Python quantitative trading refers to the process of using the Python programming language, along with its libraries and tools, to analyze financial market data, develop trading strategies, and execute trades.

Python has become one of the most preferred programming languages for quantitative trading due to its simplicity, ease of learning, robust ecosystem, and rich financial libraries.

Quantitative trading is widely used in the financial sector. It allows traders to develop and execute trading strategies systematically, increasing trading efficiency and improving the science behind decision-making.

Quantitative trading mainly involves using mathematical and statistical methods, combined with computer technology, to analyze financial markets and develop trading strategies.

For more details on Python quantitative trading, you can refer to: Python Quantitative Trading.

Example Application

Let's look at a simple example of Python quantitative trading using a moving average strategy and Yahoo Finance data.

The basic idea of this strategy is to generate buy and sell signals by comparing the short-term and long-term moving averages.

Before running this example, you need to install three packages:

pip install pandas yfinance matplotlib

Package Explanation:

Pandas: A powerful open-source data processing and analysis library designed for efficient data manipulation.

yfinance: A library used for obtaining financial data, supporting the retrieval of stock, index, and other financial market data from Yahoo Finance.

Matplotlib: A 2D plotting library used for creating static, dynamic, and interactive data visualizations.

Fetching Historical Stock Data

Use yfinance to get historical stock data. Below is a simple example:

import yfinance as yf # Fetch stock data symbol = "600519.SS" start_date = "2022-01-01" end_date = "2023-01-01" data = yf.download(symbol, start=start_date, end=end_date) print(data.head())

Output:

Open High Low Close Adj Close Volume Date 2022-01-04 2055.00000 2068.949951 2014.000000 2051.229980 1973.508057 3384262 2022-01-05 2045.00000 2065.000000 2018.000000 2024.000000 1947.309937 2839551 2022-01-06 2022.01001 2036.000000 1938.510010 1982.219971 1907.112915 5179475 2022-01-07 1975.00000 1988.880005 1939.319946 1942.000000 1868.416870 2981669 2022-01-10 1928.01001 1977.000000 1917.550049 1966.000000 1891.507446 2962670

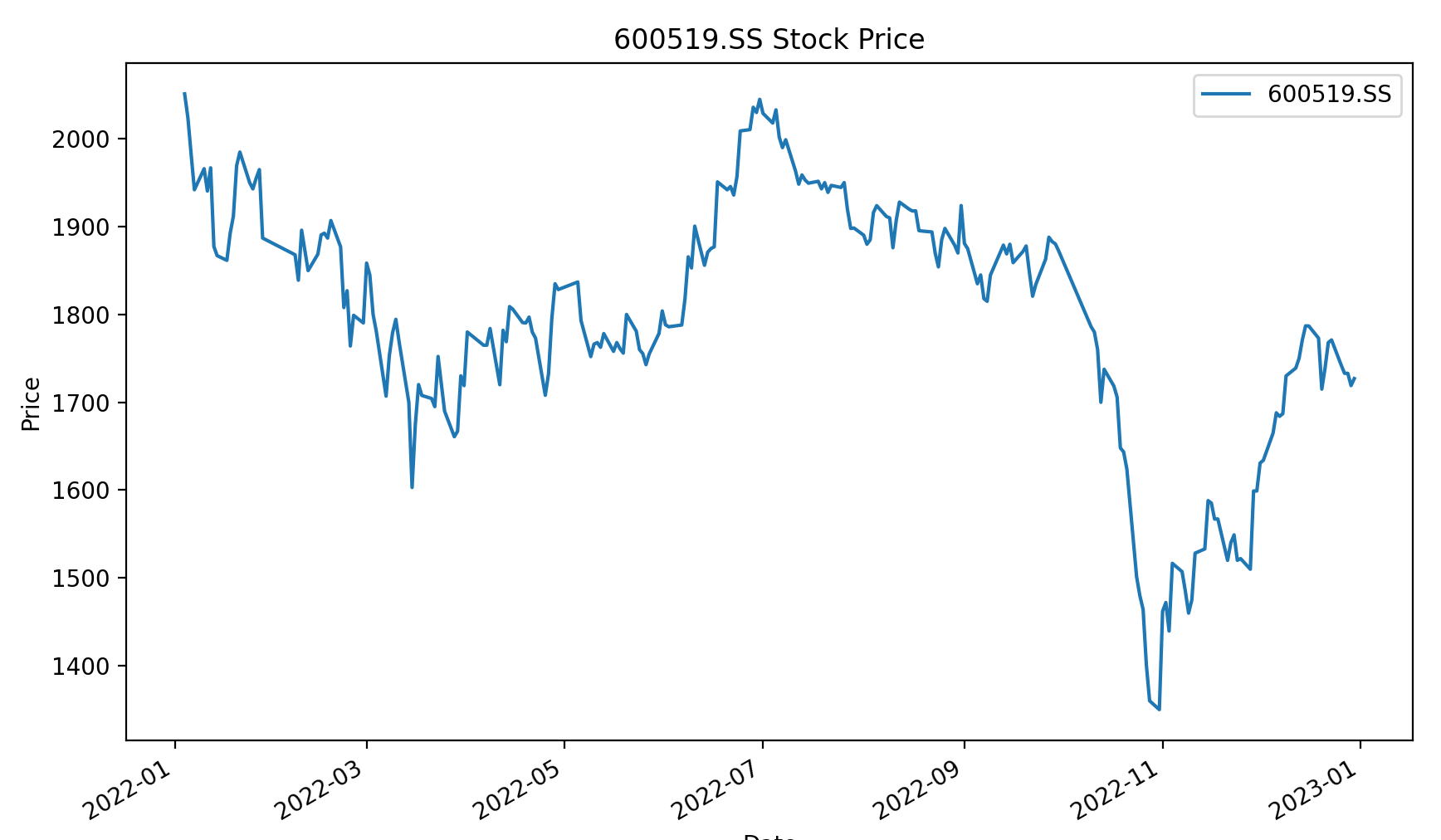

Simple Data Analysis and Visualization

Using pandas for data analysis and matplotlib for visualization:

import yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

# Fetch stock data

symbol = "600519.SS"

start_date = "2022-01-01"

end_date = "2023-01-01"

data = yf.download(symbol, start=start_date, end=end_date)

# Simple data analysis

print(data.describe())

# Plot the stock price chart

data['Close'].plot(figsize=(10, 6), label=symbol)

plt.title(f"{symbol} Stock Price")

plt.xlabel("Date")

plt.ylabel("Price")

plt.legend()

plt.show()The chart will look like this:

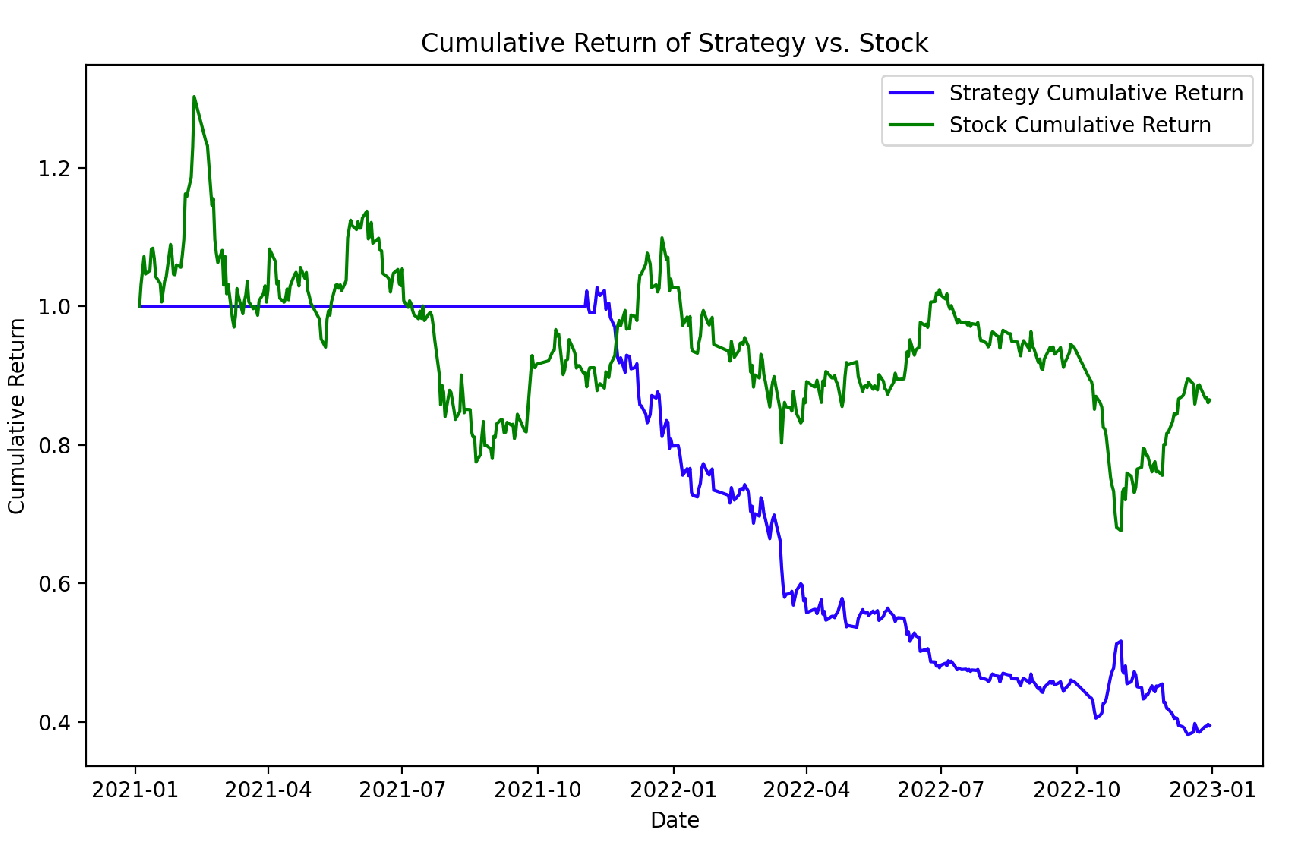

Backtesting Moving Average Crossover Strategy

Backtesting is the process of simulating and evaluating a trading strategy on historical market data.

Here is a simple example of backtesting a moving average crossover strategy. The strategy buys when the 50-day moving average crosses above the 200-day moving average, and sells when it crosses below. The strategy's performance is outputted as total return, annualized return, and maximum drawdown.

import yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

# Fetch stock data

symbol = "600519.SS"

start_date = "2021-01-01"

end_date = "2023-01-01"

data = yf.download(symbol, start=start_date, end=end_date)

# Calculate moving averages

data['SMA_50'] = data['Close'].rolling(window=50).mean()

data['SMA_200'] = data['Close'].rolling(window=200).mean()

# Initialize signal column

data['Signal'] = 0

# Generate crossover signals

data.loc[data['SMA_50'] > data['SMA_200'], 'Signal'] = 1

data.loc[data['SMA_50'] < data['SMA_200'], 'Signal'] = -1

# Calculate daily returns

data['Daily_Return'] = data['Close'].pct_change()

# Calculate strategy returns (shift(1) to avoid look-ahead bias)

data['Strategy_Return'] = data['Signal'].shift(1) * data['Daily_Return']

# Calculate cumulative returns

data['Cumulative_Return'] = (1 + data['Strategy_Return']).cumprod()

# Output strategy performance

strategy_performance = {

'Total Return': data['Cumulative_Return'].iloc[-1] - 1,

'Annualized Return': (data['Cumulative_Return'].iloc[-1] ** (252 / len(data))) - 1,

'Max Drawdown': (data['Cumulative_Return'] / data['Cumulative_Return'].cummax() - 1).min(),

}

print("Strategy Performance:")

for key, value in strategy_performance.items():

print(f"{key}: {value:.4f}")

# Plot cumulative returns

plt.figure(figsize=(10, 6))

plt.plot(data['Cumulative_Return'], label='Strategy Cumulative Return', color='b')

plt.plot(data['Close'] / data['Close'].iloc[0], label='Stock Cumulative Return', color='g')

plt.title("Cumulative Return of Strategy vs. Stock")

plt.xlabel("Date")

plt.ylabel("Cumulative Return")

plt.legend()

plt.show()This will generate a chart similar to the one shown here:

Note:

This is just a simple example, and in real applications, more complex strategies and additional considerations are necessary.