Who Will Become the Next Ultimate Unicorn?

Since the release of ChatGPT in 2022, generative AI has entered its third year of explosive growth, and its popularity remains unabated.

According to research institutions, in the third quarter of 2024, global venture capital investment reached approximately $66.5 billion, with nearly $19 billion coming from AI investments, accounting for 28% of the total. AI venture capital continues to rise despite the broader economic downturn.

As the technology wave evolves, the investment focus in generative AI (GenAI) has shifted in line with the maturity of the industry. This year, we have clearly seen that investors are increasingly focused on consumer-grade AI applications.

The well-known Silicon Valley incubator a16z has listed consumer-grade AI applications as one of its key areas, believing that "just as the iPhone changed daily consumer interactions with technology, generative AI may reshape everything from travel and therapy to e-commerce." VC firm NEA has also increased its focus on consumer-grade AI, exploring opportunities in AI Commerce, AI video, and AI consumer finance. The number of consumer-facing AI startups incubated by top Silicon Valley incubator Y Combinator in the second half of this year has doubled compared to the first half. (Source: “YC S24 Complete Project List! 190 AI Projects at a Glance | Exclusive by Silicon Rabbit”).

We can see that a consensus is forming among Silicon Valley investors regarding the opportunities in consumer-grade AI applications. Investment focus is gradually shifting from foundational model development to innovation at the application layer, with investors increasingly seeking business models that can directly generate economic benefits.

UpHonest Capital, an early-stage venture capital firm in Silicon Valley, conducted in-depth research and analysis on this phenomenon, aiming to identify the direction of the next consumer-facing AI applications that will reach valuations of $10 billion or even $100 billion.

This article will address the following questions:

How to identify when a platform-level application is on the verge of an explosion in growth?

How will Consumer AI change existing consumer tech products?

What are the different categories of Consumer AI, and what is the current market situation?

In the consumer market, which niche sectors are most likely to be upgraded or replaced by AI?

Which startups have the potential to become the next $10 billion or $100 billion companies?

01. Platform-Level Applications on the Verge of Explosive Growth: GenAI Infrastructure is Becoming More Mature

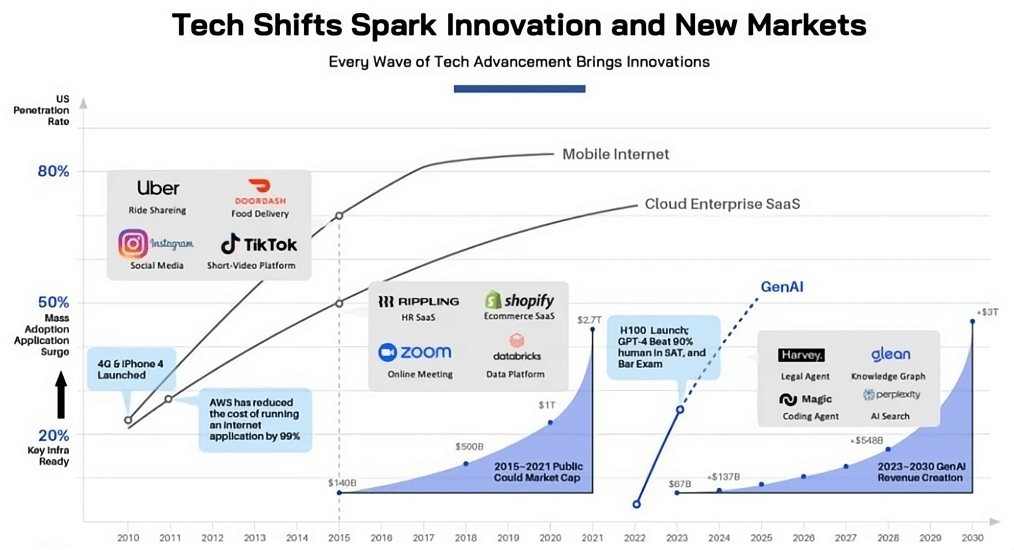

In every wave of technological change, the five years following the completion of infrastructure development are considered the golden period for application companies, during which many $10 billion or $100 billion companies emerge.

For example, during the five years after the release of the iPhone 4 (2009-2013), the mobile internet wave saw the emergence of companies like Uber (founded in 2009), Bytedance (2012), Instagram (2010), and Snap (2011).

Similarly, in the five years following the release of a16z's report "Software is Eating the World" (2011-2016), the cloud and SaaS proliferation era gave birth to companies like Databricks (2013), Snowflake (2012), and Zoom (2011).

(Source: Silicon Rabbit’s Chart)

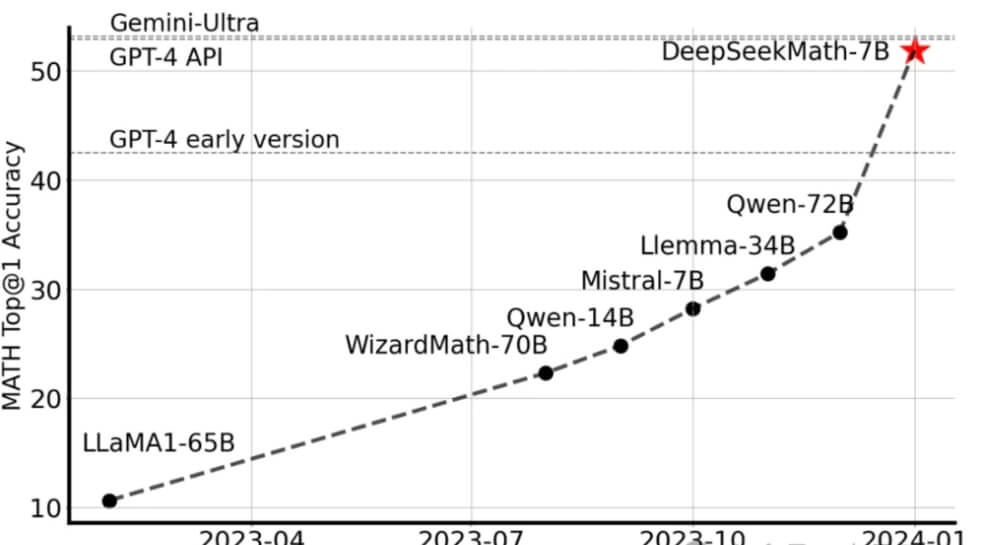

This year marks the third year since ChatGPT’s release. From the perspective of both model costs and capabilities, the infrastructure for GenAI has gradually been established, and we are now entering the critical window for application explosion.

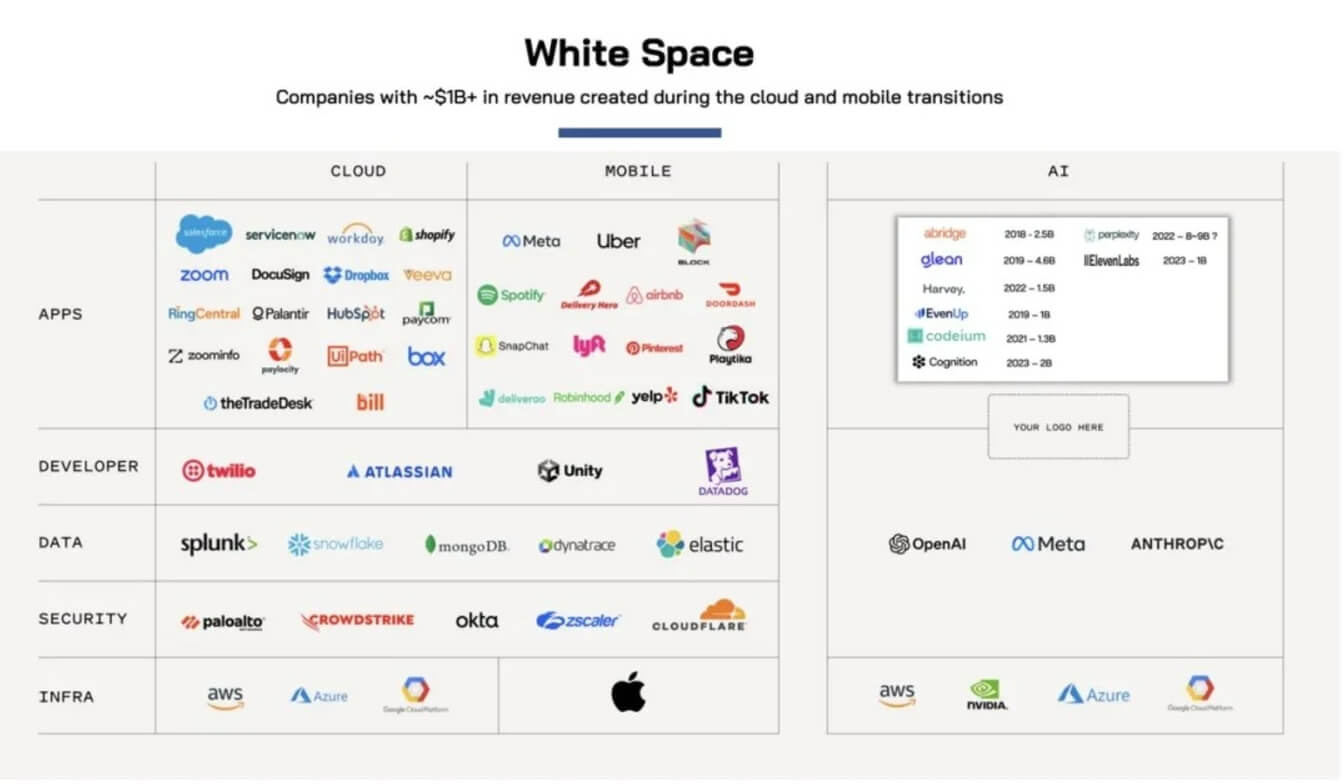

From Sequoia's report (left), we can see that during the cloud and mobile internet era, more than 50 companies with over $1 billion in revenue were born. In the GenAI era (right), however, there are still relatively few generative AI applications with over $1 billion in revenue. Among them, the highest-revenue consumer products are OpenAI's ChatGPT and Microsoft's GitHub Copilot, but these are not entirely independent application companies.

As GenAI technology infrastructure matures, the application explosion is about to enter a golden growth period.

Although there are currently no consumer AI companies with over $1 billion in revenue, former Index Ventures partner Rex Woodbury believes that following the patterns of previous technological waves, early-stage investors who focus on these potential companies during the seed round can expect returns of 900 to 4300 times when these companies go public.

02. Two Types of Consumer AI Startups: Three Ways to Reshape the Industry

Currently, Consumer AI companies mainly offer scalable, customized, one-stop services to consumers. These companies can be roughly divided into two types:

Type One: Companies that provide products or services for users, who pay directly for the products or services. However, these companies may face challenges with user retention, as customers can easily switch to better alternatives.

Type Two: Companies that provide networks or content to users, who "pay" with their time, which is converted into advertising revenue. Once the company occupies a large portion of the user's time, it can expand into more business areas, eventually becoming a super app.

Compared to traditional consumer tech products, Consumer AI not only allows for the rapid dissemination of personalized high-end services, but it can also lower the entry barriers for specialized skills such as video production and language learning.

In fields that require empathy and understanding, such as education and psychological counseling, AI can be upgraded to provide 24/7, customized personal services.

03. The Growing Interest in Consumer AI Investments: Who Will Be the Next $100 Billion Company?

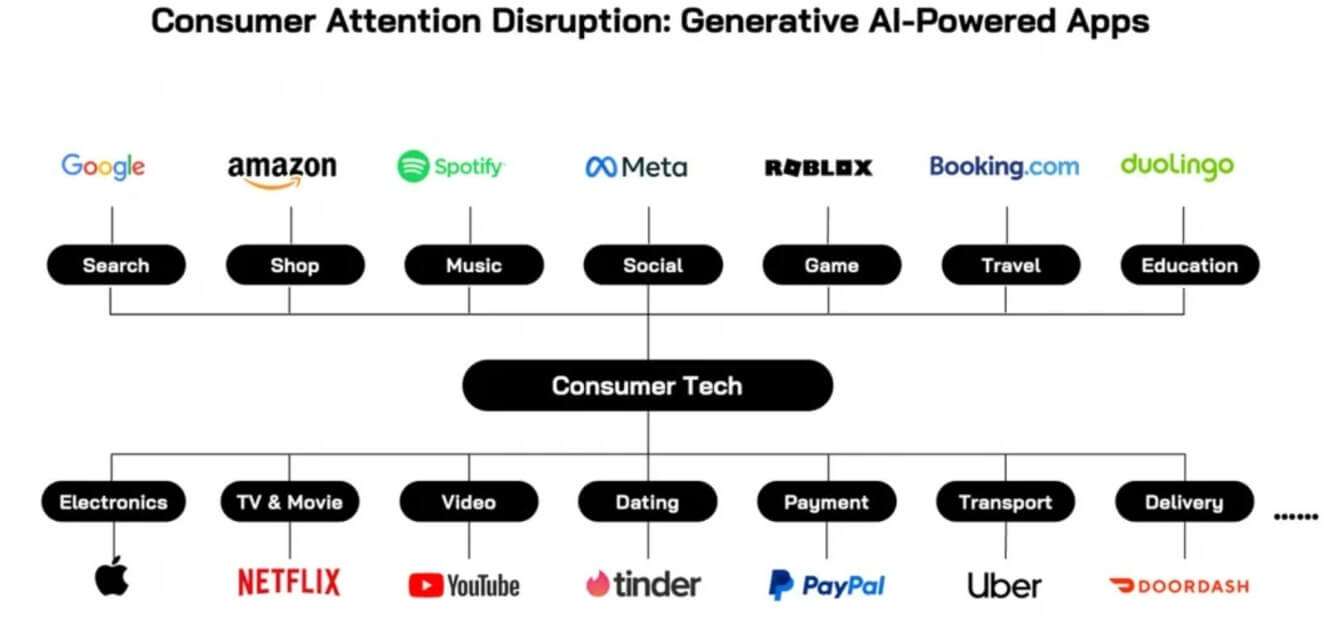

Looking back, the consumer market for tech products has always been the most promising and imaginative, and the generative AI space is no different.

However, in reality, we’ve seen that most unicorns emerging in the application layer this year are business-to-business (B2B) companies. On the other hand, business-to-consumer (B2C) applications are somewhat quieter, with entrepreneurs and investors remaining relatively cautious. Clearly, the value of Consumer AI and its potential market have not yet been fully realized.

YC partner Michael Seibel has also noticed this trend. He believes most founders are pursuing AI opportunities in the B2B space, with fewer entrepreneurs exploring the consumer AI space.

Regardless of the type, the rapid growth of generative AI application companies will inevitably disrupt traditional industries. Which consumer tech giants are most likely to be upgraded or replaced by AI? Which startups have the potential to leap into the $10 billion or $100 billion league in the storm of technological transformation? By examining the current consumer tech market, we have identified several sectors that are most likely to see significant growth with GenAI, or even be replaced by it.

Our research shows that within six key sectors—travel, language, video, shopping, social, and gaming—several AI startups are already scaling up and have the potential for sustained growth. These sectors are most likely to enter a new era with the help of GenAI.

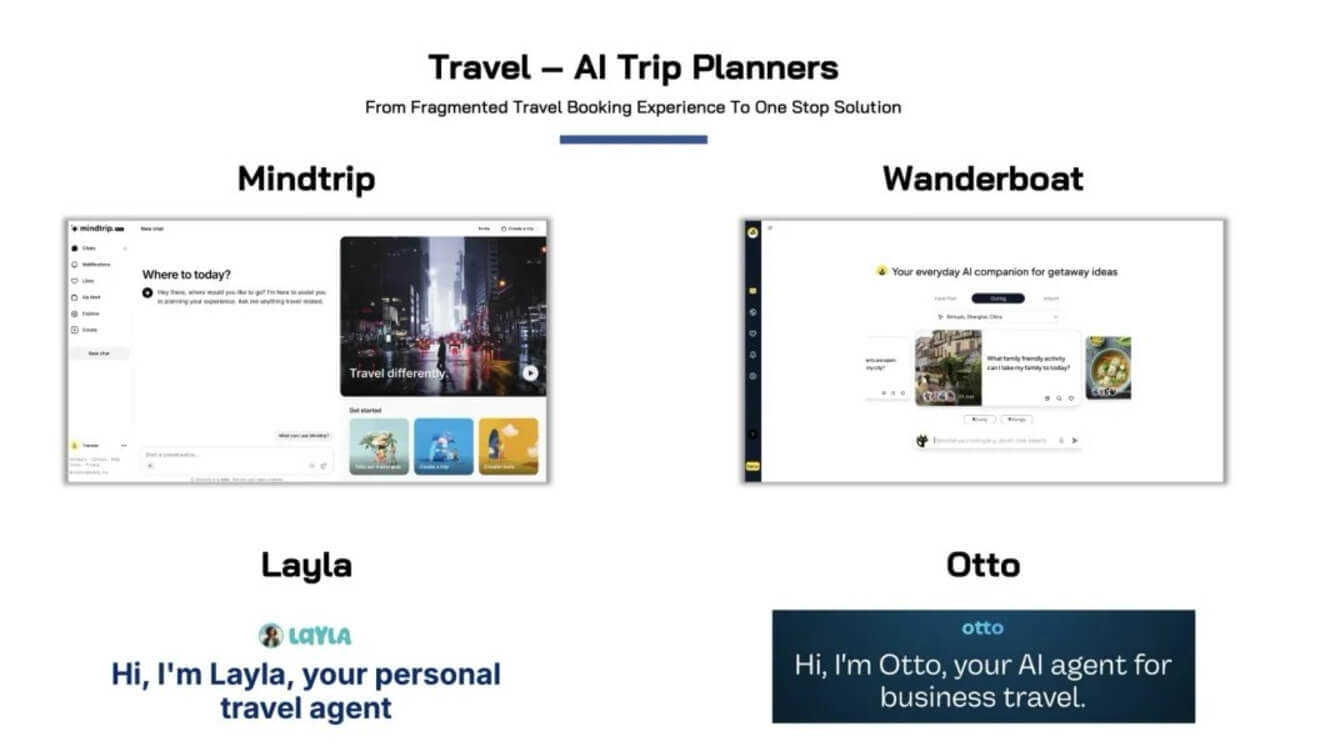

1. Travel Sector: Changing How Travelers Interact with Information

From social media recommendations, itinerary planning, flight and hotel bookings, to finalizing the travel plan, users typically need to visit dozens of web pages and spend hours before completing their plans. However, now AI can help create personalized travel arrangements for you.

a. Wanderboat — AI Customizes Travel Itineraries, with Monthly Active Users Over 100,000

Founded in 2023, Wanderboat was established by You Wu and Xiaochuan Ni, two Chinese founders who both previously worked as chief application scientists at Microsoft’s Bing Chat and Copilot teams, with deep expertise in AI search.

Wanderboat offers a “Hands-Off” feature where users only need to provide a series of links or relevant documents, and the AI will generate a list of travel recommendations. Additionally, when users click on a location or event on the map, the AI seamlessly integrates and provides related information and suggestions.

Wanderboat also established a community for sharing itineraries. Currently, without any paid marketing, Wanderboat has reached six-figure monthly active users and has received investment from Sequoia and UpHonest Capital.

Website: https://wanderboat.ai/home

b. Mindtrip — AI for Team Travel, $12 Million Seed Round Raised

Founded in 2023, Mindtrip's founding team previously launched the car e-commerce platform Roadster, which was sold for a valuation of $360 million, with experience in successful consumer internet ventures.

Mindtrip’s platform generates unified itineraries based on each team member's preferences. Users can discuss and share plans, with the AI adjusting the itinerary according to everyone’s individual preferences, offering a convenient and efficient planning service for group travel.

Mindtrip raised $12 million in a seed round in September, led by Forerunner and Costanoa Ventures. The company now has six-figure active users and is collaborating with some travel companies to offer embedded AI Agent features.

Website: https://mindtrip.ai/

c. Other Startups: Layla, 24H1, Otto

Layla, co-founded by travel influencers, has received investments from M13 and Firstminute Capital.

24H1 has achieved over 250 million views on social media.

Otto, founded by former Expedia executives, has raised investments from Madrona and industry veterans, focusing on providing TripAgent services for business travel.

In fact, when ChatGPT was first released, many AI travel planning apps emerged, but most failed. Only a few have continued to receive funding. However, in the second half of this year, VC-backed startups have begun to emerge in this sector, and their business models are gradually maturing.

2. Language Sector: Breaking Traditional Language Learning Frameworks and Offering Immersive, Personalized Teaching

Large language models provide rich datasets and contextual environments for language learning, breaking the limits of fixed scenarios and texts. Enterprises can now offer a variety of real-world interactive scenarios for users, fulfilling niche and informal contexts that traditional teaching frameworks cannot.

a. Tomo — AI Learning Companion for Language Learners

Tomo offers an AI companion for language learners that creates story-driven short video learning scenarios based on given contexts. Users can learn languages within these scenarios, helping learners better understand, memorize, and apply what they’ve learned in real-life situations.

Additionally, the app adjusts learning content based on user feedback, extending story-based lessons and keeping users engaged.

Website: https://www.usetomo.com/

b. Speak — AI Voice Recognition Model Whisper, Funded by OpenAI

Speak, an education software company, already had over 100,000 paid users before embracing GenAI. Using its user database, Speak launched the proprietary Whisper speech recognition model, which is specifically designed to understand heavily accented English from speakers of over 10 native languages, along with an AI language tutor feature.

Founded in 2016, Speak raised investments from OpenAI and Founders Fund in 2022, and now has over 10 million users across 40+ countries. Its latest round of funding in June 2023 valued the company at $500 million.

Website: https://www.speak.com

c. Praktika — Personal Tutor Service, Annual Recurring Revenue of $20 Million

Founded in 2022, Praktika offers personalized tutoring experiences through an AI Avatar. The more users interact with the Avatar, the more customized their learning experience becomes.

By integrating detailed emotional and tonal shifts, Praktika developed a highly engaging language acquisition method. As of May, the company had over 1.2 million active users, with a revenue of $20 million over the past year.

Website: https://praktika.ai

Most companies in the language sector use AI to accumulate large user datasets and create personalized learning methods. With the integration of voice models, AI Tutors can now offer 24/7, multilingual, real-world conversations.

3. Video Sector: Who Will Be the Next TikTok?

From the internet to mobile internet, and now to GenAI, video has always been a critical opportunity during platform transformations, accounting for 82% of internet traffic today. In the past five years alone, video traffic has grown fivefold. The rise of generative AI has further lowered the barriers to video production and content creation.

a. Runway — AI Video Creation Tool, Valuation of $4 Billion

Founded in 2018, Runway was one of the first companies to focus on AI video generation. Initially a video editing tool, Runway pivoted to video rendering and generation. In February 2023, it launched its first video generation model, Gen-1, and achieved a valuation of $1.5 billion.

Today, Runway is an AI and machine learning creative tools platform focused on providing various AI capabilities to creators, simplifying creative expression and boosting work efficiency. It integrates multiple AI models to support video editing, image processing, text generation, and audio processing. The latest Gen-3 Alpha model released in June 2023 has likely pushed the valuation to $4 billion.

Website: https://runwayml.com

b. Luma AI — 3D Model AI Generation, Valuation of $300 Million

Founded in 2021, Luma AI initially focused on 3D model generation and rendering. Its core technology, NeRF, is a 3D reconstruction technique that generates new viewpoints from existing perspective images. Luma AI launched its AI model Dream Machine for more extensive movement generation.

In January 2023, Luma AI completed a funding round, bringing its valuation to $300 million.

Website: https://lumalabs.ai

c. Viggle — AI Animation Generation, Discord Users Over 4 Million

Founded in 2022, Viggle is focused on AI animation generation. Its product, Viggle, uses the proprietary JST-1 machine learning model to animate text, images, and videos. In April 2024, Viggle became popular with its AI animation generation feature.

Viggle raised Series A funding in August 2023, led by a16z. Since its beta launch in March 2024, its Discord community grew to over 4 million users. A viral video of a "transformation" rap video made the app a hit, with over 15 million views and 850,000 likes on YouTube.

Website: https://viggle.ai

d. Genmo — Open-Source Video Generation Model, Generates Videos Up to 5.4 Seconds Long

Genmo, founded in late 2022 by Google researchers Paras Jain and Ajay Jain, focuses on AI video generation technology. Genmo offers services such as text-to-video, image editing, and more. Its open-source model, Mochi 1, is the largest video generation model to date, with 1 billion parameters.

Genmo recently completed a $28.4 million funding round led by NEA.

Website: https://www.genmo.ai

Video generation is one of the most active sectors in GenAI investment, with both large companies and startups targeting this niche. Although large enterprises have more resources and established ecosystems, startups often have an advantage in innovating features and products, which could eventually help them grow into billion-dollar companies.

4. Shopping Sector: Optimizing Shopping Experience, Building Personalized Shopping Experts

Generative AI can provide personalized product recommendations based on users’ behavior and preferences, enhancing user experience and shopping satisfaction. AI-driven chatbots and customer service bots can offer 24/7 instant responses, answering questions and improving service efficiency.

a. Daydream — AI Shopping Search, $50 Million Raised

Daydream provides a high-quality virtual reality platform, creating GenAI-powered consumer search portals. It connects over 2,000 brands and supports a more natural search interaction mode. Users are no longer limited to keyword-based searches, with AI providing recommendations based on time, location, and occasion.

Founded by Julie Bornstein, who previously created The Yes (a personalized shopping platform for women’s fashion), Daydream raised $50 million in seed funding in June 2023, led by Forerunner Ventures and Index Ventures, with investments from Google Ventures and True Ventures.

Website: https://daydream.ing

5. Gaming Sector: Shaping All Aspects of Gaming, Creating More Interactive Experiences

Through large model inference capabilities, AI can provide more realistic interactions, enhancing the gaming experience. AI technology can also generate in-game content and offer new gaming experiences.

a. Inworld AI — AI NPC Creation, Valuation of $50 Million

Founded in 2021, Inworld AI was one of the first companies to create AI NPCs. By merging large language models and chatbots, it allows developers to create NPCs in bulk with natural language descriptions. In just one year, Inworld AI raised $69.7 million, and in August 2022, it completed a $50 million Series A funding round led by Intel Capital and Section 32, with a valuation of $500 million.

Website: https://inworld.ai

b. Series AI — Using AI to Develop Interactive Games

Series AI uses large language models (LLMs) and generative AI to make video games more interactive. Recently, it acquired the mobile game studio Pixelberry, known for its interactive storytelling game Choices: Stories You Play.

Series AI raised funds from a16z and has significant experience in game development, including prior successes in creating and selling game studios.

Website: https://www.series.inc

Generative AI technology is transforming game design, development, marketing, and user experience, creating new opportunities and challenges in the gaming industry.

6. Social Sector: Upgraded Virtual Companionship and Personalized Social Interactions

Generative AI can offer personalized social experiences based on users' preferences and behavior patterns, such as personalized recommendations and customized content. At the same time, generative AI has also created new forms of social interaction, like virtual companionship and simulated romantic relationships.

a. Daze — GenAI-Powered Social App with 150,000 Waiting Users

Daze is a real-time messaging app enhanced by generative AI. Its most popular video has garnered over 8 million views, and during its beta testing phase, it had 150,000 waiting users. With Daze, users' chats are no longer limited to text boxes; colorful messages can float on the screen, accompanied by images, graphics, stickers, GIFs, drawings, decorative backgrounds, and more.

Currently, the majority of Daze's beta users are aged between 13 to 22 years. Among 1,400 beta testers, Daze's 60-day retention rate exceeds 50%. Before its official release, Daze completed a seed round of funding from investors such as a16z and Maveron. (Source: "The social platform that aims to beat WhatsApp has Gen Z excited even before its launch")

We have also observed that users are quickly migrating between generative AI applications. Startups face the risk of big companies rapidly copying creative features, making it difficult to build a technical moat. For instance, after Clubhouse became popular, both Twitter and Spotify launched audio social spaces on their platforms. Therefore, whether generative AI-based social apps can escape the shadow of these tech giants and quickly convert viral growth into network effects remains uncertain.

Consumer AI Becomes a Key Focus for GenAI Investment

Looking at the current industry situation, most consumer AI startups are relatively young but growing rapidly, having established a stable user base.

On the other hand, we see that investors are increasingly focusing on consumer AI applications, gradually filling market gaps. However, for tech giants, consumer AI is still viewed as an upgrade to existing products rather than a native generative AI application. The speed at which these giants are catching up has put significant competitive pressure on startups.

New billion-dollar and multi-billion-dollar companies are expected to emerge from this intense competition.