In B2B sales, catering to complex organizational needs requires a systematic and comprehensive sales module. As businesses navigate market cycles and customer value factors, the right sales strategy—whether focused on growth, operational efficiency, or cost reduction—becomes crucial. For SaaS companies, balancing long-term value with short-term sales goals is key to thriving in an evolving, resource-scarce market.

The sales business module is an essential part of providing information or data-driven products and services to enterprise/institution/company clients (B2B). It should not be underestimated in any process.

B2B business implies that our customers are relatively complex organizations, composed of multiple stakeholders. It also means we need to meet a variety of rational demands from different roles within the organization, rather than the relatively emotional and singular demands that arise in a B2C sales model. Therefore, the design of the sales business module needs to be detailed, systematic, comprehensive, and standardized.

Before discussing the design of the sales business module, we need to understand several factors that influence its design:

1. Market and Cyclical Factors

Currently, the market and cycles are influenced by three overlapping situations:

The decline of the last technological revolution: The ITC era is largely in its downward phase, and new technologies such as AI, new energy, and new materials are emerging but have not yet fully commercialized, become practical, or integrated into everyday life. As a result, they have yet to directly impact our work and daily lives.

Industry-driven decline: Since China's tax reform in 1994, the land-based fiscal system of 1998, and joining the WTO, there have been several major industry drivers, such as real estate (investment-driven), e-commerce (capital-driven), and export processing (export-driven). However, due to various internal and external factors, these industries have entered a recession and can no longer drive the growth of the next economic cycle.

Short cycles caused by supply-demand imbalances: Fiscal and monetary policies, market-driven capital flows, irrational investments and expansions by enterprises, and excess supply all contribute to short cycles of supply-demand imbalance. Currently, we are at the tail end of one of these short cycles.

The impact of the market and cycles on the sales business module can be abstracted as follows:

Initial phase: In the early stage, companies are startups, and the market has yet to fully accept the changes brought by new technologies and industries. We need to engage in substantial forward-looking communication with various stakeholders in the market. This requires personnel who can discuss the future, business, and products, so the sales module is likely to be small but precise.

Growth phase: Companies have gained a certain scale, and the market has started to accept changes brought by new technologies and industries. Commercialization and consumer influence have begun to emerge, and investment resources are flowing in to accelerate growth. At this stage, the company needs to expand its market visibility and share rapidly while optimizing products and technologies based on customer needs. The sales team should expand, incorporate more marketing elements, and open new sales channels to support market growth.

Maturity phase: The market enters full competition, and companies must compete for market share and capture the cyclical windfall. At this stage, the sales module expands significantly, often deploying a regional structure. The sales system focuses on employee productivity, establishing training, SOPs, and scaling strategies to maintain productivity while expanding.

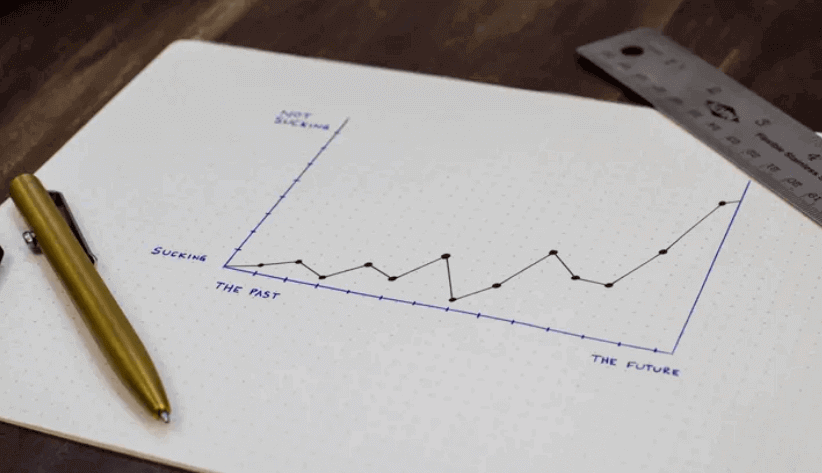

Decline phase: This phase can last a long time and often first manifests in the investment and media landscape, with diminished company performance, slowed growth, reduced employee productivity, and a drop in customer funnel/conversion rates. This leads to adjustment strategies such as focusing on industry-specific deepening, offering more differentiated services, and building a moat around core customers. Sales teams slim down and become more flexible, diverse, and efficiency-driven.

2. Factors Affecting Customer Value Contribution

Customer value contribution stems from the impact our products or services have in creating value for customers:

Value related to revenue growth: This leads to sustained revenue growth for the company, such as launching new retail systems, micro-mall systems, new store management systems, or adding online platforms. These products or services can alter the business structure of a company, bringing steady revenue growth. Customers are most concerned about and willing to invest resources in this area, but decision-making can be lengthy due to internal resource allocation and collaboration issues.

Value related to market coverage growth: Systems such as SEM, SFA, e-commerce, and omnichannel marketing can improve or increase market coverage efficiency, bringing in more potential customers at a low cost via the internet. This value is an added bonus for customers, so refining product and service capabilities in this area is an excellent strategy. Even beginners can quickly grow in this area by knocking on doors, clearly articulating the benefits, and networking.

Value related to operational efficiency: Systems such as sales management, customer management, BI data warehouses, and ERP/SCM optimize internal operational efficiency. This is especially true for service companies with over 500 employees, internet companies with over 700 employees, and mid-sized or larger manufacturers. These companies have clear operational efficiency needs, but such demands are hard to trigger unless the pain is felt. Sales systems need to continually plant the seed in the minds of customers and manage relationships to ensure that when the need arises, the customer turns to us first.

Value related to cost reduction and efficiency: Systems such as HR, finance, and OA reduce the increase in labor costs due to repetitive tasks through automation and external procurement. Sales for these products remain a game of coverage—the more extensive the sales system’s reach, the more opportunities to secure deals quickly.

3. Factors Affecting Customer Organization Relationships

The impact on customer organization relationships depends on how many different teams are affected by our products or services. The more teams impacted, the higher the difficulty; the fewer teams, the lower the difficulty:

Intra-functional impact: This affects only one department or function, and other related teams just need to execute, such as legal purchasing an online contract system or BI implementing a new data warehouse system. This sales model requires a "wide net, short cycle" strategy to quickly capture the market.

Cross-functional impact: Besides the main department, upstream and downstream teams may also need to change their workflows, such as SFA, OA, or financial reimbursement systems. This sales model needs "deep communication, full presentation, single-point breakthrough" strategies, offering a comprehensive solution and pressing the main decision-making department to close the deal quickly.

Operational chain impact: Products like Feishu, WeChat Work, CRM, or ERP affect the entire operational chain of a company. Sales models for these products focus on a "partnership" strategy, where partners provide trustworthy and excellent advice for large-scale adjustments and optimizations.

4. Factors Affecting Customer Procurement Costs

Procurement costs influence sales systems primarily through personnel profiles, workflows, and customer relationship management strategies, though detailed data is lacking.

Based on these influencing factors, and from our observations in B2B software business operations, we have encountered four types of businesses:

Type 1: Basic software systems and technical services, such as corporate websites, domain names, corporate mailboxes, and corporate network hardware/software outsourcing. Sales focus on direct sales and online sales.

Type 2: Enterprise information solutions, such as CRM, ERP, SFA, and data centers, offering value-chain information capabilities to enterprises. Sales focus on direct sales, service providers, and regional exclusive agents.

Type 3: Platform rights and traffic purchasing, such as internet intermediary platforms, recruitment platforms, and e-commerce platforms. Sales focus on direct sales, often with a service provider system heavily reliant on the product.

Type 4: Subscription-based SaaS enterprises. These businesses iterate commercial models from types one and two, offering customers lower total procurement and operational costs with flexible, efficient enterprise information services. Sales focus on direct sales and product sales agents.

Subscription-based services, or SaaS, have distinct differences from enterprise informationization, software, and solutions in the ITC era, fostering more systematic sales management and operations. The design of the sales business module for SaaS businesses must consider three key scenarios:

Long-term value contribution but short-term sales strategies.

Infinite potential market with scarce effective sales and customer resources.

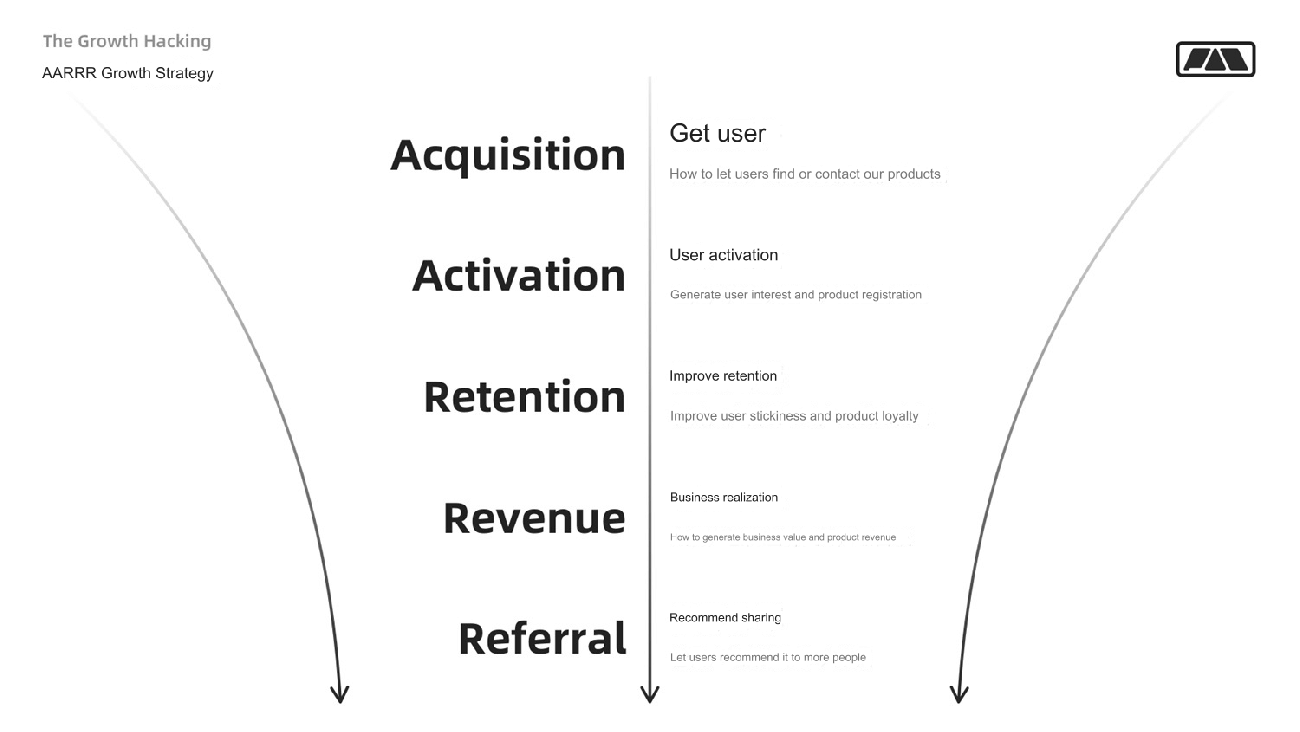

Innovation in B2B marketing models and the continuous rise in CAC (customer acquisition cost).