For cross-border e-commerce, this is the hottest moment for the Latin American region. According to incomplete statistics from Xiaguangshe, since August this year, there have been at least six summits and salons related to "going to Latin America" held in Shenzhen. Similarly, just this past September, there were no fewer than five business delegations targeting Brazil as their destination in this overseas expansion wave.

On August 31, at a Latin America summit held in Shenzhen’s Bantian area, not only was every seat taken, but businesspeople eager to learn about this new market were standing outside the venue. The event maintained this "packed" state throughout its four-hour duration. Among the six keynote speakers, three focused their core presentations on the Brazilian market.

Even MercadoLibre’s second-quarter financial report for 2024 highlighted that Brazil’s GMV growth reached 36%, the highest since 2021. The number of items sold in Brazil led by a significant margin, with a 37% year-on-year increase.

Latin America is truly on fire. For cross-border e-commerce, this is the hottest moment for the region. If Latin America is "the world’s last blue ocean," then Brazil is the "Shenzhen" of this fast-growing blue ocean.

Has Brazil become the new promised land for cross-border e-commerce?

You might rarely hear about Chinese companies making money in Brazil, though there have been legends about nameless entrepreneurs like “Zhang San, Li Si, Wang Wu” getting rich. However, the actual state of e-commerce in Brazil is often described as "thunderous applause, but little rain." While the market seems hot, few dare to enter.

This aligns with the typical market development trajectory: creating initial hype to attract ambitious entrepreneurs, expanding supply, stimulating demand, and building consumer stickiness. The market grows gradually as a result.

However, in Brazil, this "hype before substance" stage appears to take longer. Geographically, Brazil ranks as the 6th farthest country from China, at a distance of 16,632 kilometers. The farther the business, the more considerations of cost-benefit ratios and potential high risks come into play.

Brazil is genuinely hot—a blue ocean market that has ignited the passion of countless entrepreneurs. However, it remains a place where many observe from a distance but few dare to act. Most merchants hesitate at Brazil's gateway, unable to muster the courage to enter.

This article aims to provide an authentic picture of Brazil for hesitant businesses, hoping they will find the courage to proceed after gaining some familiarity with the unfamiliar.

Distant Brazil, close-at-hand opportunities

The term "the last blue ocean market" doesn’t exclusively refer to Latin America. Regions like Africa, the Middle East, and Central Asia are often similarly described.

As long as development has not reached its ceiling, and there is a place for Chinese products, a market can be termed the "last blue ocean." It sounds like a fleeting opportunity that won’t come again.

However, not every blue ocean market guarantees demand for Chinese businesses. For example:

-

Africa: While it has potential, the underdeveloped logistics infrastructure requires a long wait for returns.

-

Russia: While demand exists, political instability leads to economic stagnation, making survival the primary concern rather than growth.

-

The Middle East: Though also a blue ocean, its smaller population base means the market pie isn’t as large.

In comparison, Latin America is not only the last blue ocean but one that offers visible hope. For cross-border e-commerce, Latin America—particularly Brazil—is expected to be one of the fastest-growing markets over the next 5-10 years.

Why focus on Brazil now?

China’s merchants have traditionally been deterred by Brazil’s distance. A flight from Shenzhen to Brazil takes at least 34 hours with two layovers. In the past, proximity often played a major role in deciding whether to enter a market.

But today, Brazil’s unique advantages are becoming evident.

With regions like the U.S., Europe, and Southeast Asia now saturated, competition has become fierce. A Brazilian e-commerce professional describes it as "brutally competitive." In Latin America, Mexico and Chile have lower entry barriers and more developed logistics systems. For instance:

-

In Chile, AliExpress, SHEIN, and Temu together hold over 50% of the market share for cross-border e-commerce.

-

In Mexico, the number of Amazon sellers grew by 52% in 2023, reaching nearly 27,000.

Brazil, on the other hand, has the largest consumer market in Latin America but more complex customs and tax policies. Many Chinese merchants only turn to Brazil after exploring Mexico and Chile. Yet, Brazil’s vast market means products that enter rarely struggle to sell. With over 150 million people living in poverty, there is high demand for affordable products. Meanwhile, the wealthy minority seeks high-quality goods for an upgraded lifestyle.

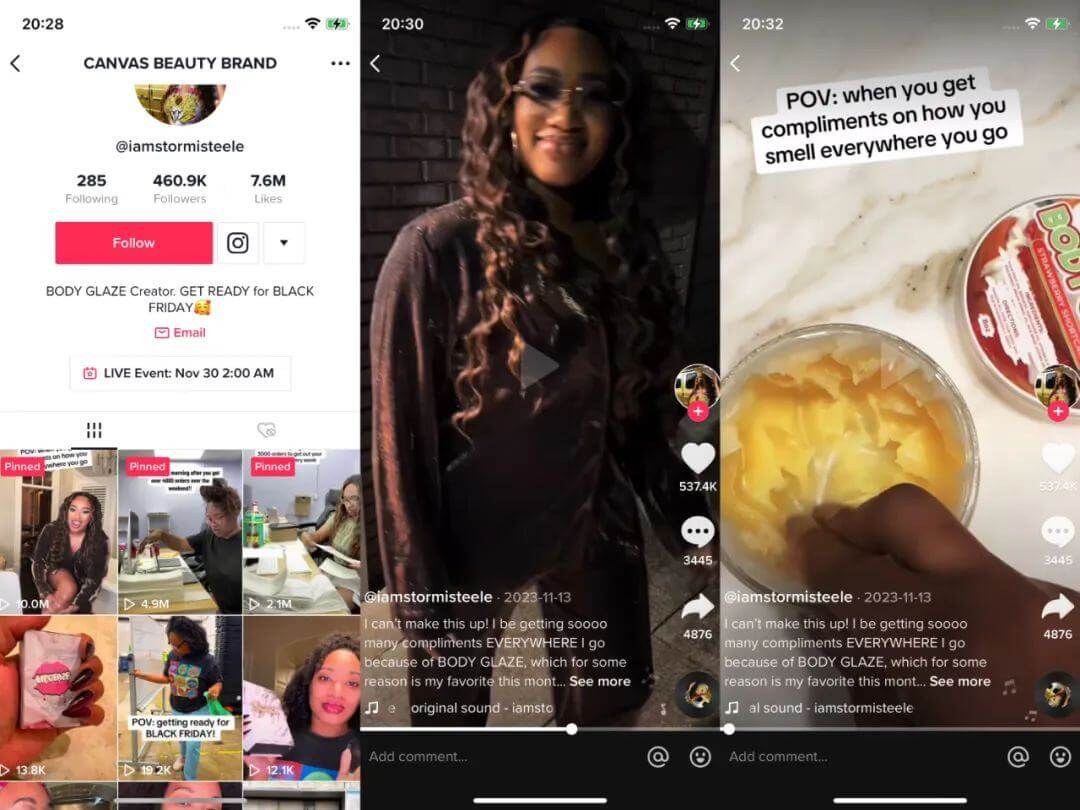

Brazilians are also open to digitalization and enjoy entertainment-focused platforms. For instance, Kuaishou’s international version, Kwai, focuses on Brazil, where it boasts over 60 million monthly active users—30% of Brazil’s population.

This combination of digital affinity and demand makes Brazil a market transitioning from offline to online retail. Platforms like Temu, MercadoLibre, and Amazon are making significant investments:

-

Temu added Brazil as its 70th site.

-

MercadoLibre invested $4.6 billion in new distribution centers.

-

Amazon Brazil joined its logistics program in 2024, enabling sellers to share U.S. FBA inventory.

Challenges of entering Brazil

Brazil’s potential comes with significant challenges:

-

High Taxes: Known as the "land of many taxes," Brazil imposes complex tariffs, including:

-

17% tax on cross-border packages below $50.

-

Packages above $50 face a 60% tariff plus the 17% tax.

-

Certification Requirements: Products like electronics and medical items need certifications (e.g., INMETRO, ANVISA, ANATEL).

These costs mean that to turn a profit, goods may need to be priced 3-4 times higher than in mature markets.

Is Brazil worth it?

Brazil is an evolving market with opportunities similar to China’s in the 1990s. Merchants must embrace both its promise and its difficulties. Successful entry requires deep localization and a balance between cost-effectiveness and profitability. Brazil’s blue ocean is not limitless but still offers significant rewards for the prepared.