Due to the nature of B2B products, I often needed to travel for on-site interviews and research with clients. These clients were usually leading companies in their respective industries, so even a minor mistake could have a significant impact on the company's image.

For a B2B PM, conducting a good customer research session is essential. Research helps you understand the real customer use scenarios and gives insight into where your product fits within the customer’s decision-making chain, allowing for continuous product optimization.

This article will elaborate on how to conduct successful enterprise customer research through three stages: Before Research, During Research, and After Research.

Before Research

Before conducting customer research, two things need to be done: first, scheduling the customer, and second, preparing research materials.

Scheduling the Customer

In this aspect, there is a significant difference between B2B and B2C products. B2C products often have dedicated research teams that handle customer interactions, arranging online or in-office interviews for research.

In B2B, it's different. Most of the time, PMs are responsible for the research work themselves. For B2B products, especially when dealing with large clients, it often requires traveling to the client’s site. Also, you may need assistance from colleagues in sales or marketing, as they are the ones who have direct contact with these clients. Without their help, it can be challenging to schedule meetings with the right customers.

In this situation, having a good relationship with frontline colleagues is crucial. This is especially true if your company has multiple product lines, where different PMs may rely on the same sales staff to schedule customer interviews. The better your relationship with these colleagues, the more likely they are to help you.

Here are two suggestions on how to build good relationships with frontline colleagues:

When you’re on a business trip, if sales or presales colleagues need help with technical validation for a project, offer to assist them at the client’s site. Help them when you can, and over time, they’ll be more willing to help you.

After each business trip, treat your frontline colleagues to a simple meal. It doesn’t need to be extravagant, but it should show your appreciation. Frontline colleagues are often traveling and appreciate the chance to sit down, relax, and chat. Building rapport during these moments will make them more inclined to assist you in the future.

Additionally, when scheduling customers, try to reach out to your frontline colleagues before the trip and let them know the general goals of your research. This way, they can help arrange the meetings and plan the itinerary. If you’re meeting with large clients, scheduling two meetings a day (one in the morning and one in the afternoon) should suffice. Large companies in second-tier cities are often located far apart in industrial zones, so allow ample travel time between meetings. Being late can negatively affect both your company’s image and your relationship with frontline colleagues.

Preparing Research Materials

There are two main parts to research materials: client information and research outlines.

Client information can be obtained from frontline colleagues, such as the company’s background, staff size, business details, and the participants in the meeting. A basic understanding will suffice.

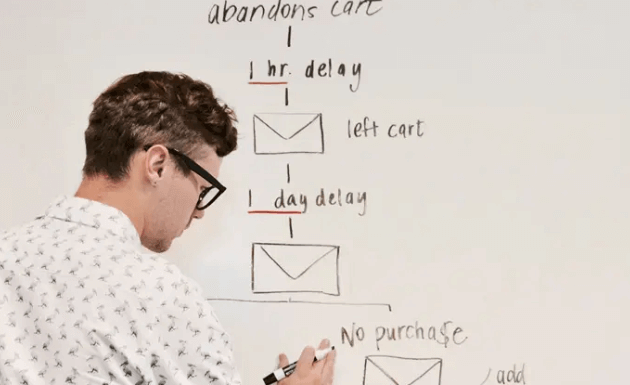

The research outline, however, is crucial. The success of a research session largely depends on the quality of the research outline. Therefore, it's essential to design a well-thought-out research outline before the session.

Due to differences in companies and products, I will outline my own approach to creating a research outline for reference. Feel free to adjust based on your own needs.

Research Purpose: Each outline should have a clear research purpose, such as addressing a specific problem.

Research Group: The target client group for this questionnaire, e.g., clients from the internet or real estate industries.

Research Roles: The target roles of the research participants. In B2B products, the decision-making chain is often long, with three different user roles: end users, operational staff, and decision-makers. The questionnaire must specify which role is being researched.

Expected Research Volume: The duration of the research trip and the target number of enterprise clients. I usually estimate about 10 clients per week.

Time per Session: Each research session should last no more than two hours. It’s important to manage the time, as you shouldn’t occupy too much of the client’s time.

Introduction and Conclusion: Design the opening and closing statements for the interview.

Research Questions: Tailor the questions based on your company’s products and characteristics. When designing questions, try to ask about the underlying reasons behind actions, not just the methods. Also, keep the questions to a maximum of 15, as the pace may vary with different clients, and you may not get through all the questions.

During the research process, clients won’t always follow the steps you envision, and discussions can easily go off-topic. So, adapt as needed and ask questions as opportunities arise.

During Research

After preparing for the research, can you start the session? Not quite yet—there are still two things you need to do:

Put on something a bit more formal—no tank tops and shorts.

Sync the research information with the frontline colleagues accompanying you, so they know what you’re trying to achieve.

The first step is to show the client that you’re professional and respect them. I once had a PM colleague show up to a client site in shorts and sandals, resulting in an immediate complaint sent to our company’s inbox.

The second step is to ensure that your colleagues know your research goals, even though they may not speak during the session. At least they’ll have a general idea of the questions you’ll be asking. Frontline colleagues often worry that PMs might ask inappropriate questions, damaging the client relationship, forcing them to patch things up later over drinks.

Once you’ve done these two things, you can start the session. Exchange business cards at the beginning, then calmly and confidently follow your research process.

If two PMs are traveling together, one can lead the interview while the other takes notes. The note-taker should aim to record everything the client says.

However, in my company, they are quite thrifty, so usually, it’s just one person conducting the research. In this case, you’ll need to rely on recordings to capture information. Whether or not to inform the client about the recording depends on the situation. For instance, clients in the internet industry typically won’t mind, but manufacturing clients tend to be more sensitive. As for recording devices, a simple iPhone works just fine—no need for a professional recorder.

During the research, if a discussion about other products comes up, make sure to follow up with the relevant product lines afterward. Don’t let it slip.

At the end of the session, if you’ve built a good rapport with the client, consider giving them a book related to your product. This serves two purposes: to thank the client for their time and to give them a sense of achievement. Giving a book is a gesture of sharing knowledge, which is more acceptable than money and still maintains the client’s dignity. This makes them more likely to engage with you again in the future.

After Research

The on-site research phase may be over, but the research process is not. To close the loop effectively, you need to complete three more tasks:

Document the day's research: Summarize each day’s research findings and share them with the product team. Even if your colleagues aren’t working on the same product, they may spot new opportunities or issues that can improve the next research session.

Follow up on customer issues: Compile a record of the problems raised by customers. If any of these issues are resolved, notify the client via phone or email to enhance their impression of your company.

Showcase helpful client contributions: If certain client contributions significantly influence product design, consider displaying their information somewhere in the product. This can boost customer loyalty. For example, one of our product lines displayed relevant client information on the “About Product” page, and the clients were thrilled.

B2B products are tough; handle them with care.