Elon Musk, the world’s richest man, faced a legal battle over a $56 billion compensation plan. Despite achieving ambitious goals for Tesla's growth, a Delaware court ruled that the compensation package was invalid, leaving Musk with no access to the windfall. This ruling follows a long legal dispute initiated by a small shareholder, who questioned the fairness of the plan. Musk’s appeal options remain, but the case highlights the tension between corporate governance and executive pay.

It’s hard to imagine that the world’s richest man, Elon Musk, would find himself in a "salary dispute." But before you rush to criticize Musk for being petty, it's important to note that the salary in question is valued at a whopping $56 billion. It seems human joys and sorrows truly aren't the same.

Unfortunately, following the dismissal by a Delaware judge today, the $56 billion compensation package has been declared invalid. This means Musk will have to start his "salary pursuit" all over again.

Musk Won the Bet on Tesla's Future but Didn't Get the Bet

To understand the origins of this astronomical compensation, we need to go back six years.

In 2018, Tesla's board set a 10-year performance goal for Musk.

Upon achieving these goals, Musk would be eligible for stock options, which would be paid out in 12 separate portions. For every set of goals he completed, the board would grant Musk 1% of the unissued stock.

Musk could potentially earn up to 303 million stock options, an amount adjusted for stock splits, which equates to about 12% of Tesla's total shares in 2018.

But it wasn’t that easy. Specifically, Musk had to meet 28 targets.

Of these, 12 were tied to the market value, increasing by $50 billion at a time, up to a cap of $650 billion. Another 8 were linked to earnings, and the final 8 to revenue.

In the end, Musk actually succeeded.

Tesla's market value reached $650 billion by the end of 2020, and Musk completed all eight earnings goals, leaving only one revenue target unfinished. According to the 2023 proxy statement, Musk had already fulfilled all options except for 25 million.

Based on the stock price at that time, the total reward amounted to $56 billion.

It’s worth noting that according to Forbes' 2018 billionaire list, Musk's net worth was barely around $20 billion.

So, this compensation plan was essentially a bet Musk made on his own abilities, with the entire future of Tesla as the stake.

He bet he could increase Tesla’s market value from $60 billion to at least $650 billion, a 983% increase, while making the company profitable over ten years.

As the results show, Musk won the bet.

Furthermore, due to recent increases in Tesla's stock price, the value of this compensation package briefly reached $101 billion, about 736.1 billion yuan.

Just let that figure sink in.

However, this astronomical compensation plan had some risks from the start.

In June 2018, Tesla’s small shareholder Richard Tornetta filed a lawsuit, claiming the board failed to fulfill its fiduciary duties, arguing the compensation was excessive and that the process had serious issues.

He accused Musk, as the major shareholder, of exerting undue influence on the board. And how small was this shareholder? At that time, he owned just 9 shares.

But Tornetta didn’t give up. With the help of many others, he fought through the courts, and by November 2022, the Delaware court began hearing the case.

The lawyers for the shareholder plaintiffs argued that Tesla's stock option plan was too "generous," and that the board members were too closely tied to Musk to properly protect shareholders' interests.

They also claimed that the performance targets set by Tesla's board for Musk were not challenging enough, and that the financial goals in Musk’s incentive plan aligned closely with the internal growth forecasts of banks and rating agencies at the time.

Thus, they strongly opposed the compensation package.

The "Salary Pursuit" Shareholders Won, but Were Rejected Twice by U.S. Judges

Now, the question arises: in 2018, Tesla's shareholders approved Musk’s historic salary package. But would Tesla’s shareholders agree to it again six years later?

Institutional investors’ opposition, alongside some investors’ support, created a clear divide of interests.

The main opposition came from shareholder advisory firms ISS and Glass-Lewis, as well as several government-linked investment institutions, including Norway’s Bank, one of Tesla's top ten shareholders and manager of the Norwegian pension fund.

They unanimously argued that the plan was too aggressive and would severely dilute individual shareholder rights.

Glass Lewis stated in a report, "From both a pure dollar perspective and the stock dilution effect, the massive scale of this reward plan is concerning. Given the severity of the issues, the company's justification fails to quell these concerns."

The critics also focused their attention on Musk.

On the one hand, in June of this year, Tesla’s stock price was in a significant decline, and its dominance in the electric vehicle market was under threat. On the other hand, Musk was criticized for investing too much of his time and resources in other ventures, particularly his acquisition of X platform in 2022.

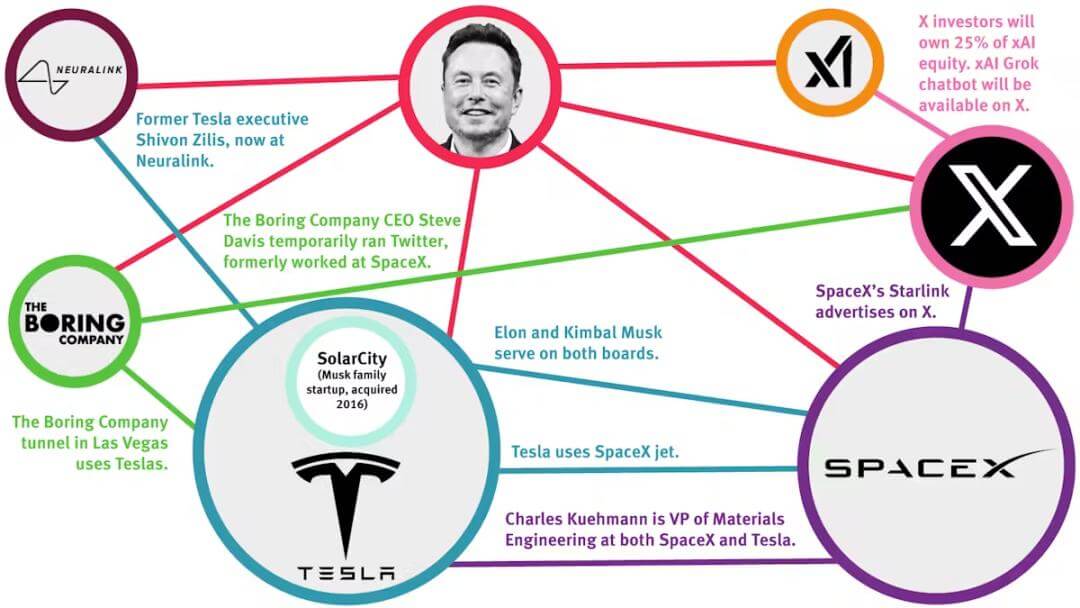

After all, Musk currently manages multiple companies, including Tesla, SpaceX, X, Neuralink, and xAI, which raises doubts about how much time and effort he’s truly investing in Tesla.

Well-known Tesla investors such as Ron Baron, Cathie Wood, and the Scottish Mortgage Investment Trust all voiced their support.

Musk also continuously lobbied Tesla shareholders through the X platform, offering private tours of Tesla’s Texas factory and launching strong attacks on his critics.

"They are the ones breaking their vows."

To ensure the vote passed, Musk even threatened to leave Tesla.

In the end, the outcome wasn’t surprising.

At Tesla’s shareholders meeting in June of this year, two major proposals were voted on: Musk's salary plan and the relocation of the company's registration from Delaware to Texas.

Both proposals passed, with approximately 72% of voting shares supporting the compensation plan.

But the story doesn’t end there. The shareholders voted in favor, the board clicked the agree button, but the Delaware judge hit the pause button again.

This led to a new round of rulings on Monday.

Sadly, Delaware judge Kathaleen McCormick again upheld the January ruling, meaning Musk still has no right to receive the $56 billion compensation package.

A side note: as the first female leader of Delaware’s Chancery Court (the primary venue for U.S. corporate litigation), McCormick has had several encounters with Musk.

In July 2022, McCormick presided over a case where Twitter (now X) sued Musk.

At the time, Musk attempted to back out of the $44 billion acquisition deal, but McCormick decisively rejected Musk’s delay tactics and accelerated the trial. Ultimately, just before the trial, Musk agreed to complete the acquisition of the social platform.

She later explained that her swift handling of the Twitter case was to protect the company and shareholders from significant harm due to uncertainty.

The Judge’s Hammer Is More Powerful Than Shareholders' Signatures

Regarding this ruling, McCormick stated that Tesla's board also had no right to reinstate Musk’s compensation package.

In her 101-page opinion, she wrote:

"Even if the shareholder vote could have had an approval effect, it cannot apply in this case..."

"Undoubtedly, the board could have decided to pay Musk a reasonable salary, but the board yielded to Musk’s demands and failed to prove that these terms were entirely fair."

"If the court allows the losing party to create new facts to modify the judgment, lawsuits will become endless."

She further pointed out that Tesla had made several significant misstatements about the vote and insisted that this vote couldn’t be seen as a panacea for agreeing to Musk’s salary.

Upon hearing the news, Musk exploded on X, posting that "shareholders should control the company vote, not judges," and called it "absolute corruption." Tesla also stated in court documents and on X that they would appeal, arguing that the judge's overturning of the decision of the majority of shareholders was wrong.

With McCormick’s final ruling this week, Musk's only option now is to appeal to the Delaware Supreme Court. The appeal process could last up to a year.

Interestingly, this lawsuit has also generated $345 million in legal fees.

McCormick has ordered Tesla to pay the lawyers who filed the case $345 million, which, although far less than their initial request of $6 billion, will still be one of the largest fee awards in securities litigation history.

Moreover, McCormick stated that the fees can be paid in cash or Tesla stock.

In short, this $56 billion tug-of-war is far from over. And even the world’s richest man, Musk, will have to taste the bitterness of a "salary dispute."