TSMC has completed successful trial production of 2nm wafers, surpassing expectations with a yield rate of 60%. As competitors like Samsung and Intel struggle with their respective processes, TSMC solidifies its dominance in the semiconductor foundry market.

On December 6, Taiwan-based Economic Daily News reported that TSMC had completed trial production of 2nm process wafers at its Baoshan plant in Hsinchu County. Impressively, the yield rate for these trial productions reached 60%, far surpassing the company’s internal expectations.

According to TSMC Chairman Mark Liu’s statements during the Q3 earnings call, market demand for 2nm technology is expected to be immense, potentially surpassing that of the 3nm process.

Expanding Capacity for 2nm

TSMC has already planned at least four factories across Hsinchu and Kaohsiung dedicated to 2nm production. By early 2026, when operating at full capacity, these plants are projected to produce a total of 120,000 wafers per month.

With Samsung facing setbacks in process development and Intel’s foundry business mired in uncertainty, TSMC has established a dominant position in the semiconductor foundry industry.

The Right Strategic Path

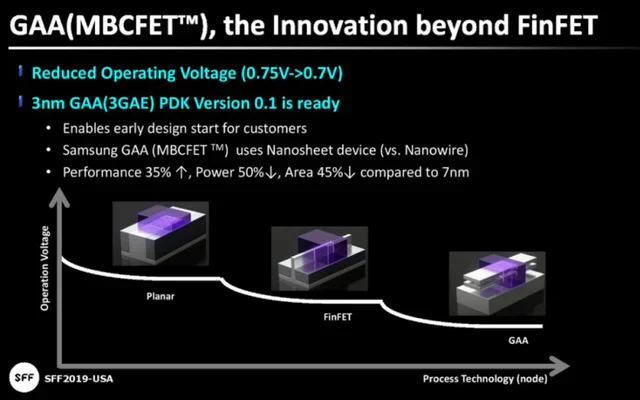

In the chip manufacturing industry, the 2nm node is widely regarded as a “decisive milestone.” Its significance lies in the limitations of the previously reliable FinFET architecture, which begins to fail at this scale due to the inherent "short-channel effects" of CMOS devices.

Understanding the Technology

The term “14nm” or “7nm” refers to the length of the conductive channel in a transistor. As transistor density increases, these channels must become shorter. However, shorter channels reduce gate control, leading to increased leakage current.

To address this, Chinese-American scientist Chenming Hu proposed the FinFET architecture in 1999, featuring a 3D fish-fin-like gate design that mitigates leakage issues while maintaining smaller channel lengths. This architecture extended Moore’s Law for nearly 20 years until its limitations emerged at the 5nm process.

The successor to FinFET, GAAFET (Gate-All-Around FET), was introduced to address these challenges. GAAFET rotates the gate fins 90 degrees and divides them vertically into multiple layers, increasing the contact area with the channel.

However, GAAFET significantly increases the complexity of the manufacturing process.

TSMC’s Strategic Conservatism

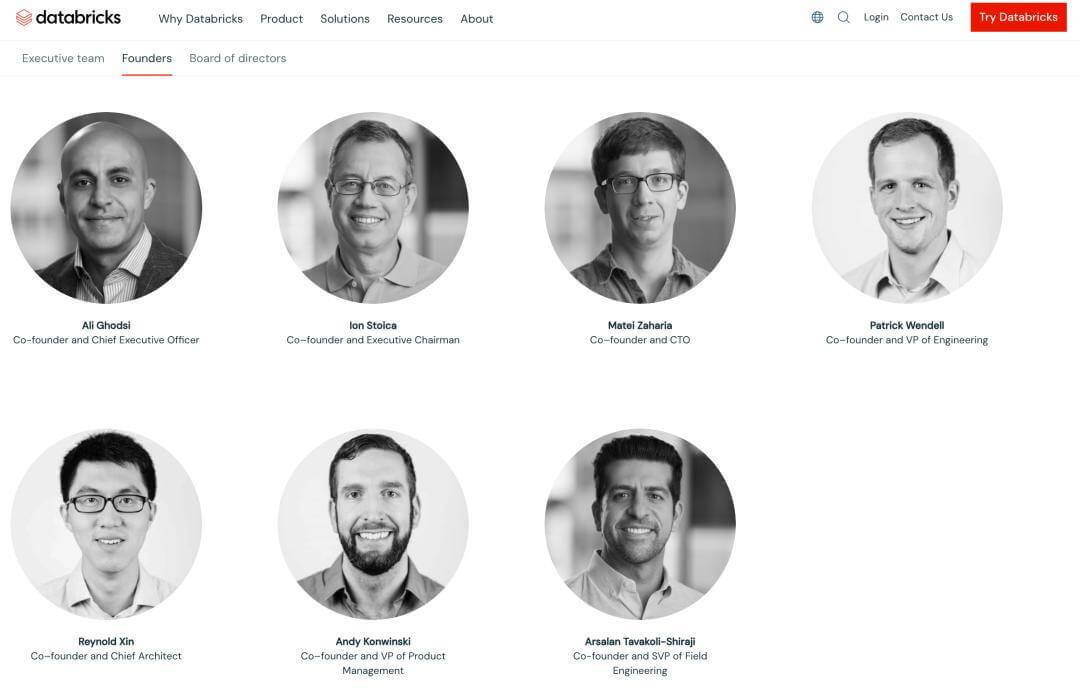

Unlike Samsung, which adopted GAAFET for its 3nm process but faced a yield rate of less than 20%, TSMC continued refining the FinFET structure for its 3nm technology. As a result, TSMC achieved yield rates exceeding 80%, nearing 90%.

This conservative strategy allowed TSMC to monopolize the global 3nm chip market. Its Q3 2023 revenue reached $23.504 billion, a year-over-year increase of 36.27%, with net profits of $10.063 billion, up 50.18%.

Building on this success, TSMC is now well-positioned to develop its 2nm process, demonstrating superior performance even with the GAAFET architecture during trial production.

Does TSMC Have Any Real Competitors?

TSMC’s N2 process is expected to deliver a 10%-15% performance improvement over its N3E process (second-generation 3nm) while reducing power consumption by 25%-30%. This makes it particularly appealing to SoC manufacturers for consumer electronics.

However, the costs of 2nm manufacturing are expected to be steep. According to Taiwanese media, the price per wafer could reach $30,000—significantly higher than $18,500 for 3nm and $15,000 for 4nm. These rising costs will inevitably be passed on to consumers.

TSMC’s dominance has enabled it to increase prices even for mature processes like 5nm, which saw a 4%-10% price hike in 2023.

Competitors' Struggles

Samsung plans to focus exclusively on 2nm after its difficulties with 3nm. Reports suggest it may retrofit its Hwaseong S3 production line for 2nm equipment, aiming for volume production by 2027.

Intel, on the other hand, has trial-produced its 18A (equivalent to 2nm) process but faces low yields and internal turbulence, making its timeline uncertain.

Conclusion

In the race for 2nm technology, TSMC’s competitors remain far behind. Downstream clients will likely have to accept TSMC’s price hikes for the foreseeable future.