Explore the inspiring journey of AppLovin CEO Adam Foroughi, from his early life in war-torn Iran to his successful ventures in Silicon Valley. Learn how AppLovin grew into a global leader in advertising technology, leveraging AI to reshape the advertising industry and accelerate business growth.

A Former Advertising Unicorn That Went Public via Gaming Now Quietly Surpasses Nvidia with AI

AI business applications have produced an annual AI dark horse!

December 3 Report by Zhidx — The stock price of the American AI advertising giant AppLovin has surged from $38.78 per share at the beginning of the year to $340.59 per share, an increase of over 790%, far exceeding the stock price growth of AI computing giant Nvidia from the beginning of the year to June 7 when it conducted a stock split. AI is the key contributor to its incredible stock price surge.

In its latest financial report, AppLovin's quarterly revenue was $1.2 billion, up 39% year-on-year, and net profit was $434 million, up 300%. The performance growth was primarily driven by the optimization of its AI advertising engine AXON 2.0 for the overall advertising business. During the same period, AppLovin’s adjusted profit margin for its advertising technology platform reached 78%.

This has left many companies searching for AI commercialization opportunities in awe!

While most AI companies are facing commercialization challenges, AppLovin has risen against the tide, achieving a dramatic turnaround with its AI transformation. With performance growth far exceeding industry standards, it has become a Wall Street favorite, with its market value surpassing $100 billion.

The key is that it struck gold by optimizing marketing with AI.

In February 2023, AppLovin launched its AI engine AXON 2.0 and integrated it into two important platforms: the all-in-one advertising platform AppDiscovery and the AI ad creation platform SparkLabs.

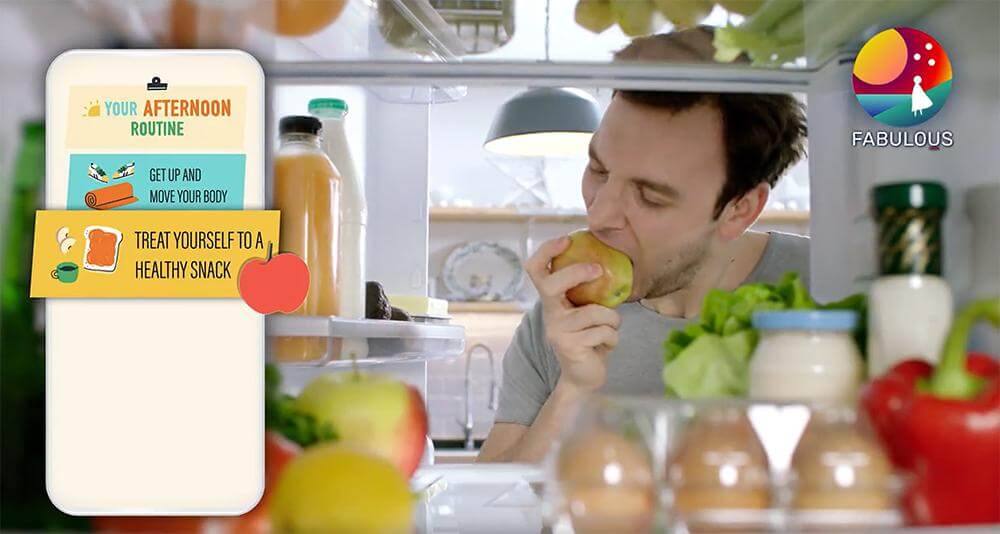

The former focuses on advertising placement, effective viewing, user targeting accuracy, efficiency, and monetization—similar to the push notifications and feeds that flood the screens on platforms like TikTok.

The latter primarily uses AI technology to create various ad materials, such as the mini-games that pop up during videos or are embedded in content, designed to drive traffic. AppLovin refers to these mini-games with ads as "meta-games." When users click on them, they are usually redirected to similar mini-games from different developers.

SparkLabs can use AI technology to create playable ads (Image source: AppLovin)

AppLovin has been building its AI advertising ecosystem for the past three years and has gradually formed a complete intelligent solution. Today, it boasts daily active users of 1.4 billion, on par with global streaming app TikTok and China’s leading social media app WeChat.

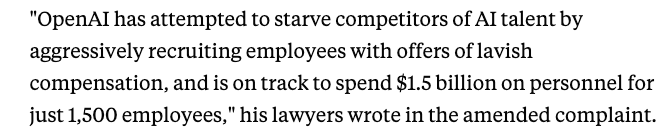

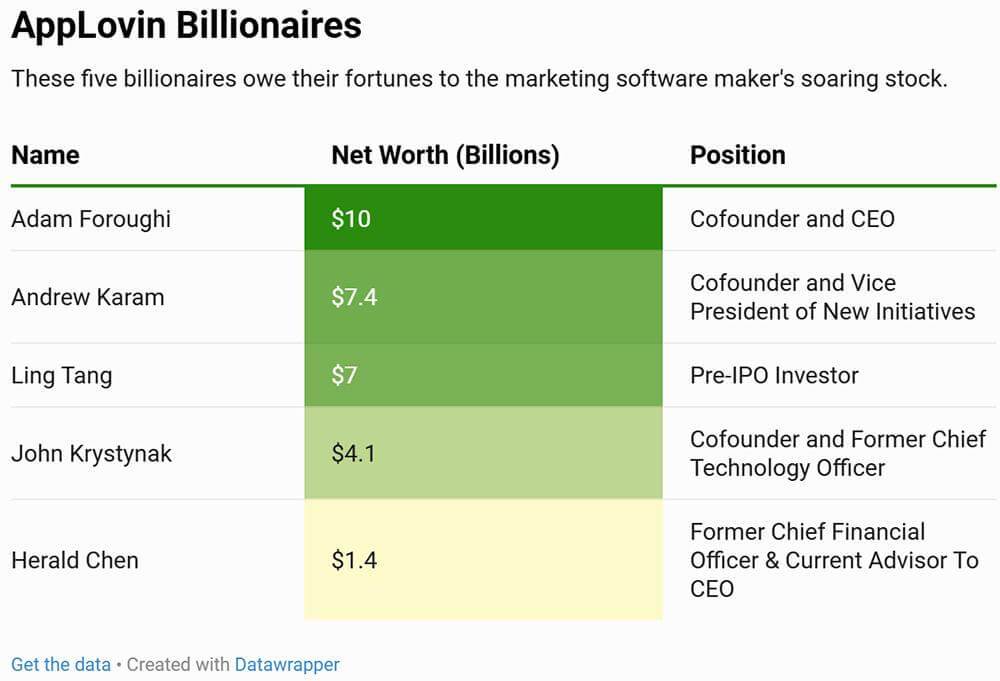

Thanks to its strong performance and stock price growth, many of AppLovin’s executives have successfully reaped the benefits of the AI industry’s rapid growth.

As of the time of writing, AppLovin's co-founder, Chairman, and CEO Adam Foroughi has a personal net worth of $10.2 billion, ranking 256th on the 2024 Forbes Global Billionaires List. At the same time, he ranks 200th on Bloomberg’s global billionaire list with a net worth of $12.7 billion. According to Forbes statistics, during the same period, Nvidia’s founder and CEO Jensen Huang had a personal net worth of $121 billion, ranking 11th globally, while Pinduoduo founder Colin Huang had a personal net worth of $34.9 billion, ranked 51st globally, with Bloomberg’s billionaire rankings showing similar data.

Compared to these figures, "$10.2 billion" and "256th" may seem unremarkable. However, in the 2022 Forbes billionaire list, Foroughi’s personal net worth was only $1.3 billion, and this figure has increased nearly sevenfold in just two years. His latest global ranking has jumped from the thousandth to the hundredth place.

As of November 23, AppLovin has five executives on the 2024 Forbes Global Billionaires List, ranked from highest to lowest: co-founder and CEO Adam Foroughi, early investor Ling Tang, co-founder and VP of Product Andrew Karam, co-founder and CTO John Krystynak, and former President and CFO Herald Chen.

Among them, Foroughi’s personal net worth increased by more than $2 billion on just November 7th.

Forbes reported on November 23, 2023, that five AppLovin executives are now billionaires (Image source: Forbes)

01. AI Voice Becomes the Muse of Advertising Marketing, Winning More Awards in a Year

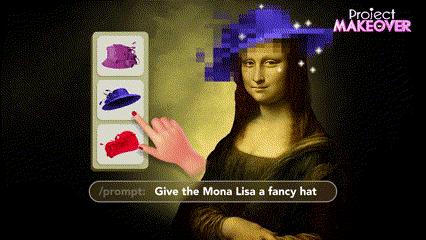

In this ad, Mona Lisa’s AI twin will “change faces” and “change outfits,” and the painting style can switch freely across centuries.

This stylized Mona Lisa video clip is from AppLovin’s SparkLabs team. According to the studio, SparkLabs is essentially a large advertising material library.

After integrating generative AI technology, the team customizes ad material segments based on advertisers' needs, significantly reducing production time to one or two weeks, and also cutting costs. According to their website, they can even generate AI ads for free.

Currently, interactive ads created by SparkLabs can increase IPM (Installs Per Mille) by 250%, and video ads showing dynamic gameplay can boost IPM by 200%. Additionally, SparkLabs can generate static display ads and CTV (Connected TV) ads.

SparkLabs uses AI to create video ads (Image source: AppLovin)

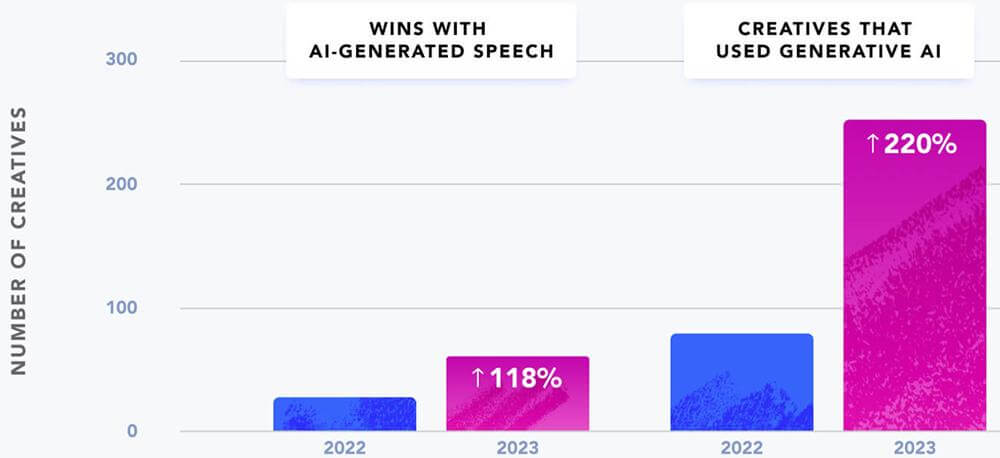

Comparing SparkLabs' performance-driven ad trends report from 2023 with the one from 2022, we can see a shift. In 2022, the key themes were “customization,” “immersive,” and “resonating with users,” with no mention of AI. In 2023, however, the key theme shifted to “generative AI tools + creativity,” with the term "AI" appearing 17 times in the report.

In 2023, the use of AI technology in ad creative design and ad material production has increased nearly threefold, primarily for generating models, aesthetic stylization, and AI-generated text-to-speech. For example, with AI voice generation technology, SparkLabs can add voiceovers to video ads, reducing the time and communication costs involved in outsourcing this work.

Official SparkLabs data shows that ads using AI-generated voiceovers won 118% more awards than in 2022. Additionally, in video, interactive ads, CTV, and ASO (App Store Optimization) scenarios, the number of creative ads using generative AI has increased by 220% compared to 2022.

After integrating generative AI technology, the creative design section of SparkLabs' ads saw significant improvement (Image source: AppLovin)

Internally, SparkLabs has established an AI working group to oversee the usage of generative AI technologies, new features, and staff engagement. The goal is to ensure that everyone on the team learns how to use generative AI to find new advertising creative ideas and improve work efficiency. In its annual review for 2023, SparkLabs reported that AI tools saved the team 1,600 hours in their advertising workflow.

Typically, after incorporating generative AI technology, these AI ads have a more striking visual impact, and their logic is more unconventional. Advertisers and platforms use this to gain more ad clicks and app downloads. In China, Baidu Marketing and Blue Focus have also recognized the opportunity to transform traditional advertising formats with AI.

Unlike AppLovin, Baidu Marketing relies on Wenxin, Baidu’s large model, to create personalized AI agents for each user, thus implementing a new form of advertising marketing. Currently, Baidu's Wenxin Intelligent Agent platform has more than 150,000 corporate users and 800,000 developers.

Meanwhile, Blue Focus's self-developed "Blue AI" marketing model integrates AI large models and generative AI tools from Baidu, Tencent, Microsoft, and others, providing content generation, cognitive assistance, and user experience innovation for different marketing stages.

Both Baidu Marketing and Blue Focus’s AI ad marketing applications are similar to AppLovin’s, using AI technology to generate ad content, optimize ad placement, and improve promotional effects.

02. Upgraded AI Ad Engine Leads to Over 60% Profit Growth

AppLovin has two main business segments: Software Platform and Apps. The former includes advertising technology platforms like AppDiscovery, while the latter includes game studios like Lion Studios, Clipwire Games, Machine Zone, Belka Games, and Athena Studio.

Among them, the company’s advertising technology platform offers an all-in-one advertising solution for mobile devices and connected TVs (CTV), covering areas like ad design, precise placement, data monitoring, and performance optimization.

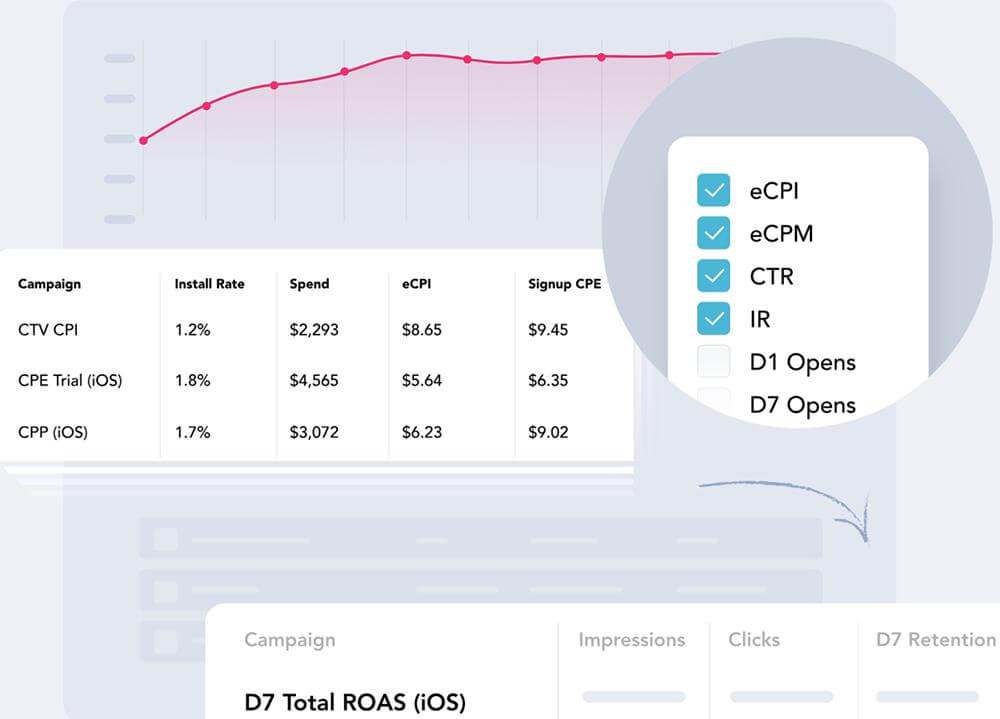

Specifically, there is AppDiscovery, which is responsible for targeting ad users, SparkLabs, which designs and creates ads, and Max, ALX, Array, and Adjust, which visualize and optimize the effectiveness of ads.

AppDiscovery can break down ad placement data from multiple dimensions (Image source: AppLovin)

On the CTV side, additional tools for matching ad placement scenarios, timing, and users, increasing the duration of ad views, and monetizing ad content are integrated into a platform called Wurl. According to AppLovin’s official website, Wurl is the industry’s first machine learning solution for CTV.

AXON is AppLovin's self-developed machine learning algorithm, launched in 2021 and upgraded to version 2.0 in 2023. It drives ad placement and monetization for the gaming business and serves as the core AI technology of the advertising platform.

For example, the intelligent ad acquisition platform AppDiscovery uses AXON to target global users with precision, automatically optimizing ad placement and discovering potential users, which significantly boosts advertisers' profits.

From AppLovin’s latest Q3 2024 financial report, the company’s revenue for this quarter reached $1.2 billion, a 39% year-on-year increase, exceeding the London Stock Exchange’s expectations of $1.13 billion. The revenue growth is mainly attributed to the continuous optimization of AXON, and this trend is more evident than in previous quarters.

Driven by upgraded models like AXON 2.0, AppLovin's advertising technology platform earned $835 million in Q3 this year, up 66% year-on-year, with adjusted EBITDA of $653 million, accounting for 78% of the business's revenue.

Compared to the previous quarter, the growth rate of the advertising platform's revenue significantly increased. This year, Q1 revenue was $678 million, and Q2 revenue was $711 million.

AppDiscovery Q3 2024 Key Performance Indicators (Image source: AppLovin)

The company stated in its shareholder letter that as AXON continuously self-learns and improves through AppLovin’s engineering team, its advertising partners can run more efficient and large-scale ad campaigns.

AppLovin has validated the strong monetization capabilities behind AI advertising in the global marketing market with its impressive performance.

According to the report, AppLovin’s software platform offers more than 1.4 billion daily active users (calculated based on mobile apps that use the AppLovin SDK), providing advertisers with broad ad coverage and high return on investment, while also offering mobile app developers increased exposure and downloads.

The domestic A-share listed company Tianyu Digital has also launched intelligent recommendations on its mobile app distribution platform. According to Tianyu’s relevant business leader, their platform has served many major AI products this year, including Kimi, Zhipu Qingyan, Wenxin Yiyan, Doubao, Xingye, etc., driving platform revenue growth by 26% year-on-year.

03. Reverse IPO with Gaming and Spent Nearly 7.2 Billion Yuan to Buy Out

AppLovin Co-founder Adam Foroughi: A Life Story Beyond Silicon Valley's Glittering Success

AppLovin co-founder Adam Foroughi is an Iranian-American, and unlike the typical Silicon Valley success story of youthful fame, his path was not one of instant recognition.

Born during a time of political turmoil in Iran, Foroughi recalls in an early interview with Yahoo Finance that his family fled Iran to France, and later immigrated to the United States in 1984. At that time, Foroughi was just four years old.

Influenced by his father, Foroughi harbored entrepreneurial dreams early on. His father was one of the more prominent real estate developers in Iran, but after escaping the war and moving to the United States, Foroughi says, “my father never managed to rebuild what he had in Iran.” This experience, especially after his father passed away, deeply motivated Foroughi to achieve something significant in life.

After graduating with a degree in finance from the University of California, Berkeley, Foroughi tried a few jobs in the finance industry. His LinkedIn profile mentions that in August 2008, he co-founded a mobile digital marketing company called Social Hour and served as CEO. Further reports from Forbes also mention that he founded another mobile digital marketing company, Lifestreet Media.

In 2012, Foroughi, along with Joe Kim and Andrew Karam, co-founded AppLovin, with Joe Kim taking the role of CTO and Andrew Karam becoming the VP of Product. At this point, Foroughi was in his early 30s.

AppLovin CEO Adam Foroughi (Image source: AppLovin)

Over the past 12 years, AppLovin’s development has, to some extent, mirrored Foroughi’s own journey, filled with twists and turns.

After its plans to enter the Chinese market were hindered, AppLovin succeeded in its U.S. IPO largely due to strong performance in its gaming business. However, the company’s market value plummeted by nearly 90% the following year. Since 2023, a continued increase in advertising technology platform revenue has sparked a rebound in its stock price.

According to game industry research firm Naavik, AppLovin has always been considered an advertising technology company. In its early years, due to its small size, advertisers and publishers were reluctant to share user data with the company. Although AppLovin was already profitable, the three founders were only able to raise $4 million from angel investors at the time.

Recognizing the need for first-party user data to compete with giants like Google and Facebook (now Meta), AppLovin shifted its focus in 2018 towards game development, marketing, and promotion. The company began aggressively acquiring game studios or forming partnerships with them, with these acquisitions and partnerships totaling over $1 billion according to company filings.

According to Crunchbase, a U.S. startup investment and financing database, AppLovin has completed 10 acquisitions since its founding. Between 2018 and 2022, it acquired several game studios and development companies, including Belka Games, Machine Zone (MZ), Clipwire Games, and Wordle. This approach allowed the company to access first-party data for training its algorithms, while also increasing the accuracy of pushing these games to target users, leveraging its advertising technology to drive business growth.

Inside AppLovin (Image source: AppLovin)

In addition to third-party games, AppLovin also developed a number of casual mobile games. According to the company’s official website, the game studio Lion Studios, established in August 2018, has launched at least 70 games, including hits like Bullet Man, Avril’s Tattoo Shop, and Save Little Brother, which topped the App Store or Google Play's free game charts.

Moreover, AppLovin also set its sights on the Chinese game market. In September 2016, the company announced plans to sell a majority stake to a Chinese private equity firm called Dongfang Hongtai Capital in Shanghai, with a valuation of $1.4 billion. Foroughi believed this move would increase AppLovin’s valuation and potentially open up opportunities for the company to go public in China. However, due to the deteriorating China-U.S. trade relations at the time, the acquisition was unsuccessful.

In early 2017, Dongfang Hongtai Capital acquired a 9.98% stake in AppLovin for $140 million in equity financing. Later that year in November, the firm added $841 million in debt financing. In July 2018, U.S. private equity firm KKR acquired a minority stake in AppLovin for $400 million, pushing the company’s valuation to $2 billion according to Reuters.

AppLovin’s Office Exterior (Image source: AppLovin)

However, AppLovin did not halt its pursuit of an IPO. On March 2, 2021, it announced it had filed for an IPO on the Nasdaq. About a month later, on April 15, AppLovin officially went public, pricing shares at $80 each, raising $2 billion and achieving a valuation of $25 billion. This was one of the few tech stocks to emerge successfully amid a generally sluggish financing market that year.

According to Naavik’s data, as AppLovin’s gaming business expanded, it accounted for more than 80% of the company’s total revenue at the time of the IPO. IPO filings show that AppLovin’s total revenue in 2018, 2019, and 2020 was $480 million, $990 million, and $1.45 billion, respectively, with a 106% year-on-year growth in 2019 and a 46% growth in 2020.

By 2022, the impact of the COVID-19 pandemic, stricter advertising tracking policies, and other factors began to shrink the growth prospects of the mobile gaming market, affecting AppLovin as well. The company’s market value shrank by nearly 90%, and it reduced the number of its game studios from 20 to 11, shifting its focus more on the advertising technology platform.

Subsequently, AppLovin’s R&D investments gradually shifted toward its self-developed AI advertising engine, AXON. Today, the AXON 2.0-powered advertising technology platform has become the company’s primary growth engine. During this period, AppLovin has continued to explore AI technologies, including AXON and generative AI, for innovative applications across various verticals like gaming, Connected TV (CTV), e-commerce, and social media.

04. Conclusion: AI Reshapes Traditional Advertising, Supporting AI Startups’ Profitability

As a multi-faceted player combining AI technology, advertising marketing, and game development, AppLovin has demonstrated with positive market feedback that AI technology can drive innovation in both advertising creation and distribution models.

The generative AI boom is bringing new growth to advertising and marketing. Microsoft and Snap are experimenting with subtle advertising in AI chatbots. Google uses generative AI to create ad visuals, text, and video content, and also deploys AI tools for intelligent bidding and dynamic display ads. Meta launched the AI ad creation platform AI Sandbox, focusing on using AI to re-create and quickly link advertisers’ brand assets. TikTok has begun using generative AI to write ad scripts.

Advertising has become an important commercial scenario for AI technology. AI companies that once rarely earned revenue from ads, such as Perplexity, are now gradually adopting advertising models in their AI products to explore diversified monetization strategies.