Databricks secures $10 billion in a historic Series J funding round, led by top investors including Thrive Capital and Andreessen Horowitz, raising its valuation to $62 billion. The AI analytics platform plans to expand its product lines, international markets, and acquisitions while maintaining rapid growth and innovation in the competitive AI landscape.

This marks one of the largest venture capital rounds in Silicon Valley history.

Databricks Secures $10 Billion in Series J Funding, Valuation Reaches $62 Billion

AI data analytics platform Databricks announced today that it is raising $10 billion in a Series J funding round led by Thrive Capital. Following the completion of this round, Databricks’ valuation will soar to $62 billion.

The funding round includes a prestigious lineup of investors. In addition to Thrive Capital, Andreessen Horowitz, DST Global, GIC, Insight Partners, and WCM Investment Management co-led the round. Other notable participants include existing investor Ontario Teachers' Pension Plan and new investors ICONIQ Growth, MGX, Sands Capital, and Wellington Management.

Databricks plans to invest the funds into new AI products, acquisitions, and significant international market expansion. The funds will also be used to provide liquidity for current and former employees and to cover related tax obligations. Notably, this quarter is expected to mark the company’s first time achieving positive free cash flow.

As of October 31, 2024, Databricks reported year-over-year growth exceeding 60% in the third quarter. The company projects its annualized revenue run rate will surpass $3 billion and achieve positive free cash flow by the fourth quarter ending January 31, 2025.

The company boasts over 500 customers with annualized revenue exceeding $1 million each. Its intelligent data warehouse product, Databricks SQL, has achieved a revenue run rate of $600 million, growing over 150% year-over-year.

01 A Star-Studded Investment Team Creating the Largest Fundraising Round in History

“This week has been crazy,” said one venture capital executive involved in the deal, highlighting the intense participation from investors eager to join this historic bet on Databricks.

In mid-November, reports suggested the fundraising round would raise around $8 billion. A few days later, the amount climbed to $9.5 billion with a valuation of $60 billion. Now, the round has reached $10 billion, valuing Databricks at $62 billion. According to CB Insights, Databricks' valuation is now second only to private companies like OpenAI and SpaceX.

Insight Partners’ Managing Director, George Mathew, remarked, “Some calls went surprisingly smoothly, but that’s how great opportunities unfold.”

Further details reveal Insight Partners invested approximately $1 billion in the round. The firm views generative AI adoption as the primary catalyst for Databricks’ next growth phase.

Bloomberg reported in November that Thrive Capital was negotiating the acquisition of about $1 billion worth of Databricks shares.

Among the lead investors, WCM Investment Management, known for public investments, contributed $400–500 million. MGX, an Abu Dhabi sovereign wealth fund, invested a similar amount, pledging to invest $100 billion in AI initiatives, with this being a small part of that commitment.

Capital Group is expected to invest at least $300 million. Known for its large-scale investments in major public companies like Waymo and Stripe, the Los Angeles-based asset manager oversees $2.7 trillion in assets and has a 93-year history.

Lightspeed Venture Partners reportedly participated with a $200 million investment, according to an unnamed source.

Other institutional investors, including Fidelity, T. Rowe Price, Franklin Templeton, and BlackRock, also joined the round at favorable entry valuations.

Databricks has raised $8.6 billion to date from various institutional investors, including Nvidia, Amazon, hedge funds, pension funds, and endowments. The sheer scale of this funding round underscores the vibrancy of the venture capital ecosystem.

However, the question remains: What kind of returns can investors expect from a decade-old company now in its Series J funding round?

Reports suggest Databricks must go public in a landmark IPO within a few years to meet investor expectations. CEO Ali Ghodsi hinted at the possibility, saying, “Theoretically, we could go public as early as next year. This funding round provides flexibility and liquidity opportunities for our employees.”

Insight Partners’ John Wolff noted that Databricks is growing at twice the rate of any public company and has reached breakeven. “If we assume comparable growth rates, its pricing is more attractive than that of other public companies in the market.”

The $10 billion round also benefits Databricks employees significantly. The company allowed employees and existing investors to sell shares while issuing new preferred shares to new investors.

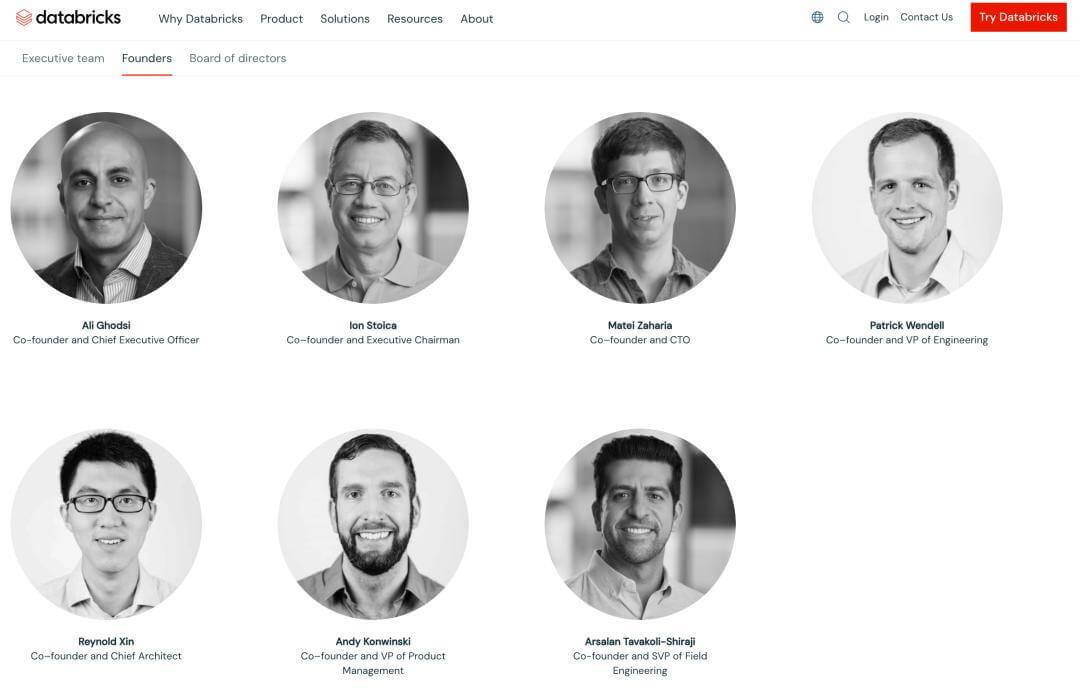

02 Founded by Seven PhD Students, Now an 11-Year Success Story with Billionaire Founders

Databricks was founded in 2013 by seven PhD students from the University of California, Berkeley. The company primarily develops AI, big data analytics, and cloud tools to help businesses build data- and AI-driven applications.

According to Forbes, at least three of its founders—CEO Ali Ghodsi, Ion Stoica, and Matei Zaharia—are now billionaires based on the company’s valuation.

Ali Ghodsi, Databricks’ CEO and co-founder, has been instrumental in the company’s growth and international expansion. Before becoming CEO in January 2016, he served as Vice President of Engineering and Product Management. He is also one of the creators of the open-source project Apache Spark. In addition to his role at Databricks, Ghodsi is a part-time professor and board member of the RiseLab at UC Berkeley.

Interestingly, Ghodsi once sought advice from his friend Mathew during Databricks' early days, mentioning his plan to enter the database market. At the time, Mathew, who was the COO of big data company Alteryx, responded, "I told him it was the dumbest idea I’d ever heard," Mathew said. "Thankfully, he didn’t listen to me, nor did he blame me for it."

Reynold Xin is the only Chinese co-founder of Databricks and serves as its Chief Architect. He initiated projects such as DataFrames and Project Tungsten. To showcase Spark’s scalability and performance, he led the 2014 Daytona GraySort competition, setting a world record by achieving 30 times the per-node efficiency of the previous benchmark.

Before joining Databricks, Reynold was a Ph.D. student at UC Berkeley’s AMPLab, focusing on scalable data processing. He authored some of the most cited papers at SIGMOD 2011, 2013, and 2015, and won Best Demo Awards at VLDB 2011 and SIGMOD 2012.

Matei Zaharia, Databricks’ Chief Technology Officer and co-founder, is also an Associate Professor of Computer Science at UC Berkeley. During his Ph.D. studies at UC Berkeley in 2009, he initiated the Apache Spark project and contributed to the development of widely used data and AI tools, including MLflow, Delta Lake, and DBRX.

Zaharia has researched combining large language models (LLMs) with external data sources, such as search systems, to improve their efficiency and output quality. His work earned him the ACM Doctoral Dissertation Award in 2014 and the Presidential Early Career Award for Scientists and Engineers.

03 Competing Head-to-Head with Snowflake, Boasting a Strong Customer Base

Databricks originated as a commercialization project for the Spark big data processing system from UC Berkeley’s AMPLab.

The company initially developed the big data tool Spark, which enables businesses to analyze internal data at lightning-fast speeds, securing its foothold in Silicon Valley. At that time, traditional data warehouse providers, using storage to analyze vast amounts of enterprise data, competed with emerging cloud computing firms like Snowflake and cloud provider offerings such as AWS Redshift.

By late 2020, Databricks launched its data warehouse product, Databricks SQL, quickly becoming a formidable rival to Snowflake.

Leveraging its expertise in AI data, Databricks has developed a suite of products, including Apache Spark, Delta Lake, MLflow, and OneLakehouse Platform, offering multiple product lines hosted on AWS, Azure, and GCP.

Databricks primarily develops software for extracting, analyzing, and building AI applications that process complex data from diverse sources. Its business model charges customers based on the computational resources they consume per second, using its proprietary DBU (Databricks Unit) as a metric.

According to its website, Databricks boasts over 500 customers, including telecom giant AT&T, electronics company HP, and language AI tool Grammarly.

Regarding the recent funding round, Databricks CEO Ali Ghodsi stated in an interview that maintaining this growth rate requires expanding its market operations and engineering talent. As for potential acquisitions, Ghodsi mentioned he is seeking AI-focused startups to enhance technology and talent.

Databricks currently employs 7,000 people and is expected to achieve positive free cash flow for the first time in the quarter ending January 31. The company is projected to surpass a $3 billion revenue run rate by January and anticipates $3.8 billion in revenue for the next fiscal year.

However, amid increasing AI competition, Databricks faces challenges from cloud providers and must develop new business lines while sustaining rapid growth.

(Sources: The Information, Databricks official website, TechCrunch)