify the authenticity of sales data, leading to significant financial risk. As a result, after raising concerns and convincing management, the model was rejected.

When participating in requirement discussions as a financial product manager, you must think beyond just the product aspects. Take a few extra steps to consider the rationality of the business, as well as the impact on financials and company strategy.

The role of finance is to reflect and supervise. First, it ensures that calculations are timely and accurate. Secondly, finance acts as the company’s gatekeeper, preventing and mitigating risks. Every financial action must follow regulated processes, with data that can be accurately audited and reflected in various reports and management decisions.

When fulfilling supervisory functions, this often involves process approvals in BPM or OA systems. When integrating with B2B systems, consistency between upstream system data and financial data must be maintained. For example, department codes and attributes must align across systems. Even though this falls under master data management, as financial products are the final downstream data consumers, no data should be overlooked during the assessment process.

2. Familiarity with Business Operations

Finance is often seen as rigid and inflexible, adhering to strict rules and regulations. However, as financial product managers, it’s essential to bridge the gap between finance and business. You must dive deep into the business, understand its background, processes, and essentials, and ideally become a trusted partner to the business teams.

To familiarize yourself with business operations, consider the following:

Understand Business Details: Gain an understanding of the company’s products and identify any irrationalities in business processes. For example, during a store visit, I discovered that one store owner was registering multiple store names to claim subsidies, resulting in inefficiencies. Addressing these issues helps both business performance and company development.

Look Beyond Your Work: Don’t just focus on day-to-day tasks. Stay alert to industry policies, competitors’ pricing strategies, and changes in financial conditions. Having this external awareness is critical for both individual growth and the company’s survival.

Respect the Market and Company: Understand market growth rates, competitive landscapes, and the company’s position within the industry. Grasping this information aids in setting effective market strategies and adjusting product strategies accordingly.

Continuous learning and practice are essential. Becoming an expert in financial products is an ongoing journey that requires adapting to ever-changing business demands.

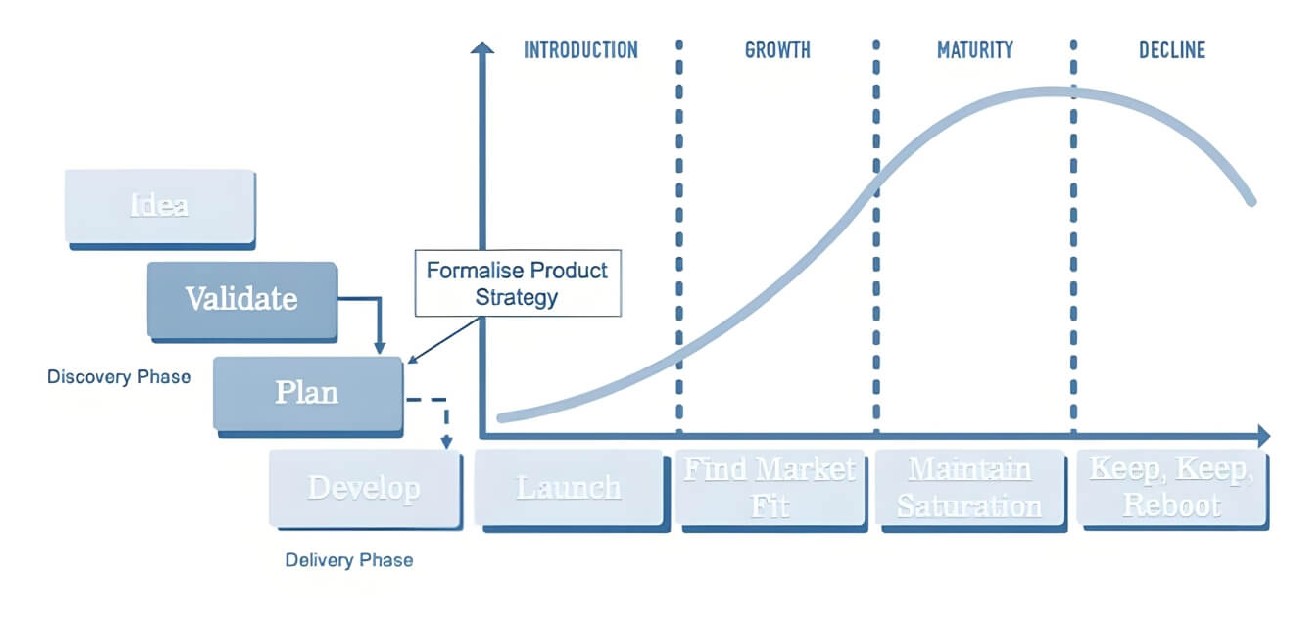

3. Solidifying Product Management Skills

A financial product manager is first and foremost a “product manager.” A product manager is often described as a “prototype guy,” but this label oversimplifies the role. After 3-5 years of experience, you should have developed your own methodologies and built a strong foundation of soft skills, creating your personal moat.

Here are a few personal tips:

Build a Reliable Persona: Always follow up on tasks and ensure that everything is completed. For example, if you encounter issues during development, don’t just report them—follow through until the task is complete.

Be Ready for Debates: Product managers must often assert their viewpoints while managing resources. Be prepared for disagreements, but remember that the goal is not to prove who is right, but to arrive at the best solution.

Think and Abstract Often: The best thinking happens when the mind is relaxed. Always record your thoughts, as writing is a process of reflection and planning. By abstracting common principles, you can focus on the core issues rather than getting lost in details.

4. Conclusion: Start with the End in Mind

Finance is most concerned with quality—data quality and business risk—followed by efficiency, and finally, empowerment. Financial products are the bedrock of financial digitization. Only by building a strong foundation can we achieve future success. To all future financial product managers, let's work hard together to push the boundaries of this field!