While Google Pay has become the preferred choice for many users, there are numerous alternatives overseas that offer similar convenience and security. Due to varying levels of internet development and the prevalence of online payments in different countries/regions, many users prefer third-party payment platforms such as Mycard, Coda, Razer, and PayPal over Google Pay. In addition to potentially higher revenue due to lower transaction fees compared to Google Pay’s 30%, these alternatives can help avoid issues like chargebacks and bad debts. This article discusses representative third-party payment platforms abroad that, like Google Pay, provide ease and convenience no matter where you are in the world.

1. PayPal

PayPal allows users to send and receive money securely, offering services that meet a wide range of financial needs for individuals and businesses.

Features:

Provides secure and fast transfer services for friends, family, and businesses.

Users can receive payments simply by entering a PayPal email address.

Available on iOS and Android devices.

Advantages:

High security to prevent fraudulent transactions.

Customers can easily shop online or offline using PayPal.

Disadvantages:

May charge fees for certain transactions, especially those related to business or international transfers.

Fraudulent transactions and disputes between buyers and sellers can pose challenges for users.

Official Link:

PayPal

2. Amazon Pay

Amazon Pay provides simple and secure transactions for customers who trust the Amazon brand. It is Amazon's digital wallet service and one of the largest online retailers in the world.

Features:

Customers can shop using Amazon Pay via their mobile devices.

Supports transactions in multiple currencies for convenient shopping.

Consumers trust the company, making them more willing to use Amazon Pay when shopping.

Advantages:

Users can easily make purchases from anywhere online.

Its customer support and user feedback have earned users' trust.

Disadvantages:

Requires an internet connection for optimal performance.

Users need an Amazon account to continue shopping online.

Official Link:

Amazon Pay

3. PhonePe

PhonePe, developed by the National Payments Corporation of India (NPCI), allows users to perform various transactions through its app, including online shopping, bill payments, mobile recharges, and bank transfers.

Features:

The UPI system is closely integrated with PhonePe.

Users can pay utility bills, recharge mobile phones, and more.

Its bill-splitting feature helps users share costs.

Advantages:

Available on iOS and Android devices, making it very user-friendly.

Employs robust security measures like multi-factor authentication, encryption, and transaction limits.

Disadvantages:

Depends on internet access, which can be challenging in areas with poor coverage.

PhonePe is constantly adapting to stay ahead of competitors as other digital payment options emerge in the Indian market.

Official Link:

PhonePe

4. Paytm

Paytm is India's largest mobile payment and commerce platform, ranking as the fourth-largest wallet globally. It partners with over 180 banks and international card organizations like VISA and MasterCard. Initially a mobile recharge and bill payment platform, it now includes features like digital wallets, online shopping, and ticket bookings.

Features:

Offers a digital wallet for securely storing cash and making payments as needed.

Customers can easily book tickets for events, movies, flights, trains, buses, and other services through the Paytm app.

Frequent cashback rewards, discounts, and promotional offers attract users to make more transactions.

Advantages:

Users receive a scratch card after each successful transaction.

Reminds users to pay bills or rent.

Disadvantages:

Some transactions may incur fees, such as wallet recharges or bank transfers.

Relies on internet connectivity, which can be difficult in areas with poor coverage.

Official Link:

Paytm

5. Apple Pay

Apple Pay ensures the security of your cards and enables secure transactions on your Apple devices. It allows users to make online and offline payments using their iPhone, Apple Watch, iPad, and Mac, providing the highest levels of protection and privacy.

Features:

Apple Pay has an impressive level of security.

Accepted by millions of websites and applications.

Supports transactions in multiple currencies, which is very useful for users traveling abroad.

Advantages:

Allows consumers to make one-click payments, enhancing the payment experience.

Tokenization and biometric authentication are two features that enhance security.

Disadvantages:

Only available on iOS devices.

Requires Apple devices that support NFC functionality.

Official Link:

Apple Pay

6. Samsung Pay

Samsung Pay provides simple and secure transactions for customers who trust the Samsung brand. It is a digital wallet service offered by Samsung, one of the largest online retailers in the world.

Features:

Customers can shop using their mobile devices via Samsung Pay.

Supports transactions in multiple currencies, making shopping easy for customers.

Consumers trust the company, making them more likely to use Samsung Pay.

Advantages:

Users can easily make purchases from anywhere online.

Its customer support and user feedback have earned users' trust.

Disadvantages:

Requires an internet connection for optimal performance.

Users need a Samsung account to continue shopping online.

Official Link:

Samsung Pay

7. BHIM

BHIM is considered one of India’s finest online payment applications. Launched by the National Payments Corporation of India (NPCI), Bharat Interface for Money (BHIM) established the UPI concept to meet the needs of the Indian market.

Features:

Provides multiple language options for Indian customers.

Offers a simple setup process to send and receive funds.

Allows payments via QR code scanning (Scan & Pay).

Advantages:

A simple, secure, and lightweight application.

Can be used without an internet connection.

Disadvantages:

The application generates slower options.

If your number is not registered with the bank, you cannot use the application.

Official Link:

BHIM

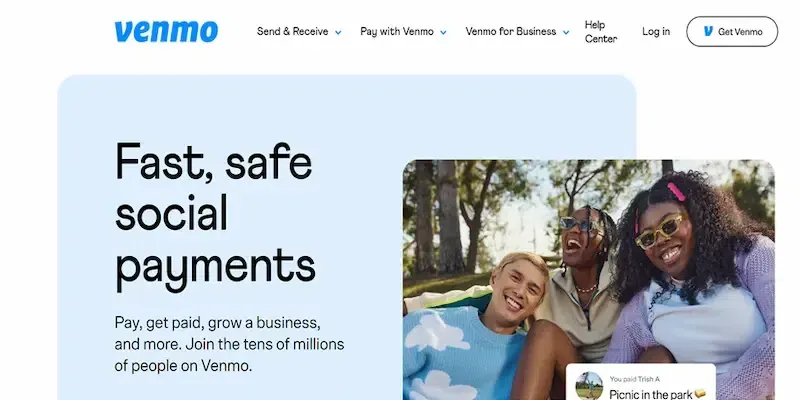

8. Venmo

Venmo is a mobile payment service that makes it easier to pay friends and family. Instant sending and receiving of funds make it ideal for splitting bills, paying rent, and sending gifts.

Features:

Can set up automatic payments for bills and rent.

Users can buy, sell, and hold cryptocurrencies within the app.

Allows purchases from favorite brands online or in-store.

Advantages:

Shop at your favorite merchants using the Venmo app.

Offers debit and credit cards for seamless payments.

Disadvantages:

Venmo may become a target for fraud and scams.

Fees apply for credit card purchases and instant transfers.

Official Link:

Venmo

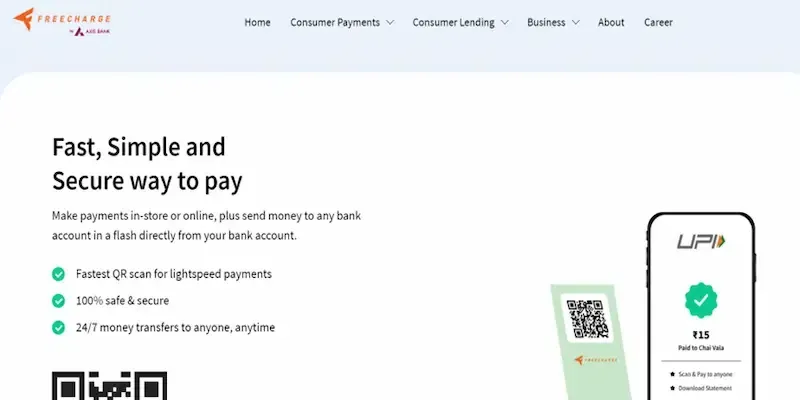

9. Freecharge

Freecharge is a popular payment application in India, backed by Axis Bank, with over 100 million users. To facilitate transactions, it accepts various payment methods, including cards, UPI, and wallet apps.

Features:

Accepts payments via BHIM and UPI.

No transaction fees or payment charges for UPI payments.

Features special chat and payment options, allowing users to pay via chat windows.

Advantages:

Quick and easy payments using QR codes.

Offers 24/7 free remittance services for businesses.

Disadvantages:

Customer service chat support can be a bit slow.

There is a minimum payment fee for utility payments.

Official Link:

Freecharge

10. CRED

CRED is another free alternative to Google Pay. CRED is developed for handling credit card payments. In addition to remittances and bill payments, you can transfer money, scan and make offline payments, manage credit cards quickly, and access special offers.

Features:

Provides quick loans for emergency backup.

Earns cashback for every credit card payment.

Allows users to check their credit score for free via the CRED app.

Advantages:

You can earn cashback by paying your credit card bills.

Provides the functionality to add multiple cards.

Disadvantages:

Comes with high transaction costs.

May offer slow payments due to weak network connections.

Official Link:

CRED

For every developer, payment is the lifeblood of a product, directly influencing its success or failure. As a developer, it's crucial to provide users with the right payment options, and the ten third-party payment platforms listed above can be chosen based on your project’s specific needs.