Sam's Club China is undergoing leadership changes with the upcoming retirement of Andrew Miles, and Jane Ewing is set to take over as the new president. This article discusses the opportunities and challenges she will face, including Sam’s rapid expansion, localization strategy, and its impact on food safety and quality control. As Sam’s China continues to grow and outperform traditional supermarkets, the company’s shift toward enhancing its supply chain and product quality is expected to shape its future direction.

Will Sam's China undergo significant adjustments in its operational focus and strategic direction?

Since the beginning of this year, Sam's development in China has been in a "tug-of-war" state. On the one hand, there have been frequent food safety incidents in the news; on the other hand, the public has flocked to Sam's, considering it the brightest performer and the fastest-growing representative of the supermarket industry in China, repeatedly analyzed by industry experts.

Such a "split" Sam’s has created a unique public opinion environment: those who love it remain loyal, while the frequent negative food-related incidents lead to public outrage and continuous criticism.

Perhaps burdened by a series of frequent negative incidents, Sam's China is facing severe challenges, and its president is about to be replaced. Under the leadership of the new president, will Sam's negative incidents be effectively controlled, and will its operational focus undergo significant adjustments? These questions will be closely watched in the future.

01. Sam's China Changes Leadership

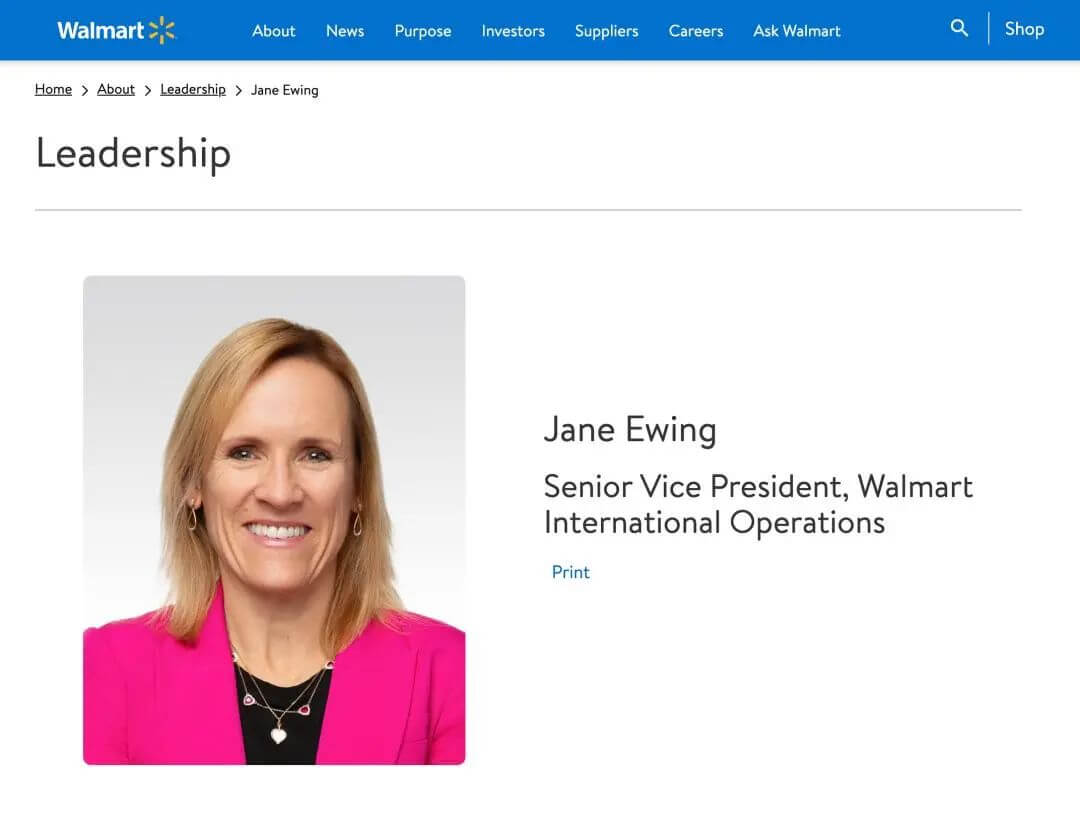

Recently, Zhu Xiaojing, President and CEO of Walmart China, announced the leadership change at Sam's China. According to the appointment letter, Walmart China’s Vice CEO and President of Sam's Club, Andrew Miles, will retire on January 31, 2025, and Jane Ewing, Senior Vice President of Walmart International's Operations, will take over as interim president of Sam's China. Jane Ewing will officially assume her role in January 2025, directly reporting to Zhu Xiaojing.

Andrew Miles, who is about to retire, joined Walmart China in 2012 as COO of Sam's Club, and in 2017, he was promoted to President of Sam's Club. From 2020, he also served as Vice CEO of Walmart China and President of Sam's Club.

Regarding Andrew Miles' retirement, Walmart described his tenure as having "led Sam's Club in China through a series of strategic transformations, driving it onto the fast track of development by creating an omnichannel membership model."

To put this in simpler terms, Andrew Miles accelerated Sam’s store openings in China while also developing both B2C and B2B membership channels, which increased membership fee revenues.

When Andrew Miles first became COO of Sam's China, Sam's had only 8 stores. By 2024, the number had exceeded 50, with an average of 3.7 new stores opening per year during his tenure.

Additionally, membership fees for Sam's China saw a significant increase. In 2016, under Andrew Miles' leadership, the membership fee was raised from ¥150/year to ¥260/year, and the premium membership fee was set at ¥680/year. According to insiders, Sam's membership comes from both B2C and B2B channels, with B2B primarily focused on corporate clients for wholesale purchasing, including employee benefits, business gifts, and small and medium-sized shops. Around 30% of sales in many Sam's stores come from B2B customers.

It can be said that Andrew Miles stabilized Sam's foundation in the Chinese market, expanding its market share while establishing a "localized" operating system, including a supply chain system. He also built a brand recognition of "cost-effective quality consumption" for Sam's in the market. However, the negative effects of localization and rapid expansion are also evident, such as inconsistent standards, poor quality control, and frequent negative incidents.

Since the beginning of this year, Sam's has seen multiple personnel changes. On September 2, Zheng Shouhuai was transferred to Senior Vice President of Walmart China and concurrently assumed the role of COO of Sam's Club. He will continue to lead the membership team. At the same time, Sam's Club’s e-commerce business has shifted its reporting line to Zhang Qing, CMO of Sam's China, instead of reporting to the COO as before. With the arrival of the new president, Jane, both COO Zheng Shouhuai and CPO Zhang Qing will now report directly to her.

Sam's new president, Jane, is a woman who joined Walmart in 2012 and has worked in various departments such as procurement, operations, human resources, and sustainability in both Walmart U.S. and Walmart International. Since 2017, she served as Walmart International's Chief Human Resources Officer, and in 2020, she was appointed Senior Vice President of Global Sustainability at Walmart. In January 2024, she returned to Walmart International as Senior Vice President of Operations, overseeing operations, supply chain, and real estate.

Sam's New President: Jane

Sources from Walmart have said that Jane, who has served in Walmart International for many years, has a deep understanding of the Chinese market and team, and has supported the transformation of Walmart and the expansion of Sam’s operations in China. During her visit to China four months ago, she emphasized that “the supply chain is Sam's core advantage.”

From the available information, it seems that Jane's approach to operations differs from that of Andrew Miles. Jane is more focused on the consistency of the supply chain, meaning that upon her appointment, she may push for alignment between Sam’s stores in China and their U.S. headquarters in terms of supplier selection. This direction could further align Sam's stores in China with the global standards of Sam’s.

02. Sam's Becomes Walmart China's "Ace in the Hole"

On November 19, Walmart released its Q3 financial report for the fiscal year ending October 31, 2024, and raised its full-year profit forecast. The report showed a 6.6% increase in total revenue to $169.6 billion. Walmart's three business segments — Walmart U.S., Walmart International, and Sam's Club — all achieved revenue growth.

Walmart's performance in China was especially strong, with net sales reaching $4.9 billion (approximately ¥35.5 billion), a 17.0% year-on-year growth. Notably, Walmart China’s net sales in the first two quarters were $5.7 billion (approximately ¥41.2 billion) and $4.6 billion (approximately ¥33.3 billion), respectively. Therefore, the total net sales for Walmart China in the first three quarters amounted to $15.2 billion (approximately ¥110 billion), likely setting a new historical high.

Sam's China has become one of the key drivers of Walmart China's growth. Sam's Club in China has maintained double-digit growth for several consecutive quarters, with e-commerce net sales growing 25% in Q3, and membership income increasing by 22%. By mid-November 2024, Sam’s China sales had reached approximately ¥85 billion, surpassing last year’s total sales. Membership numbers reached around 8.6 million, and with a minimum membership fee of ¥260/year (or ¥680/year for premium memberships), Sam's China generates over ¥2.2 billion in membership fee revenue annually.

Walmart Global has indicated that it will continue to focus on developing membership programs like Walmart+ and Sam's Club to increase customer loyalty and revenue growth.

In recent years, Walmart and Sam’s dual-brand strategy in China has resulted in a shift where Walmart’s main brand has weakened while Sam's has become more aggressive.

Li Ling, a consultant at Linkshop, pointed out several factors contributing to Walmart China’s growth: 1) Sales have grown in both the U.S. and China markets; 2) Both online and offline sales have increased in these markets; 3) Two business formats within one company in China (Walmart and Sam's) show opposite trends, with Sam's compensating for the weaknesses of traditional hypermarkets; 4) Online sales growth in China has been even higher.

“This gives us some insight: The retail market in China is huge, and even an established company like Walmart is still growing! Does online and offline have to be a zero-sum game? For healthy growth, companies must recognize the direction and plan ahead,” Li Ling said.

Clearly, Walmart headquarters is gradually adjusting its strategy in China. Since 2016, Walmart has closed over 140 stores in China. Walmart's financial reports show that from fiscal year 2020 to 2023, the number of Walmart China stores decreased from 412 to 322.

On the other hand, Walmart is accelerating the opening of Sam's stores. In 2023, Sam's contributed over ¥80 billion of Walmart China’s ¥120 billion in sales. In 2024, Sam's is expected to reach ¥100 billion in revenue. Online channels have also become an important growth driver for Sam's in China. In fiscal year 2023, online sales accounted for about 47% of Sam’s China’s total revenue. Walmart's CFO, Renni, noted in the Q2 2024 earnings call that membership growth has driven double-digit sales growth in China, with around 50% of sales coming from online channels.

Walmart has publicly stated that it expects 6 to 7 new Sam's Club stores to open every year. By 2026, the number of Sam's stores in China is expected to exceed 60, and the more Sam's stores are opened, the higher the sales performance will be.

03. Challenges and Opportunities for Sam's New President in China

The membership store model is a "slow business" that requires long-term accumulation to form internal advantages, including product selection, own brand creation, stable suppliers, and talent cultivation. In fact, before opening its first store in 1996, Walmart had already laid out its presence in the Chinese market, accumulating at least 30 to 40 years of experience.

As we all know, the supermarket industry is highly mature, with product homogeneity and low entry barriers. Whether it's a traditional hypermarket or a membership-based model, there are no "secret weapons." In the end, the competition is about "operational efficiency" — who can better control costs and offer better products at more competitive prices.

Today, the membership store model is not only performing well in China but is also on track to surpass traditional supermarkets globally. This is because membership stores excel in deep internal operations, selective SKUs, efficiency, cost control, and product quality improvement, leading to a comprehensive efficiency advantage through fine-tuned operations. According to statistics, Costco, the "pioneer" of membership warehouse clubs, actually grows very slowly, with an average annual growth rate of around 10%.

However, Sam’s development strategy in China seems to be focusing on rapid growth. Media reports suggest that over 70% of the products at Sam's China are sourced from local suppliers rather than from global suppliers, which could lead to differences in standards between Sam's China and other Sam’s stores globally. Some industry analysts believe that Sam's China has not formed strong synergies with Sam's globally in terms of product sourcing, which may be one of the reasons why Sam's China has faced frequent food safety issues.

With the new president taking office, will Sam's China undergo a significant shift in operational focus and strategic direction? Will it shift from prioritizing speed and efficiency to focusing on operational quality, efficiency, and standardization?

Given Jane's background as Senior Vice President of Operations at Walmart International and her experience in the supply chain department, it’s highly likely that she will lead Sam’s China in restructuring its supply chain system, improving operational standards, enhancing product quality, and introducing high-quality products from around the world to the Chinese market.