"I have an AI-specific meeting every week," a smartphone manufacturer mentioned at a communication event following the launch of a new phone. This highlights how AI features must first align with user intuition, reflecting the growing emphasis smartphone manufacturers place on AI.

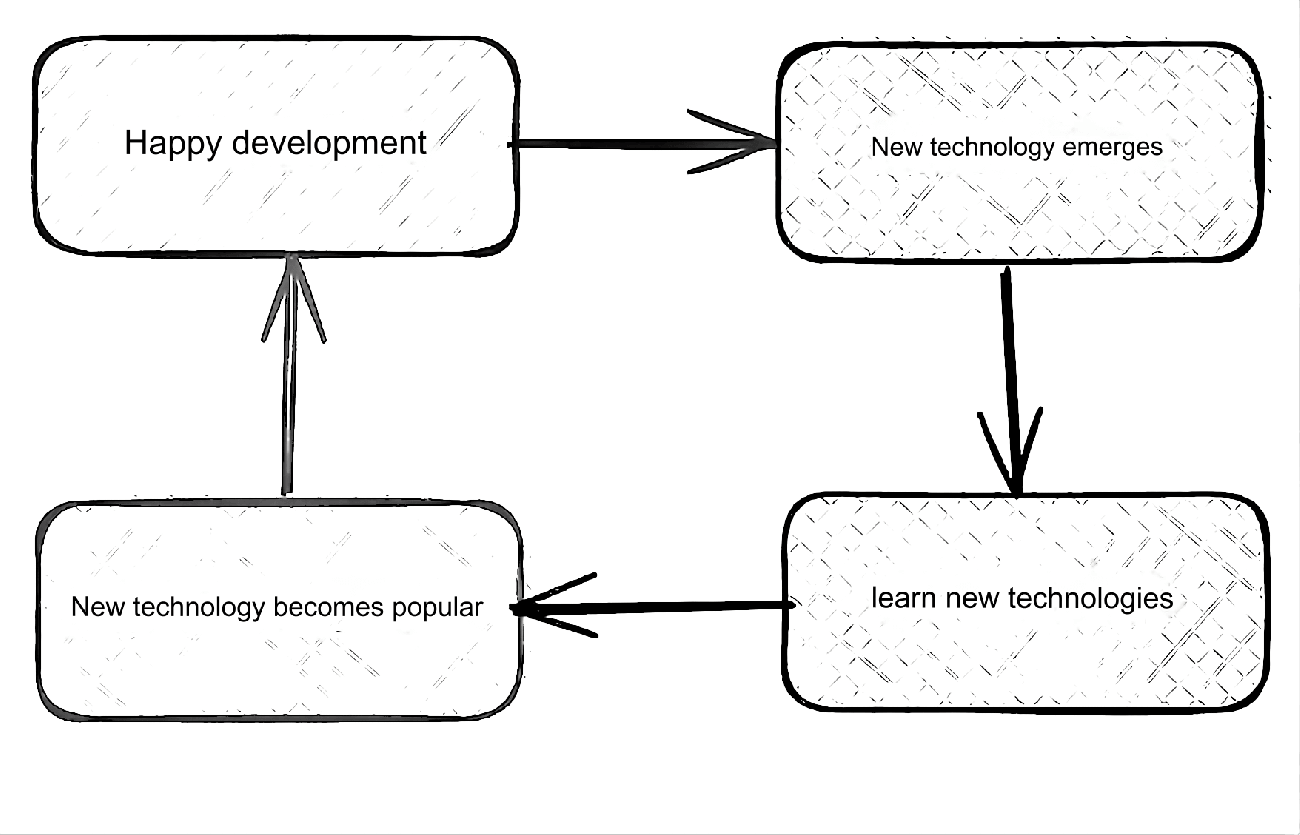

Technological development can never be paused. Each time it seems like technological iterations have reached a bottleneck and there's nothing left to innovate, a force always breaks through the existing framework, leading humanity out of a dead end and creating new possibilities.

In the end-of-year new phone releases, brands like OPPO and Xiaomi mentioned breakthroughs in ultra-narrow bezels, which are the result of significant investments in both time and money. Crafting these bezels requires glue injection and meeting chip-level dust-proof standards, which are costly investments. However, the user perception remains limited.

The hardware side of smartphones is nearing its physical limits, and there is little space for further improvement in screens, cameras, and processors. Just as the industry seemed to be entering a twilight phase, the explosion of AI on the device side has created a new opening.

Although AI was already integrated into smartphones around 2017 in areas like imaging and voice assistants, 2024 may truly be considered the "first year" of AI smartphones. This year, AI technology coincided with the overall recovery of the smartphone industry and the transition of AI from the lab to practical applications.

Against this backdrop, AI smartphones have shifted from being a supplementary "bonus feature" in select models to a "must-have feature" across all models. This has not only propelled the industry forward but also triggered a new business ecosystem waiting to be activated.

1. AI Smartphones Need to Prove Themselves

AI can be said to be one of the driving forces behind the overall recovery of the smartphone industry in 2024.

According to Canalys, AI smartphone penetration will reach 17% in 2024, and by 2025, it is expected to accelerate further, with global penetration reaching 32%—AI smartphones have accomplished in just over a year what foldable smartphones have failed to achieve in six years.

While the growth is rapid, the statistics are somewhat nuanced. In the midst of this competitive landscape, no new phone launch is without some form of AI integration. AI has become the "nuclear weapon" of flagship models—it’s not mandatory, but it must be there.

The reason for this shift is clear: with foldable screens struggling, the smartphone industry is in desperate need of a new gimmick for survival.

This can be traced back to the past few years when the smartphone industry narrowly avoided a crisis. At that time, Moore's Law, which had been pushing the consumer electronics sector forward, hit a bottleneck. This directly led to a situation where both hardware and software manufacturers were “kicking the ball back and forth,” causing the hardware upgrade model to lose effectiveness.

To address this, anxious manufacturers even attempted to port PC-level technologies like ray tracing to smartphones. However, unlike PCs, the smartphone market is not closely tied to gaming or productivity, so the impact was limited. Other solutions, such as imaging and foldable screens, had limited use and could only cater to niche markets, failing to spark a massive upgrade wave.

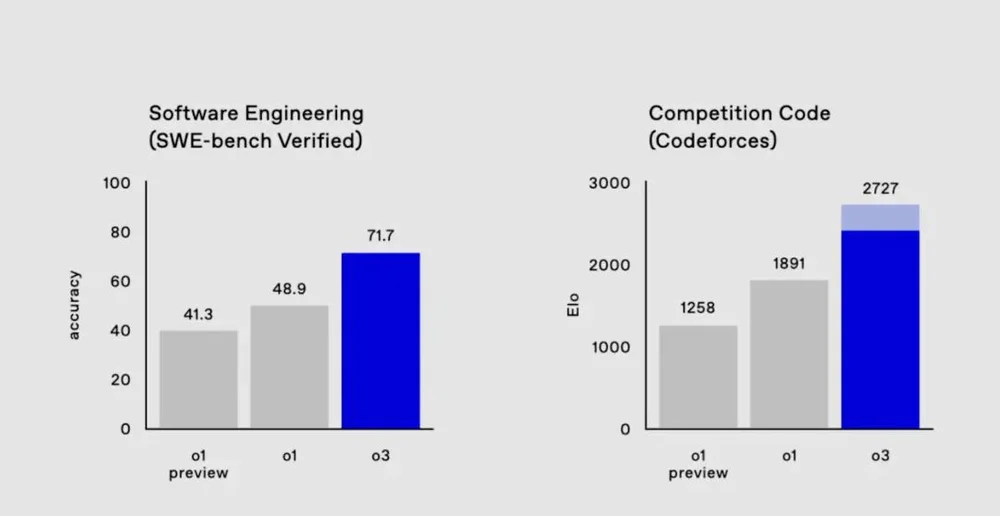

AI, however, is different. End-side AI, compared to past smartphone performance improvements, offers significant changes. According to an industry insider, AI models don't rely on small cores but instead focus on NPU (Neural Processing Unit) capabilities, ideally supported by large memory and high memory speeds.

For smartphones to truly become AI-powered, the hardware will inevitably need to be restructured, which means new device purchases. A key step in this process is convincing the broader consumer market to embrace AI smartphones.

Research conducted by Photon Planet in mid-2024 revealed that AI smartphones in stores appeared cold and indifferent—both customers and store staff showed little enthusiasm for them. A recent survey by SellCell found that 73% of Apple Intelligence users and 87% of Galaxy AI users felt that AI lacked value or had little to no value in their usage.

This is understandable, as many AI features, such as summarizing PPTs, call summaries, or image generation, are not widely used by most consumers—even with frequent iterations and upgrades. Ultimately, AI smartphones are still confined by niche demands and face the same challenges as foldable screens.

Therefore, demonstrating the value of end-side AI to users as early as possible has become a top priority for smartphone manufacturers.

Looking at the new phones released in the second half of this year, whether by Apple, Samsung, or brands like Honor, Xiaomi, and OPPO, none of them have been stingy in promoting AI features. From AI photo editing and AI conversations to more system-level deep applications, they have all been highlighted in promotional materials.

Among these, the most imaginative and appealing feature is the "autonomous driving" enabled by AI screen reading, where AI interacts with apps by reading the screen information and executing user commands.

This signifies that AI smartphones are gradually moving beyond being simple AI tools and toys, integrating more deeply into smartphone interaction and system layers, potentially disrupting traditional smartphones. This deep AI integration could lead to a significant reshuffling of end-side AI and even create new business models for manufacturers.

2. AI is a Lifeline

"Performance oversupply is a false proposition in the AI era. Games and photography demand very high performance, and component upgrades are not entirely in vain. The progress in chip manufacturing technology has actually opened up greater space for AI."

A representative from a smartphone manufacturer stated that end-side AI requires high system requirements, especially for consumer-grade products. Even basic tasks like heat dissipation seem simple but are actually quite challenging. The smartphone industry has just started addressing underlying issues like memory usage. Over the past year, many manufacturers have made optimizations for end-side deployment, but these efforts are often overlooked due to weak consumer perception.

The biggest bottleneck for end-side deployment is the use of smartphone computing resources, particularly memory. As more functions are moved to the end side, the computational demands increase, and hardware manufacturers typically don't allocate memory specifically for this purpose. Therefore, most manufacturers dynamically allocate memory based on the needs of end-side AI features.

For example, OPPO's AI LoRA architecture uses dynamic allocation solutions. It provides three end-side features, one of which is occupied by the base model, and the other two are adjusted based on actual conditions. This solution can reduce memory usage by 75% at peak.

As the architecture matures, large-scale ecosystem transformations begin. Some manufacturers believe that "next year’s presentations will likely be longer," as hardware descriptions will be replaced by AI features, which require more time to demonstrate.

In addition to smartphone manufacturers, large model companies like Zhipu have launched features this year that enable the rapid execution of complex tasks through natural language commands, based on task planning and screen information understanding abilities.

Some insiders believe that the relationship between smartphone manufacturers and app developers is not entirely adversarial. At present, it’s more of a cooperative relationship. “For developers, having users download an app does not necessarily mean they will use it. End-side AI can help increase the frequency of app usage, and manufacturers need to cooperate with developers to make AI assistants smoother.”

The most obvious advantage for app developers lies in vertical consumption data. For example, in services triggered by photography, connecting to OTA services requires millions of vertical data for specialized training. Smartphone manufacturers lack this data and have no reason to reinvent the wheel, so stable partnerships with developers are formed.

"In fact, direct calls, like navigation or shopping, are welcomed by app developers because manufacturers push services to users directly," said one manufacturer. Existing mobile services are already saturated, and developers are more focused on helping users quickly access services, especially when they need them. The easier the entry, the higher the usage frequency.

Despite this, the AI feature demonstrations in this year’s new phones show that smartphone manufacturers’ influence is growing with the acceleration of end-side deployment. When Zhao Ming of Honor demonstrated ordering from Luckin or Magic OS 9.0’s one-click shopping comparison, few considered whether it’s based on user habits or influenced by commercialization.

There’s no doubt that, through direct access, smartphone manufacturers' intelligent assistants will likely change the current mobile interaction model—from app-based to intelligent assistants, from simple touch-based to multiple interaction forms including touch, natural language, and intent recognition. This will strengthen smartphone manufacturers' “entry” positions and increase their control over app distribution, marking another battle for "traffic entry" after pre-installed apps.

3. Can It Change User Habits?

Whether users will embrace AI smartphones is the only measure of success.

Earlier surveys by SellCell revealed that, although 73% of iPhone and 87% of Galaxy AI users felt that AI features were of little value, nearly half of them considered AI an important factor in purchasing decisions. In other words, users recognize the importance of AI, but the actual experience is not satisfactory.

This is because large models designed for PC are somewhat “ill-suited” for mobile devices. Most large model companies rely on PC browsers for services that are productivity-oriented, which don’t fully align with mobile scenarios. For example, voice interactions in public spaces are less effective than touch interactions, and document summarization is less frequent than generating social media captions.

Recently, Bloomberg’s tech journalist Mark Gurman stated that iOS 19 will drop ChatGPT integration in favor of a self-developed model.

Another challenge for AI smartphones comes from user habits. As traditional smartphone operation logic is well-established, AI features can significantly simplify user habits, but users still need time to adapt to the new interactions. Just like the transition from feature phones to smartphones, which took years for users to embrace mobile ecosystems and touch-based interactions.

Smartphone manufacturers are now focusing on AI features like AI screen reading, hoping to explore new scenarios or business models in preparation for the next era.

Whether technology can drive a shift in user habits remains uncertain. After all, as a tool, smartphones give users a strong sense of control, and AI may create an over-intelligent experience that makes users feel less in control. How to guide users step by step to accept and rely on AI remains a market challenge that manufacturers must overcome.