Over the past year, Microsoft and OpenAI have undoubtedly been one of the most fascinating business combinations across the ocean.

On October 9, a report from Forbes brought both companies back into the spotlight. The report mentioned that an analytics firm predicted that if OpenAI fails to achieve profitability in the next three years, Microsoft will acquire OpenAI.

Coincidentally, on the early morning of October 10, reports emerged suggesting that OpenAI might reorganize into a public-benefit corporation (PBC) to prevent hostile takeovers and protect CEO Sam Altman from external interference.

Neither company has responded to these claims, but the message conveyed is profound.

Since the launch of ChatGPT, global tech giants have poured vast sums of money into AI, aiming to dominate the story of AGI (Artificial General Intelligence). However, since the beginning of 2024, large model startups have struggled to find a path to profitability. Even star companies like OpenAI are deep in the red and heavily reliant on large tech firms for financial support, a model that may not last long. Big corporations will not let their substantial investments go to waste. Acquiring promising startups may be one of the paths for these giants to quickly realize returns on their investments.

In fact, Microsoft is already doing this. Before the prediction of OpenAI's acquisition surfaced, Microsoft had already brought the core team of the star unicorn Inflection AI under its wing.

Among the three major cloud giants in the U.S., Microsoft has been the most decisive and comprehensive in its AI investments. After ChatGPT’s meteoric rise, Microsoft shifted from its previous, more cautious stance to aggressively pursue opportunities. Besides OpenAI, Microsoft has established connections with AI stars around the world, using capital to craft a global AI landscape in less than two years.

Aggressively and Focused on Betting on OpenAI

“Before I became CEO, I already thought that we should continue investing in new technologies, developing new markets, and even taking a more aggressive and focused approach,” Satya Nadella wrote in his book Hit Refresh.

OpenAI became the biggest fruit of Microsoft's “aggressive and focused” investment in new technologies. Microsoft CEO Satya Nadella has publicly stated, “Without Microsoft's early support, OpenAI would not exist.”

It all started in 2018.

At that time, Google’s research division, DeepMind, had already launched AlphaGo and AlphaFold, gaining a leading edge in the deep learning wave. Meanwhile, Microsoft was largely excluded from the mainstream AI spotlight and was still undergoing a crucial internal transformation.

In 2018, Nadella’s internal reforms began to show results, and Microsoft’s market value surpassed $800 billion, exceeding its highest point since the dot-com bubble. That same year, Microsoft announced a company restructuring, splitting its Windows and Devices division and establishing two new departments: the Experiences and Devices division and the Cloud and AI Platform division. The company’s focus began shifting towards cloud and AI.

As Microsoft was gradually finding a new path, OpenAI in 2018 was losing its direction.

First, major shareholder Elon Musk resigned from the OpenAI board and ceased further funding. Due to resource and financial limitations, many of OpenAI's top AI researchers left to join larger firms like Google. As a non-profit organization, OpenAI desperately needed to find new "backers."

It wasn't until the end of 2018 that Nadella met with Sam Altman, marking a turning point for both parties.

In 2019, Microsoft’s Chief Technology Officer sent an email to Nadella and Bill Gates, saying, "Google’s Gmail autocomplete function is already very good, we’ve fallen behind by several years." This made Nadella realize that they couldn’t wait any longer.

In 2019, Microsoft made its first $1 billion investment in OpenAI. According to the agreement, Microsoft’s Azure cloud would become OpenAI’s “exclusive” cloud services provider. At the same time, Nadella proactively offered to help OpenAI purchase chips, a move that would entail an unknown investment of at least tens of billions of dollars, given the computational resources required for AI model training.

At that time, many Microsoft executives were skeptical about Nadella's decision. Even Bill Gates didn’t understand why they were investing so much money in an external company. “We have our own AI,” he said.

The issue was that Microsoft’s own AI wasn’t good enough.

As early as 2009, Microsoft Research began developing AI models for speech recognition and text generation, but after 10 years, there were no breakthroughs. At the time, OpenAI had only about 40 people, and Microsoft’s thousands of researchers naturally didn’t, and wouldn’t, believe that this small, little-known team could accomplish what Microsoft had spent years trying and failing to do.

What was even harder to understand was that Nadella's “favoritism” towards OpenAI squeezed the budget space of other Microsoft departments. The head of Microsoft’s hardware division even left for Amazon because of this.

These small disturbances did not shake Nadella’s determination to invest in new technologies:

In 2021, Microsoft made an additional $1 billion investment in OpenAI, deepening their partnership and signing a long-term agreement to make GPT-3 the exclusive licensee of Microsoft’s Azure cloud computing services;

In January 2023, two months after the launch of ChatGPT, Microsoft announced a multi-year, multi-billion-dollar investment plan for OpenAI;

In April 2023, Microsoft further invested $10 billion in OpenAI, increasing its stake to 49% and securing a share of OpenAI’s profits until its investment was repaid;

In OpenAI’s latest $6.6 billion funding round, Microsoft contributed $750 million.

Since 2019, Microsoft has invested nearly $14 billion in OpenAI. While deepening its ties with OpenAI, Microsoft has also begun extending olive branches to large model startups that have different approaches from OpenAI.

Blooming Everywhere, Used for My Own Benefit

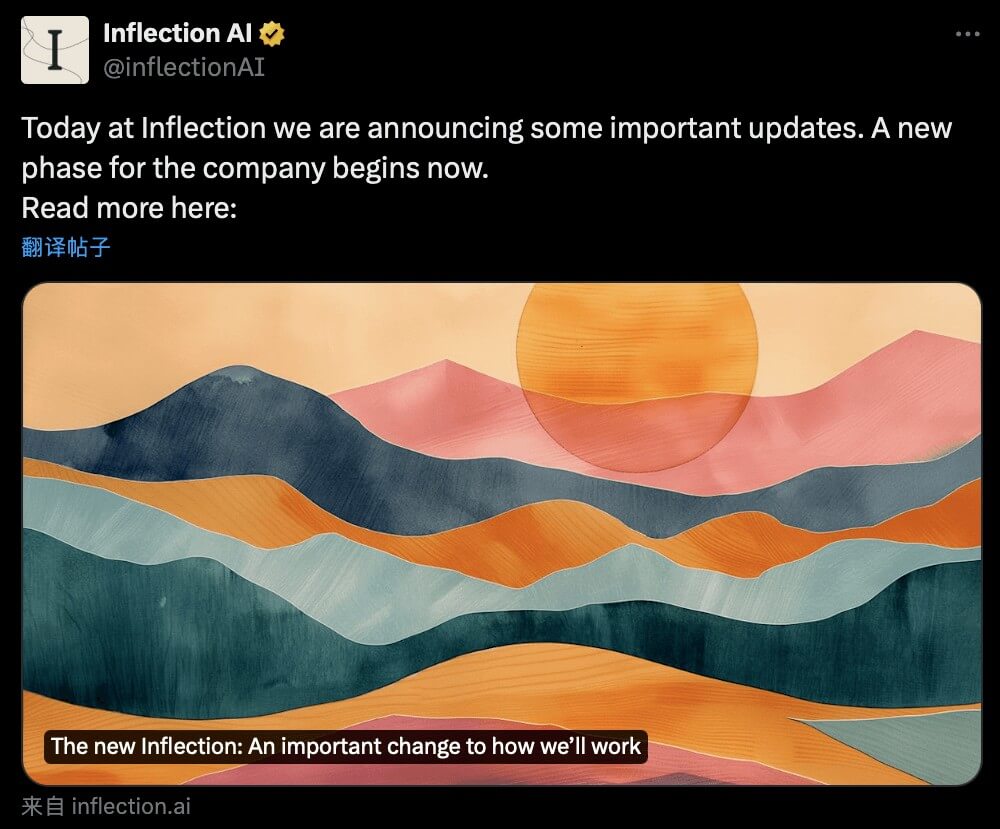

Over the past two years, Microsoft has developed a strong interest in Inflection AI.

Inflection AI was founded in 2022 by Mustafa Suleyman, one of the co-founders of DeepMind, among others. It quickly secured $225 million in angel funding and rapidly grew into a dark horse in the generative AI field.

On the technological front, Inflection AI is a representative in the “emotional AI” field. In May 2023, Inflection AI launched Pi, a chatbot powered by its self-developed large language model Inflection-1. Pi is positioned as a "friend conversationalist" rather than the mainstream "assistive tool" of the time.

Just one month later, in June 2023, Inflection AI announced that it had completed its latest funding round, raising $1.3 billion, led by Microsoft, Nvidia, and three billionaires (LinkedIn co-founder Reid Hoffman, Microsoft co-founder Bill Gates, and former Google CEO Eric Schmidt), with a post-investment valuation of $4 billion.

However, no one anticipated that, just nine months later, Inflection AI’s story would come to an abrupt end.

In March of this year, Microsoft announced that it would pay $650 million to license Inflection AI's AI software. Simultaneously, Inflection AI co-founders Mustafa Suleyman and Karén Simonyan, along with around 70 employees, collectively joined Microsoft. Microsoft even set up a new department—Microsoft AI—to handle Copilot and other consumer AI products.

As part of the deal, Inflection AI announced it would cease developing the consumer version of its Pi chatbot, which had been launched less than a year prior, and would focus on developing custom chatbots for enterprise clients.

Inflection AI’s situation sends a clear signal: Microsoft is clearly not satisfied with merely participating in the AI wave through external investments, but ultimately aims to strengthen its internal team and bolster its own AI capabilities.

However, as large model technology is still in its early stages, with no unified technical direction, the most cost-effective way for the giants to experiment is to diversify their investments.

In February of this year, Microsoft invested $16 million in Mistral AI and established a partnership.

Mistral AI, founded in May 2023 by former DeepMind and Meta scientists, represents an open-source model and MoE architecture, in contrast to OpenAI’s closed-source approach and its adherence to Scaling Law. This differentiated technical path has made Mistral AI quite popular in the market, and its valuation has surged to €6 billion (about $6.4 billion).

In April, Microsoft announced a $1.5 billion investment in G42, an AI company based in the UAE, and the two companies will also support the establishment of a $1 billion fund.

In fact, while continuously investing externally, Microsoft has never stopped its internal AI research and development.

In April of this year, Microsoft revealed it had built its own Phi-3 model family, a small open AI model family with lower operating costs than large language models like OpenAI’s GPT-4. Microsoft also mentioned that the Phi-3 model is already being adopted by companies like BlackRock and Epic and outperforms OpenAI's GPT-3.5. In the latest Phi-3.5 series, Microsoft introduced its first MoE-based model, Phi-3.5-MoE-instruct.

Beyond models, Microsoft has made widespread investments in AI applications, spanning AI Agents (Adept AI), low-code/no-code application development (Builder.ai), robotics (Figure Robotics), AI content creation (Typeface), AI character creation (Inworld AI), and other hot areas.

AI Infrastructure Giant

In some sense, infrastructure like GPUs and data centers sets the lower limit for model training, and within it lies a trillion-dollar market. As a cloud service provider, Microsoft certainly won’t miss out on this opportunity.

In 2023, Microsoft invested in two chip companies: in June, it announced a multi-billion-dollar investment in GPU cloud computing company CoreWeave to build cloud infrastructure; in September, Microsoft’s M12 venture fund participated in the Series B round of AI chip company D-Matrix, marking its entry into AI inference.

Entering 2024, Microsoft began ramping up investments in AI infrastructure worldwide, with footprints across Japan, Southeast Asia, Europe, the Middle East, North America, Latin America, and Africa. Several record-breaking investments were made:

-

In April, Microsoft announced a $2.9 billion investment in Japan over the next two years, the largest single investment in Japan in 46 years.

-

In the same month, Microsoft announced a $1.5 billion investment in UAE-based G42 to acquire a minority stake in the company, along with a $1 billion fund to develop AI skills in the UAE and beyond.

-

On May 2, Nadella made a “significant commitment” in Bangkok, announcing plans to build new cloud computing and AI infrastructure in Thailand, providing AI skill opportunities for over 100,000 people and supporting the growing developer community in the country.

-

Nadella also announced a $2.2 billion investment in Malaysia to support the country’s digital transformation, including building cloud and AI infrastructure, creating AI skill opportunities for 200,000 people, and establishing a national AI excellence center.

-

Microsoft also plans to invest $1.7 billion in Indonesia for expanding data centers.

-

On May 9, Microsoft unveiled an AI investment plan for Wisconsin, including a $3.3 billion investment in cloud and AI infrastructure, creating a manufacturing-focused AI innovation lab, and an AI skills program for over 100,000 residents.

-

Additionally, Microsoft is partnering with the U.S. National Grid to establish a new 250-megawatt solar project in Wisconsin, slated to begin operation in 2027.

-

On May 14, Microsoft announced a major investment in France, planning up to €4 billion ($4.39 billion) in the coming years, focusing on AI and a new data center in Mulhouse, marking its largest investment in France in 41 years.

-

On June 3, Microsoft announced its largest-ever investment in Sweden, totaling $3.2 billion (approximately 33.7 billion SEK). Within the next three years, Microsoft will ensure that 250,000 Swedish employees receive training on using generative AI.

-

On September 18, Microsoft, along with BlackRock, Global Infrastructure Partners (GIP), and MGX, announced the creation of a Global AI Infrastructure Partnership (GAIIP) to invest in the construction and expansion of data centers and energy facilities, with an initial goal of releasing $30 billion in capital, which is the world’s largest AI investment fund, with total potential investment up to $100 billion.

On September 25, during a visit to Mexico City, Microsoft CEO Satya Nadella announced that Microsoft plans to invest $1.3 billion in Mexico over the next three years to improve the country’s AI infrastructure. Through this investment, Microsoft aims to train 5 million people in Mexico in AI skills.

On October 2, Microsoft announced that it would invest 14.7 billion reais ($2.7 billion) in Brazil over the next three years to strengthen its cloud computing and AI infrastructure and provide AI-related training for around 5 million people.

On October 4, Microsoft announced that from 2025 onwards, it will invest €4.3 billion ($4.6 billion) in Italy over the next two years to strengthen the country’s AI infrastructure and build large-scale cloud data centers, while also enhancing AI skills for 1 million Italians by the end of 2025.

A Trillion-Dollar Gamble

Beyond the officially announced collaborations, Microsoft continues to “aggressively and strategically” expand its territory.

In March this year, Microsoft and OpenAI announced plans to build an AI supercomputer named “Stargate,” projected for launch as early as 2028, with Microsoft shouldering the bulk of the financial investment.

For Microsoft, this is no easy feat. The total cost of the “Stargate” project could exceed $115 billion, more than three times Microsoft’s entire annual capital expenditure on servers, buildings, and other equipment last year. The project will be executed in five stages, and the fourth stage’s supercomputer is expected to be operational by 2026.

To sustain the operations of such massive data centers, a substantial reserve of GPUs is essential, and Microsoft has already taken action.

In April, reports emerged that Microsoft plans to stockpile 1.8 million AI chips by the end of this year. Earlier, based on related information disclosed by Nvidia, UBS analyst Timothy Arcuri noted that Microsoft is Nvidia’s largest customer, contributing 19% of Nvidia’s fiscal 2024 revenue—a staggering $11.57 billion.

This expenditure represents a significant portion of Microsoft’s fiscal 2024 capital budget. According to fiscal 2024 financial data, total capital expenditures for the year reached $56 billion, with about half allocated to data centers and infrastructure such as land, while the rest was used for chips and server capacity. In Q4 of fiscal 2024 (April–June 2023), capital expenditures soared to $19 billion, marking a 77.6% year-on-year increase, primarily driven by infrastructure needs and server investments.

When it comes to the timeline for these investments to generate returns, Microsoft CFO Amy Hood offered an answer that most investors would find hard to accept—"15 years or even longer." Despite this, Hood emphasized that such spending is necessary to meet the growing demand for AI services and indicated that capital expenditures for fiscal 2025 are expected to surpass the current year’s levels.

From today’s perspective, the success of Microsoft’s massive AI investments hinges on three factors:

-

Revenue from Microsoft’s AI products and businesses.

So far, Microsoft has not disclosed specific revenue figures for generative AI products such as its Copilot tools. However, earlier reports suggested that despite charging $10 per month for GitHub Copilot, Microsoft is still incurring losses of over $20 per user per month on average, highlighting the challenges of monetization.In contrast, Azure’s AI services show more promising growth. During the Q3 fiscal 2024 earnings call, Hood revealed that Microsoft Azure cloud services achieved a 29% year-on-year increase in revenue, with AI services contributing 8 percentage points to this growth.

-

Efficient operations of AI data centers worldwide.

According to insiders, from fiscal 2024 to fiscal 2027 (ending June 30, 2027), Microsoft plans to spend approximately $100 billion on GPUs and data centers. As much of Microsoft’s spending is allocated to purchasing GPUs and building data centers—requiring substantial investments in land and equipment—the company will also face higher depreciation expenses, which could limit profit growth to some extent. -

Profitability of OpenAI.

OpenAI’s unique organizational structure does not distribute equity to investors but instead issues “Profit Participation Units (PPUs),” allowing investors to receive a share of OpenAI’s profits proportional to their PPUs if the company turns a profit.In other words, if OpenAI fails to become profitable, the PPUs held by investors would be worthless. A major concern is that OpenAI continues to operate at a loss, with losses expected to widen. Financial documents recently leaked reveal that OpenAI burned through $340 million in the first half of this year alone, and its losses are projected to reach $14 billion by 2026.

Indeed, the challenge of monetization extends beyond OpenAI to all companies that rely on pre-training models. The much-anticipated emergence of AGI (Artificial General Intelligence) or Super Apps has yet to materialize, while the necessary funding for training still largely depends on injections from tech giants. In the long term, this is not a sustainable model.

Under these circumstances, the dominance of AGI may ultimately return to major tech companies. From this perspective, Microsoft finds itself with no way to retreat.

As Microsoft’s current CEO, Satya Nadella, has witnessed many instances where hesitation led to failure. In his book Hit Refresh, he sharply noted:

“We started working on tablets before the iPad and e-readers before the Kindle. But sometimes, while we had the software, the essential components for success, such as touch screens and broadband networks, were not yet available. Other times, we lacked an end-to-end design approach and couldn’t deliver a complete solution to the market. We also placed too much confidence in our ability to quickly follow competitors, forgetting the inherent risks of this strategy. And we hesitated when it came to disrupting our own highly successful business models. We’ve learned from these lessons.”

Building on these lessons, when faced with another wave of disruptive technological change, decisiveness seems to be the only option. In Nadella’s view, “There are no predetermined rules on the road to creating the future. A company must plan a comprehensive vision for what it does best, then transform that vision into reality with conviction and capability.”

Still, looking at Microsoft’s rapidly expanding AI investment map, it’s hard to discern whether this is FOMO (fear of missing out) driving their actions or whether Microsoft truly sees the future ahead of others.

But taking a step back, the answer might not even matter. After all, among those riding the generative AI wave today, who isn’t taking a gamble?