Masayoshi Son had no words to say, only awkwardly embracing Jensen Huang and pretending to cry with his head in his hands. Although he didn't actually cry, he felt extremely regretful and bitter inside.

If you ask Masayoshi Son what decision he regrets the most over the past few years, the billionaire would surely immediately think of two things: impulsively investing in WeWork and subsequently selling off Nvidia shares. Every time these two events are mentioned in public, business tycoon and investor Masayoshi Son can't help but smile bitterly. These two decisions caused him to miss out on nearly $200 billion.

At the Nvidia AI Summit held in Tokyo, Japan, the highlight was undoubtedly the onstage conversation between two tech industry leaders, Jensen Huang and Masayoshi Son. Starting this year, Nvidia has been hosting AI summits in several locations worldwide, gathering industry leaders, tech experts, and researchers to discuss the future of AI.

When Jensen Huang held an event in Tokyo, of course, he invited Japan's tech giant SoftBank founder and CEO Masayoshi Son. Huang wore his signature leather jacket, and Son wore his usual comfortable sweater. These two leaders in their sixties have known each other for years, and over the past decade, they have worked closely together on many transactions, frequently attending each other's events.

Two Decisions That Masayoshi Son Regrets

When Huang introduced Son, he gave his old friend high praise. "He is a unique entrepreneur and innovator in this world. He has an extraordinary vision to recognize the winners of each era and partner with them. He brought Bill Gates and Jerry Yang into the Japanese market, helped Alibaba bring cloud computing to China, and brought Steve Jobs and the iPhone to Japan."

Their relationship is so close that after the formal compliments, Huang began teasing his old friend. "You may not know, but Masayoshi Son was once the largest shareholder of Nvidia." This was true—SoftBank once held as much as 5% of Nvidia’s shares.

Suddenly revealing this past story, Son was speechless, awkwardly hugging Huang and pretending to cry. Huang laughed and hugged Son back, saying, "Let's cry together." But during the later conversation, Huang poked fun at Son again, "Can you believe it? If you were still the largest shareholder of Nvidia?"

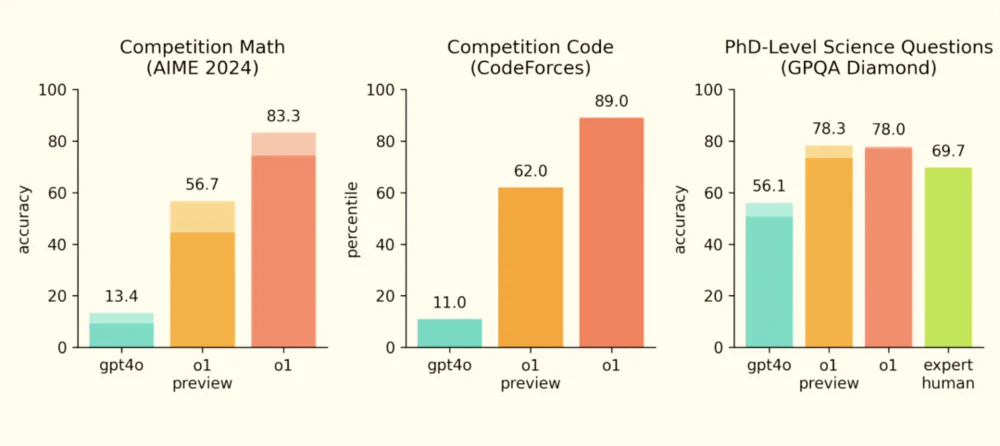

Son again struck a pose of holding his head in his hands, his face a mix of laughter and tears. This was undoubtedly one of the most embarrassing decisions in Son's illustrious investment career. In 2017, when Nvidia's stock was at a low point, SoftBank acquired nearly 5% of Nvidia for $700 million, becoming the largest shareholder. However, just two years later, SoftBank sold off these shares entirely, cashing out $3.3 billion.

From the perspective at that time, it was a fairly good return on investment. But had SoftBank held onto those shares until now, they would have been worth nearly $180 billion. In other words, SoftBank sold off its Nvidia stock just before the AI boom, missing the massive surge in Nvidia's value during the AI era, and forfeiting a return of more than two hundred times its investment.

Every time Son mentions this, he can't hide his regret. At SoftBank's shareholder meeting in July this year, he once again publicly blamed himself, saying, "Every time I think about these missed opportunities, it’s really frustrating. I almost sold Nvidia’s stock with tears in my eyes. I missed such a big fish."

Given how much Son admires Jensen Huang and is optimistic about Nvidia’s growth prospects, why did he still sell off Nvidia stock with regret? This is paying the price for another one of Son's "speechless and regretful" investment decisions.

At the end of 2018, Son led SoftBank in a major investment in the shared office startup WeWork. Despite WeWork's reckless expansion and its financial warnings, Son, who invested based on his intuition, decided to jump into the pit, promising a $10 billion investment when WeWork’s valuation peaked at $47 billion.

However, to Son’s dismay, immediately after SoftBank’s investment, WeWork’s financial problems exploded, and its valuation began to plummet. As the largest shareholder, SoftBank found itself trapped with no way out. Years later, with WeWork’s bankruptcy, SoftBank’s $10 billion investment was nearly worthless. The money used to invest in WeWork came from the sale of SoftBank's remaining Alibaba shares.

In December 2019, during a conversation with Jack Ma at the University of Tokyo, Son reflected on his investment journey, saying, "I was too bold, so sometimes I lose a lot of money." He smiled bitterly, recalling that he lost $7 billion that year, just from the WeWork investment.

Perhaps at that time, he didn’t realize that by paying the price for these mistakes, he would create even bigger regrets. Due to frequent heavy losses from investments in companies like WeWork and Uber, SoftBank’s Vision Fund's financial report that year was terrible. He had to sell off other investments to balance the books, and Nvidia's shares, which had performed decently, became the sacrificial offering.

Despite Son’s "short-sighted" decision to sell off Nvidia shares to pay for his impulsive investments, completely missing the massive returns from Nvidia’s rise in the AI era, the Arm acquisition Son made also found itself riding the AI wave, helping Son recover his fortunes.

Selling Off Nvidia Shares Cost SoftBank $180 Billion in Investment Returns

By selling off Nvidia shares, SoftBank missed out on $180 billion in investment returns. If we add the $10 billion loss from the WeWork investment, it means Son missed out on nearly $200 billion in investment opportunities in 2019.

Jensen Huang Rejects the Suggestion to Privatize Nvidia

After Huang teased Son, Son also revealed another lesser-known story between the two. At Son’s reminder, Huang told the audience that ten years ago, Son had proposed to help Huang privatize Nvidia, but Huang had turned down Son's offer. Huang smiled and said, "Now I regret it."

It was August 2016, right after SoftBank spent $32 billion to acquire the British chip design company Arm. At that time, Son said the acquisition of Arm was to invest in the future of the Internet of Things. After acquiring a cornerstone company for mobile processors, Son ambitiously turned his attention to Nvidia, the leader in graphics processing chips. He wanted to merge Nvidia and Arm to create a super chip company.

At that time, Nvidia had yet to experience the AI boom, and its core business was still limited to the gaming market, with a market value of only $40 billion. With SoftBank’s strength, acquiring both Arm and Nvidia wouldn’t have been difficult.

But directly acquiring Nvidia might have met resistance from his friend, as Huang had founded and led Nvidia for decades. In 1993, Huang and two friends founded Nvidia in a Danny’s restaurant in San Jose to explore opportunities in graphic processing chips. Over the next decades, Huang continued to lead the company, making him the longest-serving CEO in Silicon Valley.

Back then, Silicon Valley had yet to embrace the super-voting stock structure, and the chip industry required significant financing, so Nvidia’s stock was very fragmented. Huang only held 3.5% of Nvidia’s shares and voting rights, while SoftBank held 5%, making it the largest shareholder. It wasn’t until this year, when Nvidia's market value skyrocketed, that Huang’s personal wealth surpassed $100 billion, making him the richest Chinese person in the world. However, his limited voting rights didn’t affect his control over Nvidia; he had completely integrated with the company.

Huang was, of course, unwilling to sell the company he had painstakingly built and could never let go. He had previously turned down an invitation to become TSMC’s CEO. According to TSMC founder and CEO Morris Chang, in 2013, he personally asked Huang to replace him as TSMC’s CEO. At that time, TSMC's market value was over $100 billion, nearly ten times Nvidia’s size. Chang thought Huang might be interested, but Huang felt he couldn’t lead two companies far apart from each other and was concerned about impacting Nvidia’s growth prospects, so he declined. Chang had to choose to make Wei Zhejia and Liu Deyin co-CEOs, watching for five more years before retiring completely.

Years later, Huang rejected another of Son’s offers. Son’s proposal was very generous: he would lend money to Huang to privatize Nvidia, so Huang could still lead Nvidia, and then merge it with Arm.

Huang recalled with a smile, "Son said to me, ‘The market doesn’t understand Nvidia’s value. Your future is limitless. Your pain might last a while because you are investing in the future, so let me lend you money to buy Nvidia.’" The leather-clad man then laughed, saying, "Yes, Son wanted to lend me money to privatize Nvidia. Now I regret not taking his money."

It’s hard to imagine how things would have turned out if Huang had accepted Son's offer, privatized Nvidia, and merged it with Arm. Perhaps Huang didn’t want Nvidia’s normal development trajectory to be affected, so he politely declined Son’s privatization proposal. Furthermore, if privatized, Son would have become the real owner of Nvidia, and Huang wouldn't want the company he founded and led for decades to become part of SoftBank.

Although the leather-jacketed man rejected SoftBank’s privatization offer, he didn’t forget Son’s idea of merging Nvidia and Arm. Four years later, Nvidia announced it would spend $40 billion to acquire Arm, realizing Son's original idea, but this time Huang was the main protagonist.

Unfortunately, this transaction was eventually blocked by regulators, making it the largest failed M&A case in the semiconductor industry in recent years. SoftBank had to take a different path and list Arm on the NASDAQ. Today, Arm has regained its spot in the global chip industry thanks to the AI boom, but if the company had been integrated with Nvidia, its future would undoubtedly have been brighter.

Reflecting on the past, Son said, "If only we hadn’t sold Nvidia’s stock then, our gains today would have been huge. But there’s no use regretting past decisions."