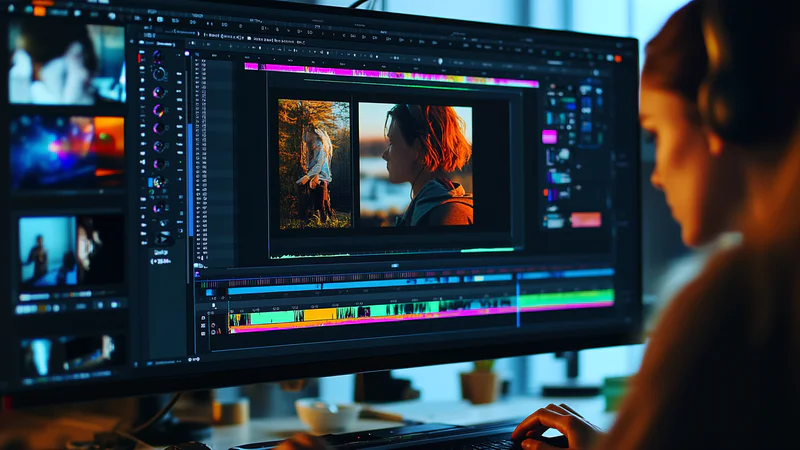

CapCut, the popular video editing app tied to TikTok, has emerged as a global leader in mobile video editing. With over 800 million active users, CapCut challenges Adobe's dominance while leveraging TikTok's vast user base. However, potential U.S. bans on TikTok and rising competition from other platforms like YouTube's Create present significant hurdles for its future growth.

On December 16, U.S. President-elect Donald Trump met with TikTok CEO Shou Zi Chew at Mar-a-Lago. While details of their meeting remain unclear, it is widely speculated that Chew's purpose was to address the looming "ban" on TikTok.

After all, TikTok boasts over 170 million users in the U.S., with numbers still growing—making it a significant market. Beyond TikTok, reports indicate that its sibling app, CapCut, is also experiencing rapid growth. CapCut's revenue is projected to grow by triple digits in 2024, potentially nearing ¥10 billion.

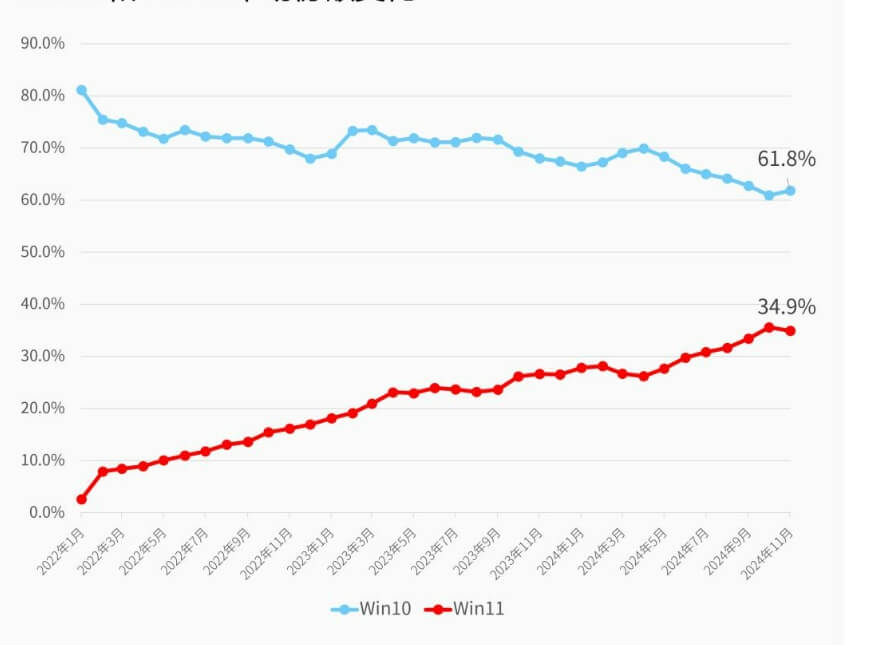

Launched in 2020, CapCut initially offered free services before transitioning to a subscription model. Fueled by TikTok's popularity, CapCut became the highest-earning video editing app globally in 2023. By August, its monthly active users surpassed 300 million, accounting for 81% of the total active users in mobile video editing. In comparison, Canva, in second place, had just 100 million monthly active users. Together, CapCut and its Chinese counterpart, Jianying, now boast over 800 million global monthly active users.

CapCut's rise is putting pressure not only on entry-level mobile editing apps but also on professional software. Reports indicate that Adobe has recently seen a significant loss of new users.

On Wednesday, Adobe reported its fiscal Q4 2024 earnings, covering the period ending November 29, 2024. Revenue for Q4 was $5.61 billion, up 11% year-on-year and exceeding market expectations of $5.54 billion. Adjusted EPS was $4.81, also above the expected $4.67. However, Adobe issued a disappointing fiscal 2025 revenue forecast, intensifying investor concerns about potential disruption from AI-driven startups like OpenAI and Runway AI.

Year-to-date, Adobe’s stock is down approximately 8%, lagging behind both the tech giants and peers in the software industry. Investors worry that creative tools powered by generative AI, such as those from OpenAI or Runway AI, may erode Adobe’s market share.

For now, the threat from OpenAI or Runway AI is "potential," but CapCut is a direct and immediate challenge to Adobe.

TikTok's Connection and CapCut's Growth

TikTok is headquartered in Singapore, while CapCut’s core team operates in mainland China. Job listings related to CapCut frequently appear on domestic recruitment platforms. With the surge in generative AI (AIGC), many companies now view it as a key revenue growth driver.

Earlier this year, ByteDance’s former CEO Kelly Zhang took charge of CapCut and its related operations, underscoring the company’s focus on this product. At the time, ByteDance CEO Liang Rubo stated in an internal letter: “AI technology will greatly disrupt content creation and may even spawn new creative platforms. We aim to actively explore, understand, and seize this opportunity.”

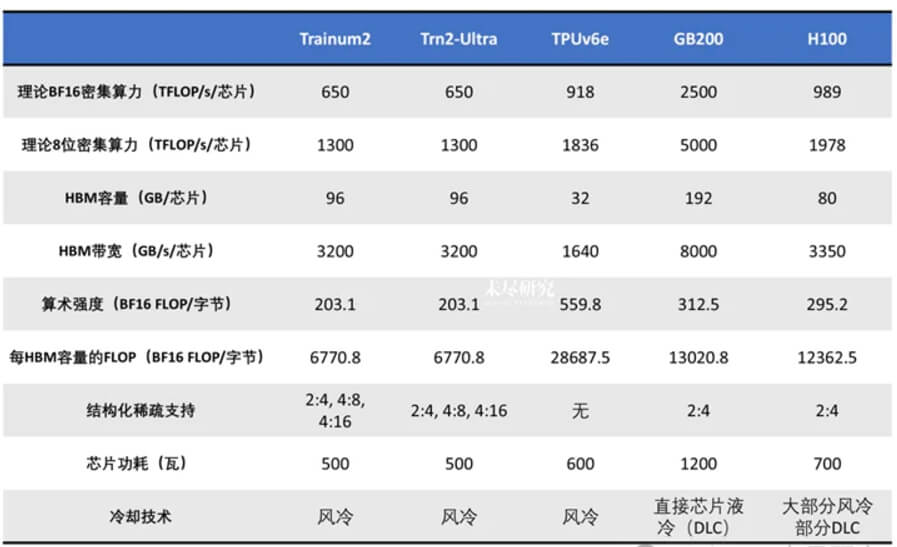

Thanks to the groundwork laid by Jianying, CapCut has developed rapidly. Beyond basic editing features, CapCut has rolled out various generative AI tools, including AI editing, AI models, and AI posters. In May, Jianying launched a generative video tool called “DreamMaker AI,” which has since been prioritized within the company. CapCut has also introduced new desktop apps, tools tailored for small businesses, and a professional version in the U.S. priced at $9.99 per month, further expanding its professional user base.

ByteDance reportedly has ambitious plans for DreamMaker, aiming to position it as the "TikTok of the AI era."

This spells trouble for Adobe, long celebrated for its software tailored to creative professionals. In 2023, four of the top five global graphic design software tools were Adobe products, with a combined market share of nearly 80%. The leader, Adobe Photoshop, alone commands a 23.76% market share, establishing Adobe as the unrivaled giant in graphic design.

Last March, Adobe unveiled its generative AI tool, Firefly, featuring capabilities like text-to-image generation, AI-driven text effects, and recoloring. Later updates added generative fill, text-to-video, and poster creation functionalities.

While Firefly’s output quality isn’t the strongest compared to competitors like MidJourney or Stable Diffusion, its key advantage lies in Adobe's extensive library of copyright-protected images, resolving a major commercialization hurdle for generative AI.

Built on Firefly, Adobe has integrated generative AI into products like Photoshop and Premiere. In October, Adobe announced an AI video creation tool at its annual user conference, gradually rolling it out to the public. Adobe’s head of Creative Cloud, David Wadhwani, stated during the earnings call that the company plans to launch “higher-priced Firefly products” soon, including video models.

Despite Adobe’s stronghold among professionals, its vast copyright library, and years of refinement, CapCut enjoys a unique advantage: its integration with TikTok.

While Adobe's tools are powerful, only a small group of professionals utilize advanced features or AI-assisted tools. Most regular users stick to basic functions and view AIGC features as primarily for entertainment, with a strong desire to share their creations.

Many standalone AI image and video apps lack direct integrations with social platforms, making exporting and sharing creations cumbersome. Once the novelty fades, users often lose interest in standalone AIGC apps.

CapCut, deeply tied to TikTok, avoids these sharing barriers, allowing its AI features to gain widespread use quickly. Compared to professional-grade products, CapCut is an "internet-native product." Its simple interface and built-in templates enable users to quickly adapt their videos and export them directly to TikTok. Published videos carry a CapCut-branded watermark, inviting viewers to try the templates themselves.

TikTok’s 170 million U.S. users represent a vast pool of potential CapCut users. In the consumer market, this user base and traffic ecosystem give CapCut a significant edge.

Challenges Ahead

However, CapCut's close ties with TikTok mean that their fates are intertwined.

If TikTok faces a ban in the U.S., CapCut would likely need to "sever ties" to survive, losing its biggest competitive advantage in the AIGC race. Additionally, reports suggest CapCut may also fall under the scope of the proposed TikTok ban. While no official documents confirm this, CapCut would struggle without TikTok’s backing.

Standing at the precipice, TikTok and CapCut must do everything they can, whether or not they are fully prepared.

TikTok's U.S. revenue was reportedly $16 billion in 2023, with a target of $30 billion this year—outpacing Douyin’s growth rate. Beyond advertising, TikTok’s social commerce has seen explosive growth in the U.S., adding 11.9 million buyers in 2023. TikTok Shop’s “Black Friday” sales surpassed $100 million in a single day.

As TikTok’s commercial footprint expands, it gains more "allies," including users and businesses. TikTok emphasizes that if the ban takes effect, U.S. small businesses on the platform would lose over $1 billion in revenue, while creators would lose nearly $300 million in just one month. Additionally, TikTok claims to have generated $5.3 billion in tax revenue in the past year.

More U.S. youth now rely on TikTok for news, and both the Biden and Trump campaigns have opened TikTok accounts. Republican donor Jeff Yass is also a major shareholder of ByteDance. Over the past six months, Trump has repeatedly stated he has no intention of banning TikTok, claiming he wouldn’t let Meta dominate the social media space and expressing a fondness for TikTok.

Reports suggest TikTok’s U.S. team remains optimistic about weathering the “ban” crisis, with no expectations of a shutdown in January—only concerns about navigating the transitional period.

Meanwhile, CapCut must continue building competitiveness and enhancing monetization. It has introduced paid cloud storage services and limited free-tier collaborators, signaling a shift toward sustainable commercial strategies.

CapCut’s success poses challenges not just for Adobe but also other competitors like YouTube, which has launched a CapCut-like app, Create, in 13 markets. While its features aren’t groundbreaking, YouTube Shorts’ 1.5 billion users provide significant support.

With threats from bans and competitors, CapCut faces a tough road ahead. Yet, its disruptive presence forces incumbents like Adobe to innovate and adapt—an undeniable win for creators and consumers alike.

Ultimately, however, CapCut’s fate rests not in the hands of its users or creators but in political decisions.