TikTok Shop in the U.S. shows great potential, but also faces numerous challenges. “The boss of Three Sheep came over (to the U.S.) to conduct a survey, and found it was very different, so they decided to stick with the Southeast Asian market,” recalled Dong Fan, founder of CreatoRev.

CreatoRev is one of the earliest MCN (multi-channel network) companies to receive a registration license in the U.S. for TikTok Shop and is also an official partner with TikTok. According to Dong, CreatoRev has signed over 8,000 influencers across all platforms, with more than 3,000 influencers specifically on TikTok.

Similar to Three Sheep, other organizations such as Yaowang Technology, Jiaoge Friends, and Dongfang Zhenxuan have also shown interest in expanding internationally, with a common focus on the U.S. market.

In June, Yaowang Technology signed the U.S.-based influencer Simplymandys, who broke the TikTok North America sales record with a single event generating $737,000 in GMV (Gross Merchandise Value), although this record was surpassed by another local influencer within 24 hours. In July, Lu Wenqing, the founder of Three Sheep, revealed in a live stream that "The U.S. company plans to be set up by September, and the overseas executives have been in Los Angeles for over 20 days. This trip is part of the official international expansion." In August, Jiaoge Friends announced that they had started building an overseas team and had opened an office in North America. Their first live stream in the U.S. saw GMV exceeding $1 million.

The U.S. market indeed seems to be a promising one.

According to a research report by Guoxin Securities, TikTok's monthly active users in the U.S. are 150 million, accounting for about 45% of the U.S. population. Data from TikTok shows that U.S. users spend an average of 90 minutes a day on TikTok, and 67% of them prefer using TikTok during their leisure time.

However, behind the potential and opportunities are characteristics that are starkly different from China's live commerce industry. According to data from overseas e-commerce and content analysis platform Tekan, the top 10 MCNs in the U.S. in October did not include any Chinese companies.

Supermodels Can’t Sell Like "Moms"

Unlike Chinese MCN companies expanding overseas, CreatoRev has always been a U.S.-based company since its inception, and it currently ranks first in terms of GMV among MCNs in the U.S. market.

Dong Fan shared with China Entrepreneur that, under TikTok Shop's previous rules, to set up a "local self-operated store" (meaning a fully U.S.-based store), at least 75% of the company's shares must be held by U.S. citizens. Besides the two founders, Dong Fan and Chen Sibiao, all other executives and employees at CreatoRev are Americans.

Currently, U.S.-based TikTok Shop stores fall into three categories: cross-border self-operated stores, fully managed stores, and local self-operated stores. Dong revealed that local self-operated stores enjoy the maximum push from TikTok's algorithm. However, starting a local self-operated store comes with many restrictions, such as requiring local shipping and a tracking number within 72 hours. Many Chinese sellers get stuck at the registration stage, making them more likely to run cross-border self-operated or fully managed stores.

This is just one of the differences.

With a first-mover advantage, CreatoRev is unquestionably TikTok's top performer in multiple dimensions, including sales volume, revenue, influencer numbers, and fan base. According to Tekan data, in October, the sales from CreatoRev’s signed influencers reached $8.466 million (about ¥60.65 million).

However, this scale doesn’t place it at the top of the crowded domestic MCN market.

“Live commerce in the U.S. is not a winner-takes-all market. Our best-performing influencer right now is Alle, the only L7-level influencer on the platform,” Dong Fan said.

In terms of follower count, Alle has 406,000 followers and is considered a "mid-tier" influencer on TikTok. Dong also revealed that this is another difference between the U.S. and China—while top-tier influencers in China are strong sellers, many mid-tier influencers in the U.S. are better at selling products.

Stormi: The First U.S. "Million-Dollar" Influencer

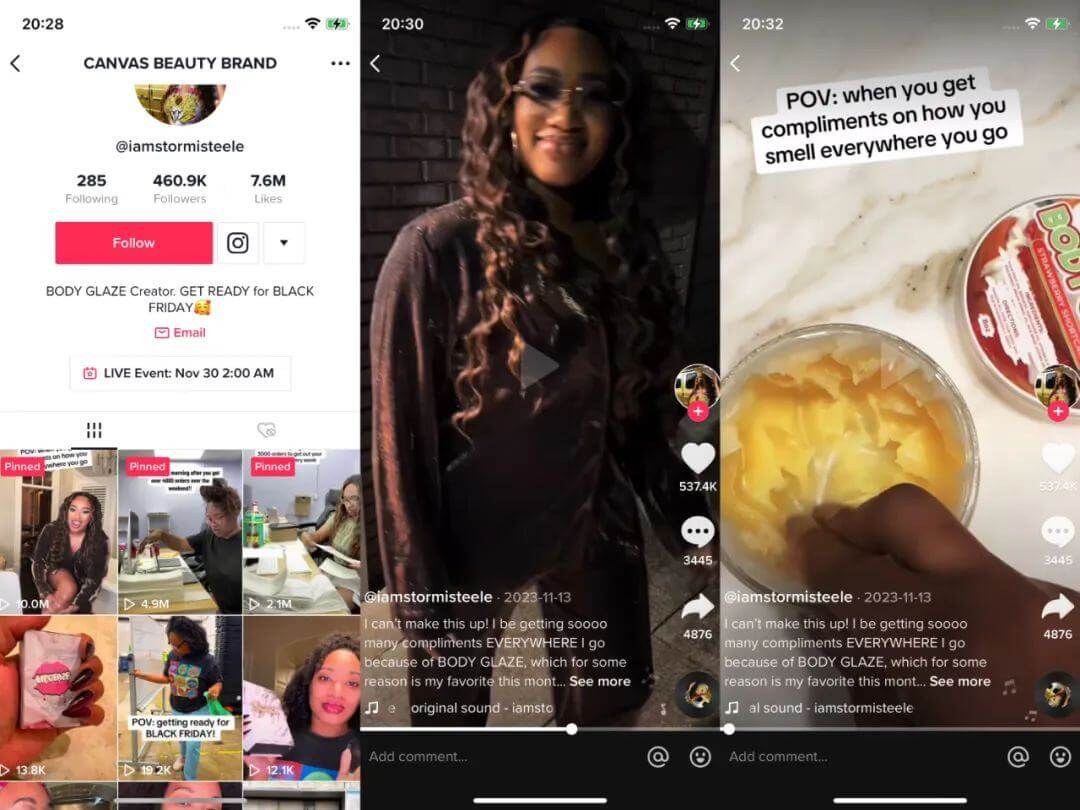

Stormi, the first U.S. influencer to hold a "million-dollar live session," is also a mid-tier "mom blogger." She surpassed Yaowang Technology’s first live stream GMV with a single event of $1.048 million.

As of now, Stormi has 461,000 followers, and most of the content on her page consists of daily life videos with her daughter and husband, aside from product sales videos. Stormi’s pinned video, which is an ad for a body lotion, had over 10 million views as of the time of writing, and according to TikTok data analysis platform FastMoss, her latest live stream sold over $30,000 worth of body lotion.

“On TikTok Shop, the top-performing influencers are mainly Midwest moms who look very ordinary—not like supermodels who are glamorous,” Dong Fan commented. He explained that the most popular and successful influencers in the U.S. are not necessarily those who are beautiful or glamorous, as their appearance can create a sense of distance from the audience, making them less likely to convert viewers into buyers.

This contrasts with China, where strong personal branding (e.g., looks, character, or story) is more prevalent among successful influencers. Xiao Yue, a content planner and director at a Chinese MCN agency, analyzed, “In China, influencers with a strong personal attribute (strong branding) are more successful in selling. It could be their appearance, personality, or a compelling story.”

Live Commerce in the U.S. Is Still in Its Early Stages

“Currently, live commerce in overseas markets is at a stage similar to China's Douyin (TikTok's Chinese version) from 2019 to 2020,” Jiaoge Friends summarized in their earnings call in August.

TikTok started incorporating the "Little Yellow Car" (shopping cart) feature at the end of 2022, and TikTok Shop officially began operations. CreatoRev became the first MCN to receive a registration license. Having worked in the entertainment industry for over a decade, Dong established CreatoRev and signed many celebrities, athletes, and international models as influencers for the company.

Dong shared with China Entrepreneur that many celebrities are reluctant to participate in live commerce. He recalled a model who, while selling T-shirts during a live stream, blocked friends from viewing the stream, “He felt very embarrassed. Even though no one was really mocking him, he just couldn’t accept the idea.”

Similar concerns also arose in China. During the initial boom of live commerce in China in 2019-2020, celebrities like Jia Nailiang and Zhu Zixiao ventured into live commerce on Douyin (TikTok's Chinese counterpart), facing criticism from the public, with terms like "Zhu Zixiao eats chicken feet live" trending on social media.

Like Dong Fan, Chinese sellers recognize the potential in the U.S. market. By the end of 2022, TikTok Shop in the U.S. saw a surge of Chinese sellers. Dong recalled, "In the early days, TikTok Shop was mostly Chinese sellers, and products like Lenovo headphones sold very well."

According to TikTok Shop data, during the first "Black Friday" promotion in September 2023, TikTok Shop exceeded $33 million in GMV in just one day.

With this strong start, TikTok Shop’s confidence in the U.S. market has soared. According to 36Kr, TikTok's overseas GMV target for 2024 is set at $50 billion, up from $20 billion in 2023. Bloomberg reported that TikTok's U.S. target for the year is $17.5 billion.

Challenges in the U.S. Market

However, even with confidence, TikTok faces challenges. In April, TikTok Shop's cross-border e-commerce arm launched a "One Billion Club" policy to support self-operated cross-border sellers in the U.S. Dong revealed that after the policy adjustment, live commerce influencers will receive four times the traffic support.

"Many large U.S. brands don’t know what live commerce is or how to approach it," Dong said. "Most brands don’t understand the ROI of live commerce and have no expectations of its success. They prefer using influencers for soft ads and return to their traditional methods."

Nonetheless, some categories have already “fired the first shot” and are continuing to gain traction. Dong revealed that the top-selling category on TikTok Shop in the U.S. is health supplements. As the top brand in this category, Golli gifted a Lamborghini to a high-performing influencer. Health supplements have now become one of the most competitive categories on TikTok Shop.

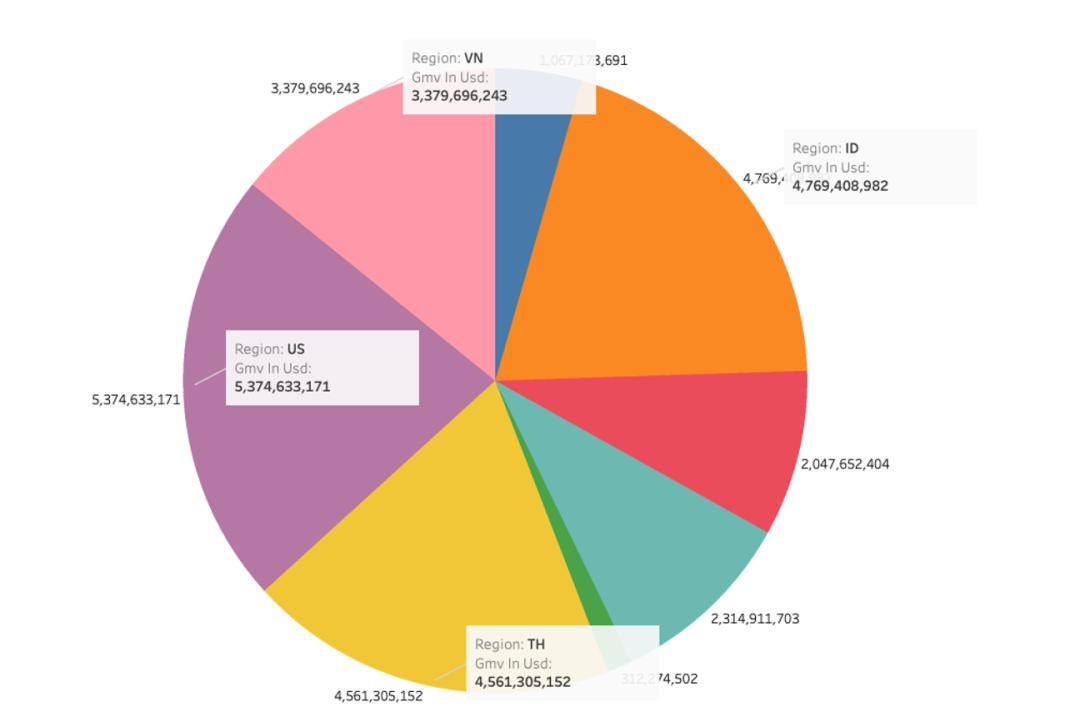

“Based on current GMV, we’re still far from where we need to be,” said Tekan data analyst Deng Zaichao. As of the end of October, TikTok's GMV in the U.S. was only $5.3 billion, though it had the highest market share among the eight countries Tekan tracks. Indonesia, Thailand, and Vietnam followed closely in second, third, and fourth place.

Different Market Dynamics

Despite some challenges, TikTok's entrance into the U.S. market continues to evolve. Amazon, its main competitor, has been reducing commission rates and storage fees, forcing TikTok to adjust its strategy. In September, TikTok Shop paused its all-in-one closed-loop model.