In this article, the author shares a general framework for product growth thinking, focusing on three main aspects: setting goals, identifying factors, and building models. The article outlines the specific construction process of this thinking framework, offering significant applicability and reference value. Whether for B2B or B2C products, the focus changes at different stages of product development, and the strategies and methods used are often different.

The "growth model" as a universal approach can be applied to various stages and types of products, solving the problem of achieving product goals.

Here are the specific steps to execute the model:

1. Establish the "North Star Metric"

The "North Star Metric" is the sole purpose of growth, and it is quantifiable.

Like a guiding star, it directs the course of product iteration and updates, helping you focus your limited resources on driving growth and enhancing product value. This is particularly crucial when a product reaches the mid-to-late stages of development, where scale expands, and communication efficiency decreases. An effective "North Star Metric" aids in goal management for large teams and boosts overall execution.

For different types of products, at various stages of development, the "North Star Metric" will vary and should be determined based on the product’s actual situation.

The "North Star Metric" must be closely tied to the business reality and the product's positioning.

Here are two practical examples:

For the Q&A platform "Zhihu," its "North Star Metric" is generally "the number of questions answered." This metric directly reflects user engagement on the platform—whether more people are not only asking questions but also answering them. It also aligns with the platform's core focus on both "questions" and "answers."

For the ride-hailing platform "Didi," its "North Star Metric" is typically "the average waiting time for riders." While the initial focus might have been on "the number of ride requests," in today's highly saturated market, "average waiting time" better reflects the density of passengers and drivers in a given area, as well as the intelligence of the dispatch algorithm.

It is important to note that the "North Star Metric" is not necessarily fixed; it can evolve at different stages of business growth.

Beware of "Vanity Metrics"

Not all metrics are suitable to serve as a "North Star Metric." Some metrics may appear impressive but are actually of little value.

Relying on "vanity metrics" is risky, as a wrong metric can mislead the team, ultimately leading to failure.

Common "vanity metrics" include click-through rates, page views (PV), unique visitors (UV), follower/friend/like counts, time spent on the site, the number of pages browsed, and registration numbers. These metrics can easily create a false sense of success, leading to misjudgments about the product's status, and in some cases, even causing resource wastage and team confusion.

Another characteristic of "vanity metrics" is that they are easily manipulated. For example:

A real estate agency app sets a goal to "increase the number of registered users" and assigns this target to the sales team, requiring each real estate agent to complete a certain number of new user registrations each month. This is a typical "vanity metric" for the following reasons:

This metric is not closely tied to the "North Star Metric." More registered users do not necessarily mean more real estate transactions.

It can easily be manipulated. For instance, agents can use registration bots or purchase fake phone numbers to meet their quotas. The platform may then need to allocate additional resources to address these issues.

It consumes a lot of resources and distracts the team.

2. Identify Relevant Factors

The next step is to identify factors closely related to the "North Star Metric," meaning that changes in these factors will directly impact the "North Star Metric."

You can try the following methods to identify these factors:

1. Business Understanding

Based on your understanding of the business, you can identify relevant factors.

For example, the sales revenue of a snack shop is generally related to its location, pricing, and taste of the snacks. These factors can be easily derived from a basic understanding of the offline food industry.

2. User Interviews

Conduct targeted interviews with users to uncover relevant factors.

When selecting interviewees, focus on two key groups:

High LTV (Lifetime Value) customers: These customers spend the most on your business and are the ones who have benefited the most from your services. Their feedback often contains highly relevant factors.

Low LTV customers: These are the users who abandon your product, either from the beginning or after using it for a while. Understanding their reasons for leaving can also provide important information on relevant factors.

Interviewing more "extreme" users can often yield clearer insights.

3. Data Analysis

Using data analysis to uncover relevant factors requires a clear understanding of the three main categories of data:

1) User Data

This type of data includes demographic attributes such as gender, region, education level, and preferences. These indicators reflect the characteristics of the users themselves.

For example, if your business involves selling milk tea and your market covers the entire country, when analyzing user preferences, you would need to consider regional differences, as users from different areas may have varying preferences for sweetness (e.g., users from the Jiangsu, Zhejiang, and Shanghai regions may prefer sweeter drinks).

2) Behavioral Data

Behavioral data indicates the actions users take within the product, such as page visits, element clicks, and time spent. User behavior reflects their expectations, and we can easily use behavioral data to infer users' actual needs.

Behavioral data is especially useful when optimizing business processes or product experiences.

For example, if you observe that a specific section of an app receives a high volume of clicks and long viewing times, this indicates a high level of user interest. In subsequent product iterations, you could prioritize optimizing this section. This could involve enhancing its design or improving the quality and quantity of the information provided.

3) Business Data

Business data reflects product performance indicators such as order volume, GMV (Gross Merchandise Value), and so on.

Based on your business understanding and user interviews, you can select data indicators that may be highly correlated with the "North Star Metric." For example, if the "North Star Metric" is "conversion rate," the behavioral data "7-day visit volume to product detail pages" may be highly correlated with it.

3. Building a Growth Model

A growth model is essentially a formula composed of relevant factors:

North Star Metric = A × B × C

Here, A, B, and C are the relevant factors identified in the previous steps.

For example, in terms of "conversion rate" in user behavior, the growth model might look like this:

Conversion Rate = Homepage Visits × Search Executions × Product Page Views × Order Button Clicks × …

Note that this formula only reflects user behavior. If we consider user attributes or business data, the formula may change. For instance, if your business is selling trendy sneakers, you may need to consider:

Conversion Rate = Male User Proportion × Proportion of Users Aged 15-35 × …

In terms of business data, you might consider:

Conversion Rate = Number of Popular Sneaker Brands × Inventory of Latest Models × …

We can also establish a top-level growth model for the overall business framework of a company. Take e-commerce giant Amazon as an example:

Amazon Growth = Category Expansion × Inventory per Category × Product Page Views per Item × Purchase Conversion Rate × Average Order Value × Repeat Purchases

1. Breakdown

Each relevant factor can be broken down further:

A = A1 × A2

For example, taking "conversion rate" as mentioned above, the "search execution" can be further broken down as:

Search Executions = Keyword Input × (Real-time Recommended Results Clicks + Fuzzy Search Executions) × …

You can still use the three methods mentioned earlier to find relevant factors.

Follow the "MECE" principle (Mutually Exclusive and Collectively Exhaustive) to break down the metrics as precisely as possible. This helps in assigning team tasks and achieving overall objectives.

2. Data Analysis

Once the model is built, adhere to the principle of "data-driven" decision-making. Use the results of data analysis to guide the development of product strategies.

Common data analysis methods include:

1) Trend Analysis

This involves observing changes in a certain metric over a specific dimension. A typical scenario would be tracking how certain factors change over time.

Pay extra attention to anomalies (sudden spikes, drops, or fluctuations) and investigate the events that caused the anomaly (e.g., product updates, technical optimizations, market shifts) and their correlation with the anomaly.

For instance, if you observe a pattern where "order volume peaks every Friday evening," you can consider triggering promotions or reminders during that time.

2) Distribution Analysis

This examines how a metric is distributed across different attributes.

For example, you can analyze the age distribution of customers who have purchased a product to understand the majority age group on your platform. Then, examine the product category preferences of the largest age group to understand which products they like the most.

This kind of data can directly influence inventory stocking and marketing strategies.

3) Funnel Analysis

Funnel analysis is primarily used to assess the conversion efficiency of processes, helping you identify where the most significant drop-off (bottleneck) occurs in the process and allowing for targeted optimizations.

Take the Pirate Metrics model (AARRR) as an example: if there is a noticeable drop in conversion from Acquisition to Activation, you may need to consider whether there’s an issue with lead quality and adjust your acquisition strategy accordingly.

4) Identifying Key Numbers

Identify the key attributes with the highest correlation to the core metrics. For instance, using "conversion rate" and "number of product page views within seven days" as examples:

Analyze the distribution: Rank the distribution of "seven-day product page views" in descending order, and identify the most common behaviors, such as 10 or 20 views.

Drill down and compare: Analyze and compare the conversion rates of users who viewed the product page 10 times versus 20 times.

Repeat steps 2 and 3 to identify the behaviors that yield the best results for the "North Star Metric." For example, users who view a product page 20 times in seven days may have the highest conversion rate.

3. Strategy Formulation

Based on the data analysis results, you can clearly devise product strategy plans.

Returning to the example above, when you learn that users who view a product page 20 times in seven days have the highest conversion rate, the next question is: How can you get more users to view the product page 20 times within seven days?

Essentially, the goal is to find the core behavior and encourage users who haven’t exhibited that behavior to do so, achieving the key metric.

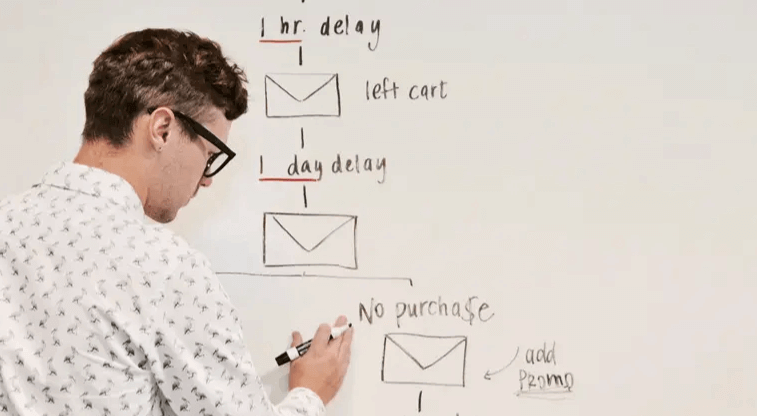

A typical process involves:

First, brainstorming.

Team members share their thoughts, proposing various potentially feasible ideas, and organizing them into a list (backlog).

Then, rapid experimentation and iteration.

The product manager or growth leader prioritizes the ideas from the list and implements them in the product based on priority.

When conducting experiments, it's important to control the scope (e.g., limiting the user group involved in the experiment) to obtain the best experimental results. A/B testing is a commonly used method.

For instance, if your experiment is to adjust the copy for the order button to see if it increases clicks, you should involve only a small group of users in the experiment (to avoid affecting the overall product) and focus on users who have previously shown poor click performance to ensure you get clear results.

The experiment results will either validate or disprove the hypothesis.

If the idea positively impacts the key metric, it can be kept; if not, discard it and move on to the next experiment.

To accelerate the process, consider running multiple experiments in parallel based on team resources.