1. Quickly Familiarize Yourself with the Business

The depth of a B2B product manager’s understanding of the business greatly influences their ability to properly plan product requirements. Insufficient business research often leads to product designs that fail to meet customers’ real needs, which can be quite unsatisfactory. There are many ways to conduct business research for B2B products, with customer research being just one of them.

Consult with Sales Personnel

Typically, after a B2B product is sold, the company assigns a dedicated salesperson to maintain long-term contact with the customer. This salesperson frequently visits the customer site, provides operational guidance, and gathers feedback. Thus, they have significant insight into the background of customer needs. However, keep in mind that the needs collected through this method are often second-hand, having been processed by the salesperson. Furthermore, due to their responsibilities, salespeople may exaggerate the importance of certain customer needs.

Analyze Data

Product managers must remain data-sensitive in their work. Any unusual data fluctuation could signal a business issue. For B2B products, key data generally includes behavior data and business result data. For example, in my current role in distribution products, behavior data includes customer registration times, feature usage frequency, and opportunity follow-up rates. Business result data includes order quantities, sales revenue, and the number of visitors from the C-side.

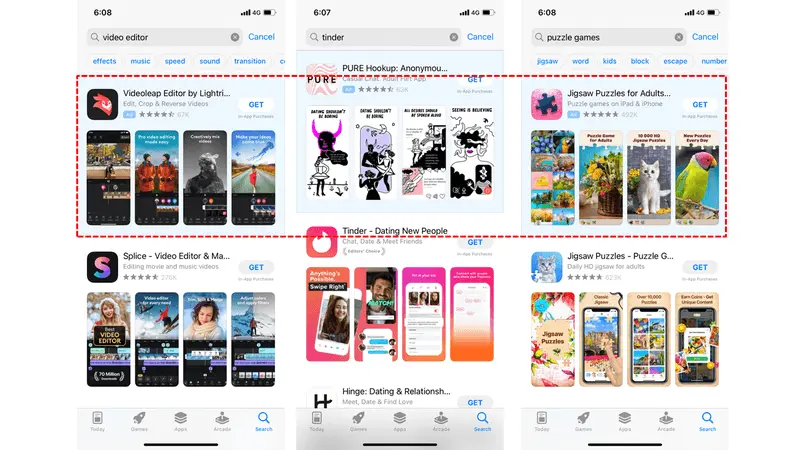

Competitive Analysis

Competitive analysis for B2B products is not as rich and accessible as it is for C-side products, but it’s still essential to use all available resources to gather information. For instance, request company funds to purchase services from top competitors.

On-Site Customer Research

I believe on-site customer research is the most effective method of business research. Through one-on-one communication with the customer, you can directly address issues and quickly obtain the answers you need. Additionally, being on-site allows you to survey customers in different roles, which helps you gain a comprehensive understanding of the customer’s business.

2. Five Steps for Conducting Customer Research

On-site customer research is the most effective form of business research, but it is also the most costly. Customers may be located all over the country, and after going through the trouble of traveling to a customer's site, inadequate preparation may lead to poor research outcomes, which can be a significant blow to both personal and company morale.

In my opinion, a successful customer research process includes the following steps:

Clarify the research purpose

Select research subjects

Prepare a research record sheet

Conduct on-site research

Produce a research report

Clarify the Research Purpose

(1) Uncover Functional Defects

One crucial point to remember is that B2B customers have a low tolerance for product flaws. They purchase products with the expectation of improving business efficiency or increasing performance. If the current version of the business process no longer meets their operational needs, resulting in losses, customers have every right to be upset.

To avoid these business defects as much as possible, product managers should not only passively receive customer feedback but also actively observe data, engage with salespeople, and visit customers for research when necessary. This helps them understand the current business situation, identify defects early, and prevent customer losses.

(2) Conduct Pre-Research for New Features

When developing B2B products, you cannot plan customer needs from a god-like perspective. Unlike C-side product managers, it’s unlikely that you will be a superuser of your product, and what you consider essential features may not be what your B2B customers need.

To develop a new feature module that enhances business efficiency, you need to consider multiple dimensions, such as the company’s operational strategy and management model. This typically involves many different roles within the customer’s organization, making on-site research the fastest way to confirm the feasibility of your solution.

Select Research Subjects

Unlike traditional outsourced B2B products, SaaS products cannot tailor functions for each individual customer. As a result, the degree to which different customers are suited to each SaaS function varies. Based on this, choosing the right research subjects for the function being studied can significantly improve the effectiveness of your research.

(1) Customer Profiles

Just as C-side products have user profiles, B2B products have customer profiles:

Note: Profile fields should be based on the needs of the business.

In my opinion, B2B product customer profiles can be divided into two main categories:

Basic Attributes: These include the customer's current strategic goals, business model, and organizational structure. This helps provide a deep understanding of the customer and guides the direction of product planning.

Business Attributes: These are based on the customer's behavior and result data with the product, allowing you to determine which modules they use most frequently and the scale of their business.

By analyzing customer profiles in conjunction with the functionality being researched, you can filter out a suitable list of customers for your research.

Customer Organizational Structure

Choosing the right company is only the first step. You can’t interview every employee, so you need to choose the right roles. Use the company’s organizational structure to identify the users of the function being researched.

For example, in a recent study focused on adding an opportunity allocation and follow-up feature to a customer relationship management module, I needed to interview sales managers and sales staff.

Prepare a Research Record Sheet

As the saying goes, “If you want to do a good job, you must first sharpen your tools.” When conducting face-to-face research, much like a journalist conducting an interview, you should prepare an outline of questions in advance to avoid a chaotic session that fails to yield useful information. Additionally, record customer responses on the research sheet for later review, making it easier to study their real needs.

The research record sheet typically includes:

Research subject, department, and role: This helps assess whether the subject's demands or opinions are consistent with their position.

Contact email, phone/WeChat: This helps maintain contact with the subject and fosters a closer relationship, allowing you to reach out for clarification if needed.

Research notes: List your question outline before the interview and note the customer’s responses during the session. This makes it easier to review and analyze after the research is complete.

On-Site Research

On-site research primarily tests the product manager’s communication and social skills as well as their ability to think on their feet. There aren't many tricks here—it's mostly about practice. I’ll share a few lessons learned from my own experiences in the hopes of helping others avoid some of the pitfalls:

Confirm the availability of the research subject. Before traveling to the customer’s city, confirm that they will be present at the agreed time on the research day. Upon arrival, double-check that they are available during the scheduled time slot.

Discern the truthfulness of customer statements. You should never take everything a customer says at face value. For example, when discussing sensitive or confidential company matters, customers may give conservative or inaccurate information. After the research, carefully analyze their responses.

Clarify unclear points on the spot. If you're relatively new to the field and don’t fully understand the business, you may encounter complex or unfamiliar terms during the interview. If these terms affect your research conclusions, seek clarification immediately, even if it makes you feel unknowledgeable. Better to be seen as uninformed in the moment than to misunderstand later.

Do not make immediate promises on-site. Remember this crucial point! Unless the customer’s request is very simple, do not promise that a feature can be implemented or give an exact timeline for its release without consulting with technical staff. If the customer is insistent, use phrases like “we’ll confirm feasibility with the tech team” or “the timeline needs to be discussed internally” to manage their expectations.

Produce a Research Report

Whether or not your company requires it, I believe that producing a research report on the day of the research is a good habit to develop. Not only will the research still be fresh in your mind, making it easier to organize, but you’ll also demonstrate your proactivity and efficiency to your superiors. Reports are usually sent via email to relevant colleagues, with copies to management and the customer being researched.